Fintech founders behind Monzo, Starling and Nutmeg launch digital bank for the wealthy

The fintech pioneers behind some of the UK’s biggest disruptors are joining forces to launch a new digital-first bank targeting high net worth individuals, according to Finance Feeds. Known internally as “Project Arnaud”, the initiative seeks to revolutionize how affluent clients manage wealth, closing gaps left by traditional institutions.

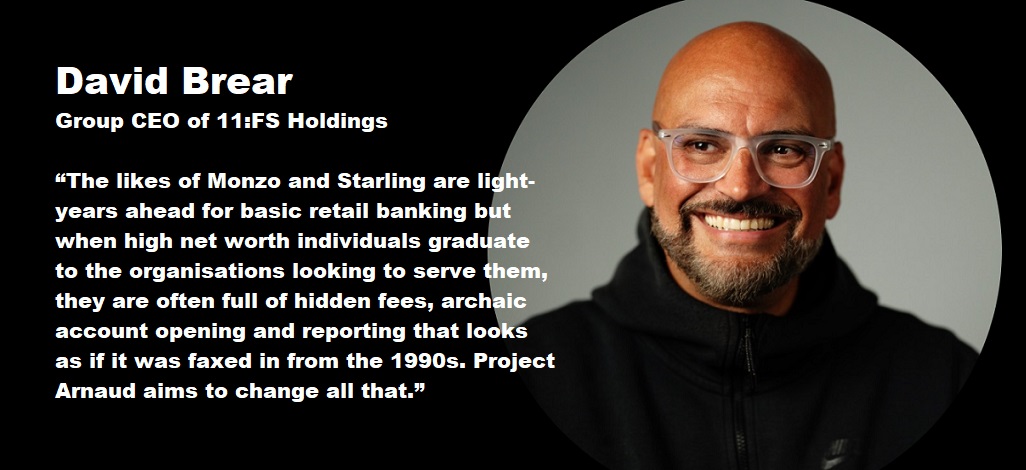

Project Arnaud is led by Jason Bates, co-founder of Monzo and Starling, David M Brear, Group CEO of 11:FS, and Max Koretskiy, co-founder of Swiss wealth manager Blackshield Capital. Together, the team is betting on a next-generation, digital-first wealth solution designed for the financially ambitious and digitally native elite.

“The likes of Monzo and Starling are light-years ahead for basic retail banking but when high net worth individuals graduate to the organisations looking to serve them, they are often full of hidden fees, archaic account opening and reporting that looks as if it was faxed in from the 1990s. Project Arnaud aims to change all that,” said David Brear.

He added: “A wealthy client recently told me he can order a Tesla in three clicks on his phone, but when he wants to adjust his investment portfolio, it takes three weeks of phone calls, emails, and scanned forms. That’s the gap between what modern life looks like and what wealth services still deliver.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: