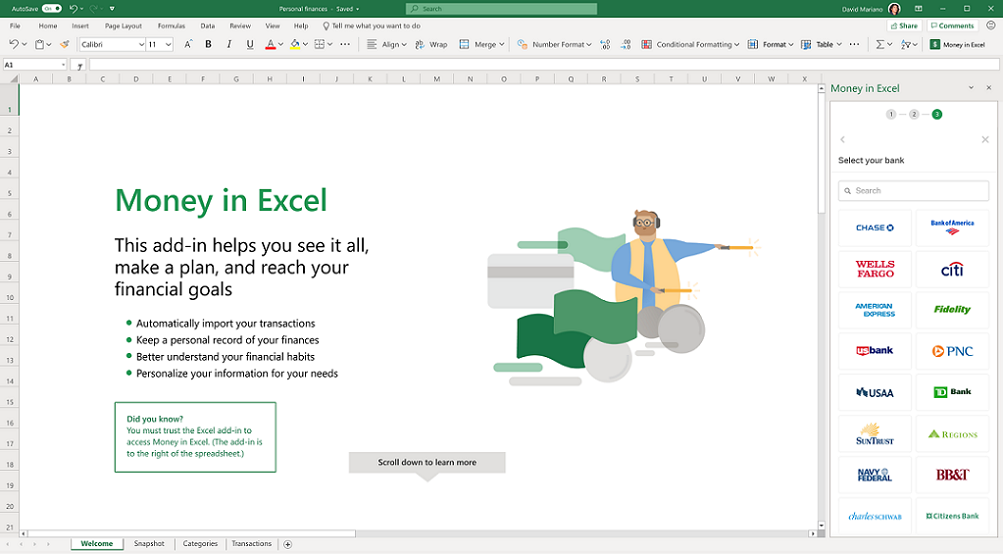

US-based fintech Plaid has announced it is working with Microsoft to develop Money in Excel app. „Money in Excel essentially turns the spreadsheet software into a fintech app – letting you sync your balances and transactions from financial accounts and easily categorize and analyze through charts and templates.”

Fintech applications have given people more control over their personal finances in a myriad of ways, whether it’s paying bills, sending money abroad, or growing their savings.

One of the earliest forms of “fintech” is a budgeting spreadsheet. For years, people have relied on Microsoft Excel to budget and track expenses for their personal finances or businesses, typically copying data over from multiple sources.

„Money in Excel features a Plaid integration and the new capabilities essentially turn the spreadsheet software into a fintech app. It allows users to securely connect their financial accounts, import the data within them, sync balances and transactions over time, and, ultimately, gain greater insights into their financial health.”, according to a Microsoft blog.

Plaid COO, Eric Sager: „In light of what’s going on in the world, the need for a digitally delivered financial system has never been more pressing. During this crisis people are learning new digital habits which may have long-lasting effects on consumer behavior. In many ways, the situation is shining a light on areas that need better experiences for consumers. We believe every company will become a fintech company in some way and that delivering financial services is no longer the sole domain of the traditional providers.”

How it works: Plaid provides the permissioned connection to financial accounts via Plaid Link from directly within the Microsoft Money in Excel experience. (article continues below)

After linking their account(s), the individual will have access to their balance and transaction history, providing an up-to-date and holistic financial picture. Plaid connects to 11,000 institutions across the US, Canada, and Europe. In the US, Plaid supports nearly every institution from the major retail banks to community credit unions. (article continues below)

A “Monthly Snapshot” sheet features personalized charts and graphs based on your data to help you better understand your spending behaviors. (article continues below)

Money in Excel gives you options to further customize by adding templates that are relevant to you – with options like recurring expenses, net worth, and more. (article continues below)

„Since the beginning, Plaid’s mission has been to make money easier for everyone, and that mission isn’t reserved for just financial services. Money in Excel is a really interesting example of the type of experience we can expect to see more of in the future.”, the company said.

Money in Excel will start to become available in the U.S. in the coming months.

Learn more about Money in Excel from the Microsoft blog and check out a related post from Plaid COO, Eric Sager about the expanding footprint of fintech in our personal and professional lives.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: