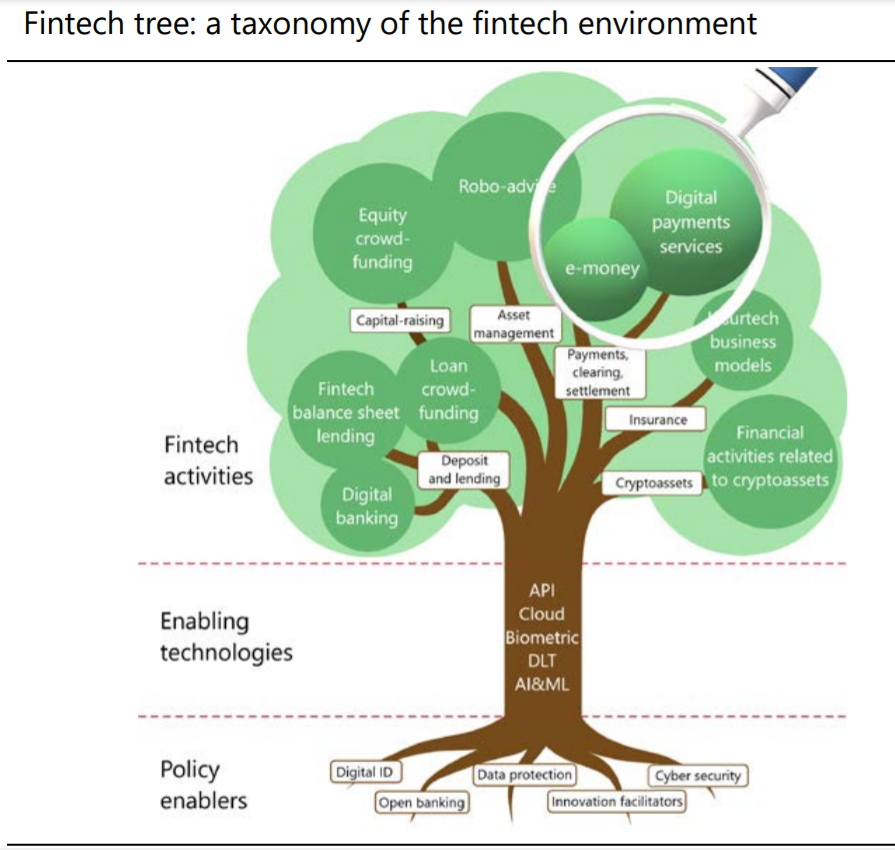

This BIS’ paper prepared by the Financial Stability Institute explores how non-bank payment service providers (NBPSPs) are regulated. Improvements in technology, coupled with growing demand for digital payment methods, are increasingly reshaping the way payments are made.

While the payments space continues to be dominated by banks in many countries, the role of NBPSPs operating a variety of business models is gaining prominence. This paper provides a cross-country overview of the regulatory requirements for digital payment and e-money services offered by NBPSPs. It benefited from responses to a CPMI survey of 75 jurisdictions conducted in early 2021 and was supplemented by a desktop review of public documents issued by selected authorities.

Non-banks can offer more types of payment service and tend to be less intensively regulated in advanced economies (AEs) than in emerging market and developing economies (EMDEs). In some jurisdictions – mostly AEs – non-banks can offer all types of payment service included in the survey, while in some EMDEs non-banks are only able to offer few. Moreover, NBPSPs in EMDEs, particularly those acquiring payment transactions, providing e-wallet services and issuing e-money, face more regulations than those in AEs. Given the potential of NBPSPs to foster financial inclusion, authorities in EMDEs might already start considering strategies for expanding their payment services markets and reviewing the appropriateness of existing regulations for these players. In this way, they can promote innovation while ensuring the safety and integrity of their financial systems.

Novel technologies are creating the potential for new means of payments to emerge. While the market capitalisation of cryptoassets is growing, it is increasingly clear that their high price volatility makes them ill-suited as a means of payment. Stablecoins, a new type of cryptoasset that emerged in 2014, are designed to maintain a stable value relative to a specified asset, or a basket of assets. While the role of stablecoins as a new payment method could potentially increase over time, the jury is still out on whether one or more stablecoins will be widely adopted as a payment method.

Regulatory approaches for stablecoins are starting to evolve. Work is under way in some jurisdictions to adapt their regulatory framework for cryptoassets, and stablecoins in particular. Prominent examples are ongoing initiatives in the United Kingdom (consultation by HM Treasury) and the United States (statement by US President’s Working Group on Financial Markets, STABLE Act proposal). At present, according to a 2020 FSB survey, most jurisdictions do not have regulations that are specific to stablecoins but see the need for adjustments to existing regulations. The EU’s MICA Regulation proposal, on the other hand, proposes a bespoke regulatory regime for cryptoassets including stablecoins. Absent a dedicated regulatory framework, if a stablecoin resembles an already regulated product or service, authorities will likely treat the stablecoin as such under existing regimes, which apply in whole or part depending on the coin’s characteristics.

The role of big techs in payments and their potential involvement in global stablecoin (GSC) arrangements will likely receive further attention. Big techs have already captured a sizeable market share in digital payments in some jurisdictions. But even where they have not, this could change quickly due to the unique features of their business models. At present, big techs are subject to the same requirements as those of other market participants when providing financial services (including payments); and there seems to be a case for relying more on entity-based rules for big techs in certain policy areas to address the risks stemming from the different activities they perform (Carstens (2021a) and Restoy (2021)). In future, some big techs may become involved in GSC arrangements. For policymakers, it will be important to appreciate the unique combination of a very specific type of entity (big techs) providing a very specific type of activity (provision of GSC), and to consider the potential implications of this interplay.

Download now:

Fintech and Payments: regulating digital payments services and e-money

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: