Romanian fintech Finqware, an open banking and financial automation infrastructure provider for businesses, reports strong results for 2025, marked by accelerated platform adoption across Central and Eastern Europe (CEE). Finqware expanded bank connectivity across Bulgaria, Poland, Czechia, Slovenia, and Slovakia, integrating the top seven banks in each market. Company data shows a doubling of processed volumes and significantly increased adoption of finance automation solutions among CFOs and finance teams.

2025: The year finance automation moved from “pilot” to critical infrastructure

For CFOs operating across multiple entities, banks, and countries, fragmented banking access has long been a source of operational risk — delayed data, manual reconciliation, inconsistent payment flows, and limited cash visibility.

In 2025, this reality began to change. Finqware’s evolution reflects a clear market maturation and an accelerated transition toward finance operations automation in CEE, where bank connectivity and direct payment execution from systems such as ERPs, TMSs, and accounting platforms are becoming essential for scale and financial governance.

Significant growth across all key platform indicators

Over the past 12 months, activity on the Finqware platform increased significantly across all relevant dimensions:

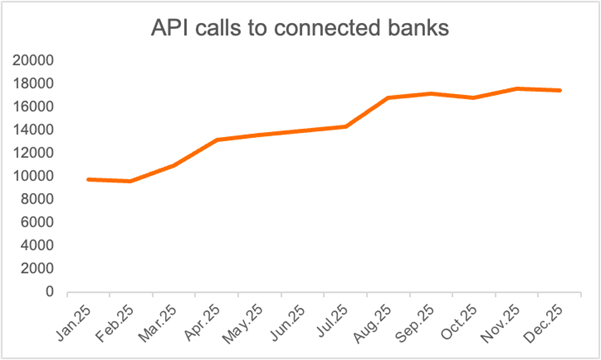

Monthly API calls grew from 10 million to 17.5 million — a 75% increase, exceeding internal projections.

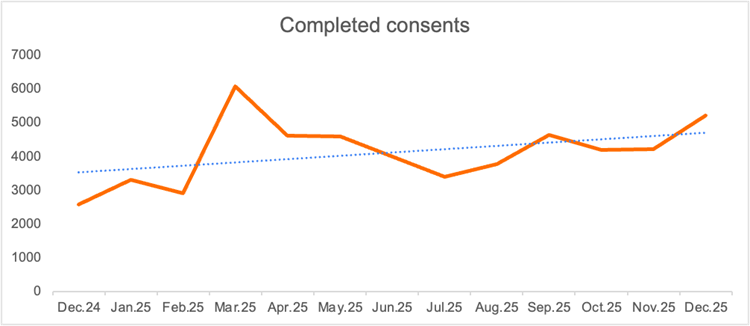

Completed consents more than doubled, rising from 2,500 to 5,200 per month, reflecting more stable flows and a more reliable technical experience.

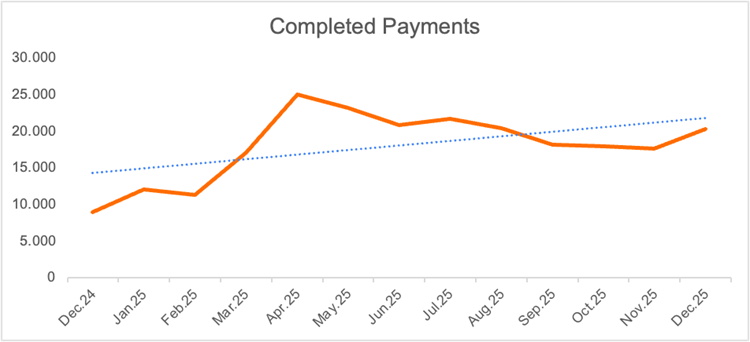

Monthly processed payments increased from 9,000 to over 20,000, a growth of more than 120%, signaling increased trust from companies in automated payment execution via the platform.

Four times more connected businesses

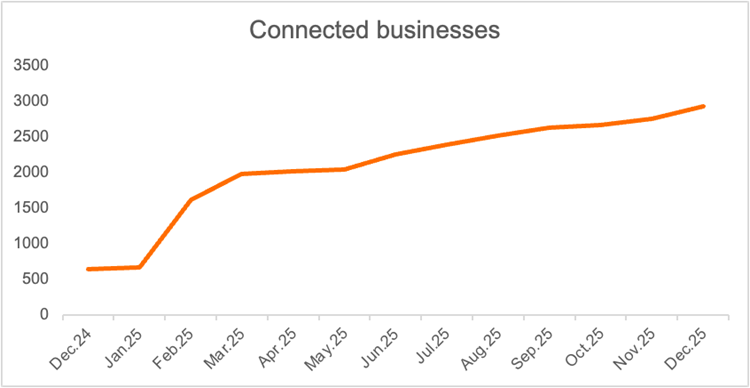

In 2025, the number of companies using Finqware’s open banking services grew more than fourfold, reaching nearly 3,000 connected businesses.

Growth was driven by two main segments:

Corporate and holding companies, using FinqTreasury for account consolidation, cash visibility, and large-scale bank connectivity automation.

SMEs, connected through accounting and ERP platforms, where automated bank statement retrieval and reconciliation significantly reduce manual work.

Unlike previous years, these connections are now recurring and business-critical, not just occasional or experimental use cases.

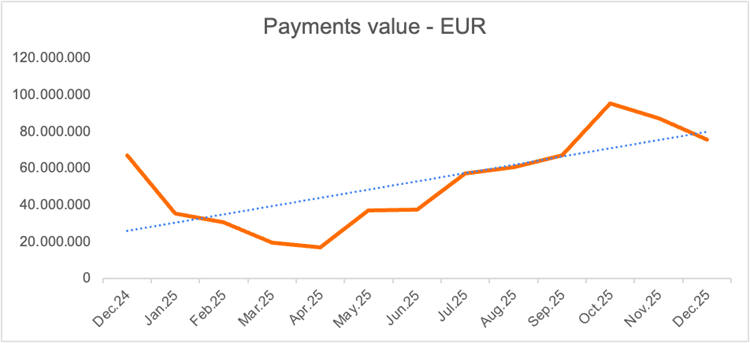

Processed payment value doubled

The total value of payments processed through Finqware doubled in 2025, increasing from a monthly average of €25 million in 2024 to €52 million.

This growth was driven primarily by:

Bulk corporate payments, initiated directly from ERPs and FinqTreasury, eliminating manual uploads in e-banking portals.

Instant A2A payments via FinqLink Pay, used for top-ups and invoice payments as a faster and more efficient alternative to cards.

Accelerated regional expansion across CEE

Finqware’s strongest expansion in 2025 took place in Hungary, where FinqTreasury currently delivers:

. 95% bank connectivity coverage

. Over 1,000 connected accounts

. More than 45,000 transactions processed daily

At the same time, Finqware expanded bank connectivity across Bulgaria, Poland, Czechia, Slovenia, and Slovakia, integrating the top seven banks in each market. This enables regional finance teams to operate on a unified infrastructure instead of managing country-by-country exceptions.

New capabilities supporting real operational use cases

Finqware’s growth in 2025 was also supported by the launch of new capabilities across the platform, each aligned with concrete, day-to-day finance use cases.

Automated Bank Statements, powering accounting platforms such as Keez and Platformis, enabling continuous reconciliation and faster financial closes.

Personal Budgeting & Planning, expanding access to open banking data for consumer-facing financial tools such as Money in Motion.

Faster Invoice Payments, where FinqLink enables instant account-to-account (A2A) payments that combine speed, security, and cost efficiency.

Together, these capabilities reflect a consistent product direction: reducing manual intervention, increasing data reliability, and enabling finance teams to operate with confidence — not just speed.

„2025 was the year when open banking became real operational infrastructure for companies — not just a technological promise. The growth we see at Finqware reflects a clear need among CFOs in the region: more control, less manual work, and finance processes that can scale alongside the business,” said Cosmin Cosma, Co-founder & CEO of Finqware.

Looking ahead to 2026

As companies across Central and Eastern Europe continue to expand regionally, the challenge is no longer access to banking data, but how effectively it is integrated into daily workflows. Finqware’s 2025 evolution points to a structural shift: finance automation is becoming the foundation for real-time visibility, faster closes, and better-informed decision-making.

For more insights and statistics about Finqware, visit: https://finqware.com/blog/finance-automation-at-scale-finqware-2025-growth/

__________

Finqware is a Romanian fintech authorized as a pan-European payment institution, specializing in financial automation and bank connectivity through open banking technology. Through its solutions — including FinqLink and FinqTreasury — Finqware supports the financial digitalization of companies such as FAN Courier, MedLife, Signal Iduna, One United Properties, Rompetrol, Electrica SA, Autonom, and many others. At the same time, the Finqware platform is used by banks such as Banca Transilvania, CEC Bank, and Salt Bank to deliver next-generation payment services based on open banking technology.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: