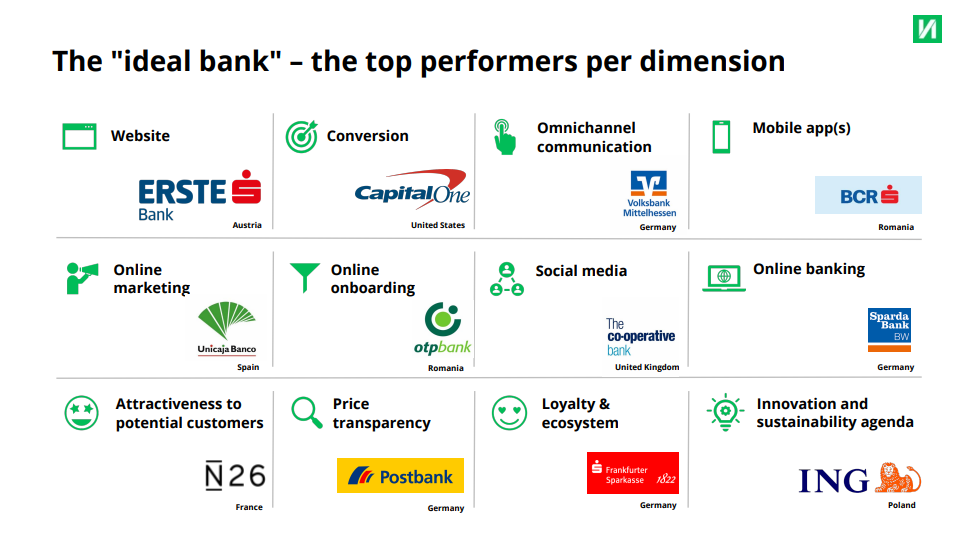

Finnconsult global study – Romania has two representatives in the „ideal bank” top: BCR – for the mobile application, and OTP Bank – for the online boarding process

To help retail banks find the right path, Finnconsult conducts an annual study on the digital customer experience at over 230 banks from 24 countries in Europe and North America. The Swiss banking system does not perform in the „ideal bank” top. Romania has two representatives in this top: BCR, on the mobile application, and OTP Bank for the online boarding process.

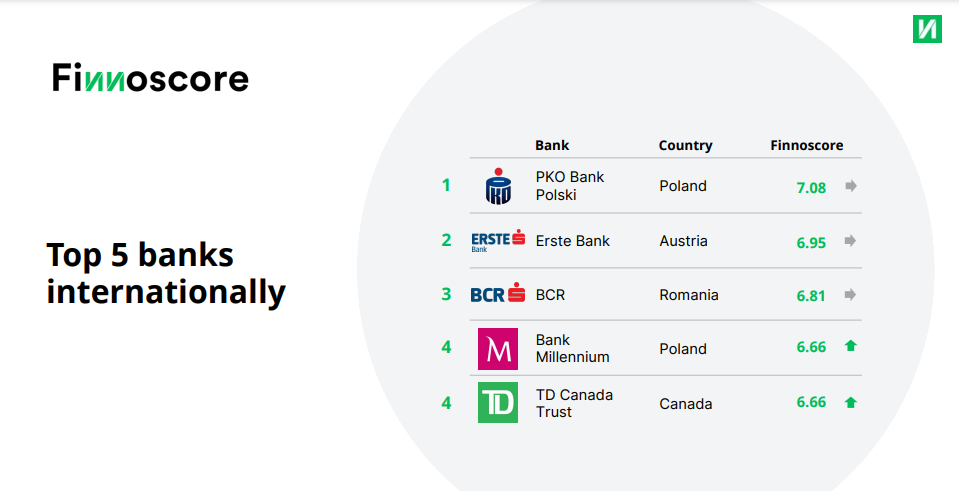

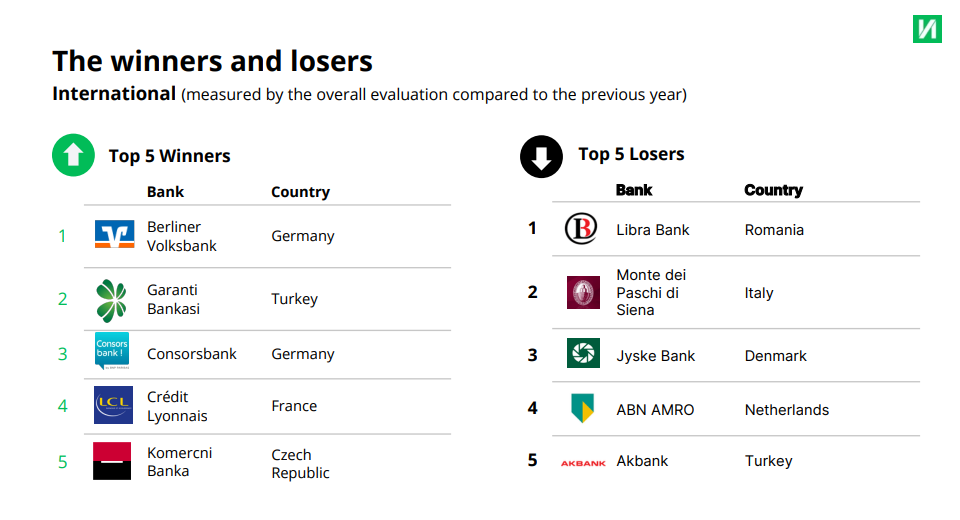

TD Canada Trust is the biggest winner among the Top 50, rising more than 30 places to land in the Top 5 (internationally). Germany does best in the D.A.CH. region with seven placings, but dropped a spot in the overall country ranking.

Also noticeable is how the gap between Germany’s banks is getting ever narrower. Austria comes in second place in the overall ranking with Erste Bank. And while the banks from Poland, Slovakia and the Czech Republic remain the industry leaders, the banking nation of Switzerland currently has no representatives in the Top 10.

The overhaul of the methodology and the creation of the Finnoscore Retailbanking study came about in cooperation with the Institute for Bank Management at the Joanneum University of Applied Sciences in Graz.

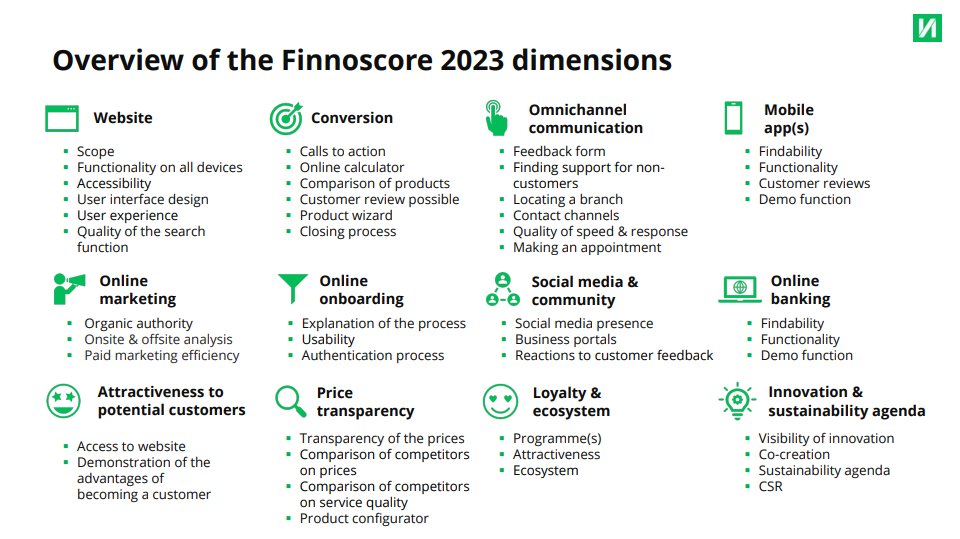

„We have 3 analysts evaluate each institution from the customer’s point of view based on 300 criteria and use best practice examples to show how the top performers do it in each of the 12 assessment dimensions. In this way, we show how banks can improve the relationship with their existing customers and attract new ones.” – says Chris Berger, the CEO of Finncosult.

Key Findings of Finnoscore 2023 International

With regard to conversion, 35% of the banks have implemented a product wizard that is capable of significantly improving the customer interaction as well as the overall customer journey. As the first touchpoint for customers, this possibility is especially important when it comes to more complex products that are difficult to select.

More than half of the banks in the sample are implementing concrete and visible initiatives regarding sustainability, on products or with employee involvement. This also includes supporting the community with the remodelling of playgrounds, as well as seminars and regional campaigns.

In the area of online onboarding, more than 79% of the banks in the sample offer authentication without media disruption. This means that customers no longer have to go the post office, a branch or an external provider to become a customer.

In the case of omnichannel communication, less than half of the banks offer more than three contact channels – however, in Germany, the figure is 71% and in Switzerland 86%. Moreover, only one third of banks provide the possibility to make an appointment directly online.

The Swiss banking system does not perform in the „ideal bank” top. Romania has two representatives in this top: BCR, on the mobile application, and OTP Bank for the online boarding process.

More details here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: