Financial stability risks from cryptoassets in emerging market economies. „Authorities can consider (selective) bans, containment and regulation”.

Report by the Consultative Group of Directors of Financial Stability (CGDFS) established at the BIS Representative Office for the Americas

The market value of cryptoassets peaked at around $3 trillion in November 2021. However, the bubble burst in early 2022, triggered by the collapse of the then third largest stablecoin TerraUSD. Cryptoassets lost almost two thirds of their value. In November 2022, the bankruptcy of FTX, one of the world’s largest crypto exchange platforms, further amplified market stress. Cryptoasset markets entered a “crypto winter”.

In emerging market economies (EMEs), cryptoasset adoption has been on a steady rise. For some users, cryptoassets provide an alternative to limited investment and savings instruments. For others they offer a seemingly safe haven against volatile domestic currencies. For EME financial authorities, there are serious concerns about their ability to monitor cryptoasset markets and to assess the financial stability risks from cryptoassets.

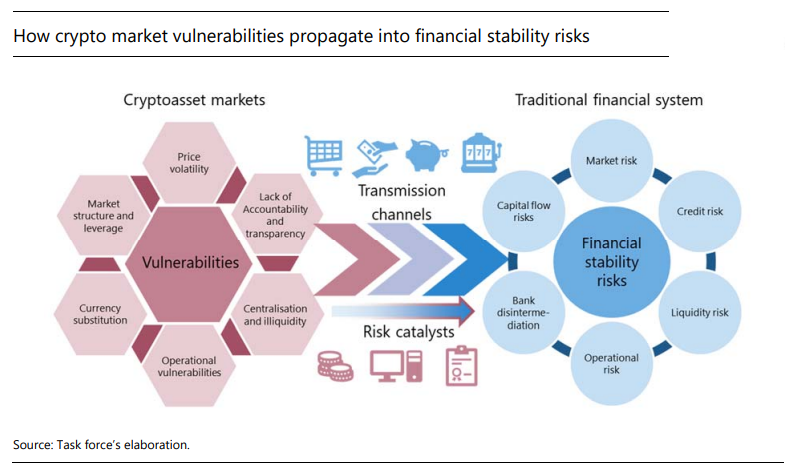

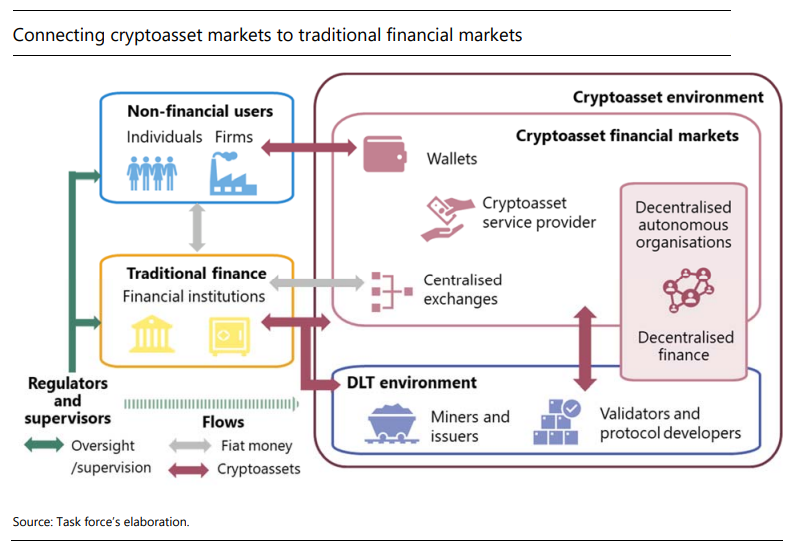

This report studies how vulnerabilities in the nature, structure, composition and function of cryptoasset markets translate into financial stability risks in traditional financial markets. This includes market, liquidity, credit and operational risks, bank disintermediation and capital flow risks. It then outlines the transmission channels through which these risks can affect financial stability. Risk catalysts in EMEs can strengthen these transmission channels, increasing a country’s vulnerability to financial stability risks. In general, the report finds three catalysts: the economic and financial landscape, technological penetration and regulatory stance.

The last part of the report details some principles for regulating and supervising cryptoasset markets in EMEs. Authorities can consider (selective) bans, containment and regulation. The report focuses on three main principles: establishing clear mandates for authorities, complementing activity-based regulation with entity-based regulation and addressing data gaps. This report was prepared by a task force under the auspices of the Consultative Council for the Americas (CCA) Consultative Council of Directors of Financial Stability.

Recent developments

Crypto exchange pilot in the Colombian sandbox

Colombia’s sandbox has been enabled by the Colombian financial regulators as a mechanism to promote technological, product and business model innovations. A pilot has been approved that allows alliances between financial institutions under the surveillance of the Financial Superintendency of Colombia and crypto exchanges to conduct digital transactions, such as deposits and withdrawals with cryptoassets within a controlled space, which helps to mitigate the operational risk.

Through this sandbox, innovative models are implemented with a relaxation of specific regulations, so that allow entrepreneurs can try out new models, and regulators can better understand such experiments for regulatory purposes. Participants can test and carry out operations in Colombian pesos with crypto firms, protected by high security standards, reporting obligations and adequate risk management.

Operations are supervised by the financial authorities, who ensure that consumer protection from the financial consumer standpoint is safeguarded. These initiatives seek to improve the prevention of money laundering, risk management, cyber security and AML/CFT compliance etc.

Cryptoassets as legal tender and cryptoasset payment cards

The adoption of Bitcoin as legal tender, as in El Salvador from September 2021, implies large risks, especially given the currency’s high price volatility. The risks pertain to financial stability, financial integrity, consumer protection and contingent fiscal liabilities (IMF (2021)). In El Salvador businesses are required to accept Bitcoin for payments and the government sponsors a Bitcoin wallet to incentivise the cryptoasset’s adoption as a medium of exchange.

A year after the introduction of Bitcoin as legal tender, only a fifth of the population was using the Chivo Wallet for Bitcoin transactions. More than double that number downloaded the app, but only to claim the $30 offered as an incentive. Among business owners, only a fifth said they were accepting Bitcoin as payment (Alvarez et al (2022)). The government spent more than $100 million buying bitcoins, which one year later were worth less than $50 million.

Another example of a potential domestic currency substitution risk is the case of a prepaid card offered by a large crypto exchange that allows its users, with a valid national ID, to make purchases and pay bills using cryptoassets. Users can perform transactions, both in physical and online stores, where their cryptoassets are converted to fiat currency in real time at the point of purchase.

As mentioned before, this type of product may be perceived as a hedge or a solution against economic and political uncertainty, and it may encourage an accelerated adoption of cryptoassets. It is worth monitoring the development of this product to evaluate the adoption of cryptoassets and the potential currency substitution risk.

Cryptoassets for remittances

The use of cryptoassets for international remittances could be adopted as a cheaper and faster alternative to traditional means of sending money abroad. In their latest estimate, one of the biggest Mexican crypto exchanges claimed that, in the first half of 2022, it processed remittances for $1 billion in cryptoassets, approximately 3.6% of the total flow in that period. If this kind of service became widespread, capital flow risks could develop.

However, Mexican financial authorities have emphasised the importance of maintaining a healthy distance between financial institutions and cryptoassets (see Box A). Financial institutions are not permitted to carry out external operations with cryptoassets, nor can they offer related services to

their clients. Users must therefore convert cryptoassets to Mexican pesos to use them as a means of payment and to enter the financial system. These measures imply a clear delimitation of the potential risks that the use of cryptoassets for remittances and cross-border payments might imply for financial stability.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: