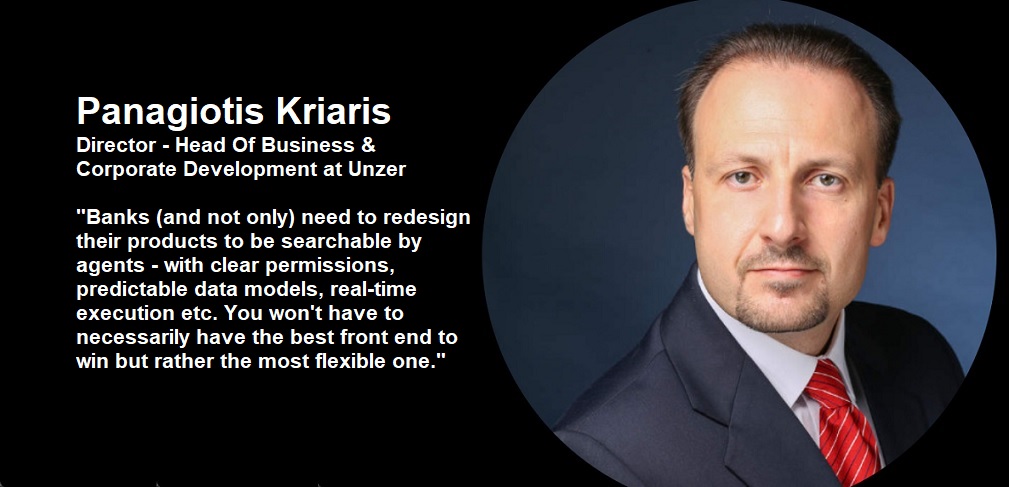

Financial services are moving from super apps to super agents. „It is the greatest structural change in decades.” – said in a blog post Panagiotis Kriaris, Director – Head Of Business & Corporate Development at Unzer.

Super apps transformed banking by reshaping how customers interact:

. One unified entry point instead of standalone, fragmented services

. Platforms and ecosystems as the dominant distribution model

. A shift from products to event-driven, contextual experiences

Now super agents are becoming the customer gateway themselves:

. The interaction moves into the background, becoming invisible

. Data, services, and decisions unite into one intelligent execution layer

. Customer intent is translated into outcomes without traditional journeys

𝗪𝗵𝗮𝘁 𝗱𝗼𝗲𝘀 𝘁𝗵𝗮𝘁 𝗺𝗲𝗮𝗻 𝗳𝗼𝗿 𝗯𝗮𝗻𝗸𝗶𝗻𝗴?

It flips the model entirely. Super agents become the new controlling layer. Distribution and execution blend into one. Agents will recommend and select products on behalf of users.

Banks won’t just need to be customer-centric – they’ll need to become agent-centric. If a bank’s products aren’t discoverable by agents, they will effectively not exist.

The question for banks is not whether they will become agent-centric, but how soon.

At last week’s Singapore FinTech Festival, Jason Cao, CEO of Huawei Global Digital Finance, offered clear guidance on the trends and how banks can react:

1. AI super agents will become the default entry point for financial services, shifting interactions from screens to intent-driven experiences.

2. Traditional banking models don’t have the capacity to serve every customer with the same depth. AI removes the resource bottleneck, enabling hyper-personalisation at scale.

3. AI will become a working counterpart embedded in the organisation, changing decision-making from rules and data to knowledge and agents.

4. The traditional classification of banks is starting to blur. In the future we will only have two kinds of banks: AI banks and the others.

5. Three trends stand out as AI use matures: 1) the shift from internal use cases to customer-facing scenarios 2) the move from efficiency gains to real value creation 3) the transition from isolated applications to end-to-end process redesign re-engineering.

6. Agent-driven customer interaction will depend on 3 pillars: accurate intent recognition, agents that can plan and remember context, and response times that feel instant. These are the building blocks of next-generation, language-based banking experiences.

7. Banks struggle to scale AI because they lack real-world scenarios, engineering capacity, and the partner network needed to move beyond pilots. Ronghai is Huawei’s answer: a ready-made ecosystem that gives banks proven scenarios and integration support, so they don’t have to build everything themselves. This makes AI deployment faster, more reliable, and far less fragmented.

What’s the disruptive part?

Instead of designing screens for customers, banks will have to design interfaces for agents. The UI or what we will call UI will be much more integrated into the product, the data structures, the constraints and the actions an agent can call. The better that layer is built, the easier it will be for agents. In practice, we will likely see fewer customer-facing flows and far more tools for orchestration, testing, and exposing product logic in a consistent way. UX teams won’t disappear, but their main job will become how customer journeys will be built and shared.

Cannot stress enough how this shift is not just about the UX but is mainly a distribution one. Banks (and not only) need to redesign their products to be searchable by agents – with clear permissions, predictable data models, real-time execution etc. You won’t have to necessarily have the best front end to win but rather the most flexible one.

Agentic AI will boost relevance for digital-first challenger banks?

Challenger banks don’t have an edge just because they’re digital-first. Most of what made them stand out, i.e. smoother UX, nicer apps, faster onboarding won’t matter in an agent-driven world because the customer won’t see any of it. Agents won’t judge them on design but instead they’ll judge them on how well their products meet their criteria. Where challengers do have a real advantage is in agility. They can restructure products, expose the logic agents need, and change internal workflows much faster than big banks. That flexibility will help them adapt their services to what agents actually need.

Graphic Source: Huawei

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: