an article written by John Ginovsky

The BNPL phenomenon is no fad. Consumers and merchants know about it and want it, and many fintechs are cashing in on the demand. Financial institutions need to rethink the very nature of lending and payments to meet rapidly changing consumer expectations and stem a significant loss of revenue.

If there was any doubt that the “buy now, pay later” (BNPL) phenomenon is here to stay consider this: The nine-year-old fintech company Affirm now originates close to $1 billion in loans annually solely for upscale exercise equipment company Peloton.

That one client relationship accounted for 28% of Affirm’s total revenue for fiscal 2020, which amounted to $1.2 billion. Affirm also claims as clients Verizon, Expedia, Warby Parker, and Walmart.

Notably, 48% of Affirm’s total customers are Millennials and the portfolio’s average credit score is about 740 — indicating that BNPL users are relatively young, established and creditworthy.

If you question the staying power of BNPL, consider that Amazon has its own offering, called “Amazon BNPL,” in which consumers pay one-fifth of the purchase price on eligible products up front, then the rest in equal, interest-free amounts over four months.

Several studies demonstrate that BNPL is a trend on the rise, and financial institutions must react quickly if they are to compete with the many fintechs providing such services — including Affirm and Klarna — but even more so because of the payment and tech giants in the game including market leader PayPal.

“Banks that underestimate the threat may see continued loss in share and could lose out on participating in a growing value pool … among younger and new-to-credit customers,” according to a McKinsey report. “To avoid that outcome, U.S. banks need to understand the landscape for POS financing and choose from among the emerging models.” (“POS lending” is another term for “buy now, pay later.”)

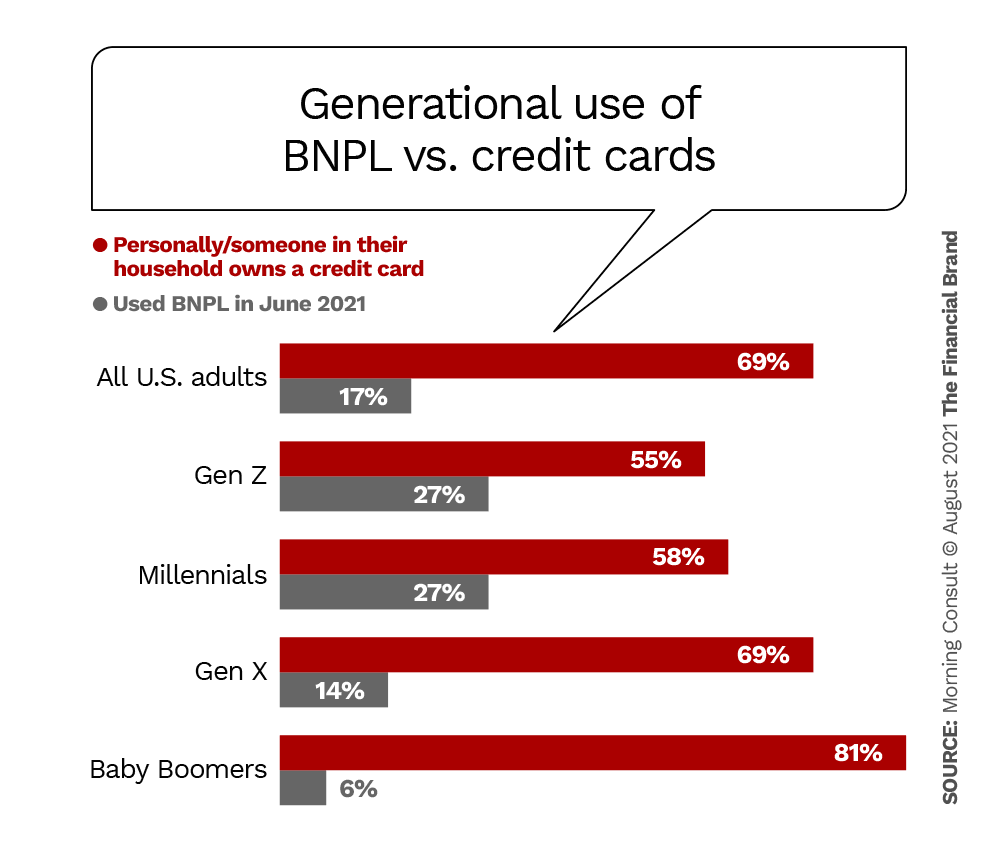

A survey of 4,400 U.S. adults by Morning Consult confirms how interest in BNPL skews toward the key Millennial and Gen Z segments, which are also so less likely to own a credit card than older adults.

“BNPL providers offer what can be a superior consumer experience compared to traditional credit solutions, which includes real-time approval processes, simpler and tech-savvy user experiences, and transparent pricing terms including 0% APR,” says a massive report on this industry by Financial Technology Partners (FTP).

The FTP report estimates that the total market potential for BNPL in the U.S. is about $5 trillion, which accounts for about 20% of the global market. “The Covid-19 pandemic has accelerated the shift to BNPL as commerce increasingly moves online and consumers look for ways to better manage their finances,” the report states.

Globally, FTP indicates that BNPL will jump from 2.1% of all payment methods to 4.2% in 2024, while most other payment methods decline. One exception is digital/mobile wallets, as shown in the table below.

In the U.S., credit originated at the point of sale is projected to continue its growth from 7% of unsecured lending balances in 2019 to 13-15% of balances by 2023, according to McKinsey. Further, a joint Credit Karma/Qualtrics survey found that 42% of Americans already have used some sort of BNPL service.

For more details download the full article here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: