Financial inclusion in emerging countries – an Ingenico white paper

February 20, 2012 – Three billion people live on less than US$ 2/EUR 1.50 per day. More than 2.5 billion of the world’s adults remain “unbanked” and do not use formal or semi-formal financial services. These alarming figures, combined with the economic growth of emerging countries, lead governments, NGOs, public and private institutions to bring financial services to the lowest income segment of society.

February 20, 2012 – Three billion people live on less than US$ 2/EUR 1.50 per day. More than 2.5 billion of the world’s adults remain “unbanked” and do not use formal or semi-formal financial services. These alarming figures, combined with the economic growth of emerging countries, lead governments, NGOs, public and private institutions to bring financial services to the lowest income segment of society.

As of today, the world’s 10,000 micro finance institutions provide funding to 190 million active clients; 500 million potential microfinance clients have yet to be reached. 128 million microfinance clients are among the poorest people on the planet, living on less than US$ 1.25 (EUR 0.96) per day, according to the latest Ingenico white paper: „Bringing financial services to emerging countries”.

The active loan portfolio of microfinance institutions is estimated at US$ 65 billion (EUR 50 billion). In December 2009, total investments in the microfinance sector reached US$ 21.3 billion (EUR 16.4 billion)33.

Financial inclusion is an essential part of government policies to ensure the benefits of economic growth are shared by a larger part of the population. Thanks to financial inclusion, people can achieve better nutrition, education and

health in a more secure environment favoring trade.

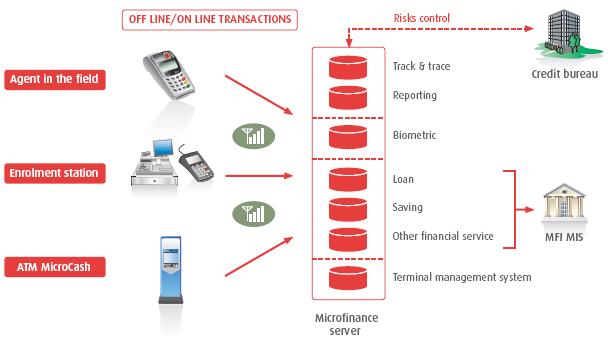

Financial inclusion can only be developed with an integrated approach, providing a secure system for all its stakeholders. Micro finance platform developers provide centralized systems to run the operations. In the field, POS terminals deliver a cost-efficient and easy way to integrate solution to deliver services to the customers, independently from their social level, while ensuring all operations are conducted in a secure manner. Moreover, thanks to mobile communications, POS terminals can ensure the security and control of the whole system, including micro finance institutions, agents and end-customers.

Systems architecture for financial inclusion and microfinance systems

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: