Analysis of pseudonymized and aggregated data from 3.6 million Nubank customers illustrates drivers and barriers along the journey to long-term financial health

According to the World Bank’s latest Global Findex Database, approximately 75% of the world’s adults have an account. That number has grown significantly over the past several years, which is a sign of real progress in the pursuit to bring more people into the formal financial system and create an inclusive, digital economy that works for everyone.

But that rise in access has not corresponded with a rise in the full use of the associated tools and services that put people on a path towards a more secure sense of financial health. We set out to understand why.

In this innovative study, Mastercard and Nubank partnered to investigate the needs, preferences, attitudes, goals and behaviors of millions of consumers. Through a combination of qualitative interviews, surveys of 2,000 Nubank customers and Brazilian consumers and granular analysis of three years of aggregated and pseudonymized transactional and behavioral data from over 3.6 million Nubank customers, we’ve gathered a rich set of insights to inform how we can collectively close the gap between account access and a sense of sustainable financial security and health.

The study, which analyzed consumer behaviors and needs through pseudonymized and aggregated quantitative data and qualitative surveys with Nubank’s customers and non-customers, suggests that Brazil stands out in Latin America for being at a stage of growing financial inclusion, with 70% card penetration (i.e. individuals owning a debit or credit card, according to the World Bank Global Findex), 55% card usage and a high level of real-time payments usage.

The elimination of typical infrastructure barriers to financial inclusion makes Brazil an advantageous market for studying the process and impact of financial inclusion independent of those barriers.

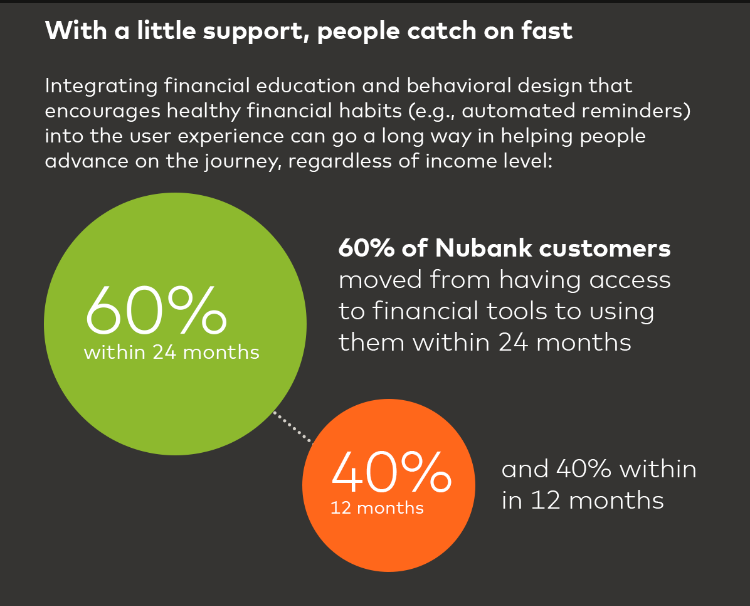

Sixty percent of Nubank’s customers moved from financial access to usage in 24 months and 40% within 12 months, regardless of income level. The study also suggests that making payments with prepaid cards can be a stepping stone to accessing advanced financial products. More than three-quarters (80%) of people who used a prepaid card used it as their first financial product, 67% went on to access loan products, and 36% progressed to make investments.

In Brazil, 84% of adults have access to financial accounts, but they may lack financial education to progress along the inclusion journey. Active financial product usage may also increase familiarity and trust, leading to accelerated financial inclusion.

“Since Nubank was founded, financial education has always been one of our pillars and it is also present in the design of our products and services in order to empower consumers to make the best decisions for their lives and have control over their money,” says Cristina Junqueira – co-founder and Chief Growth Officer from Nubank. “Although access to financial services in and of itself has had a major impact, advancing the literacy journey on these topics brings greater and more sustainable benefits not only to individuals, but to the community as a whole.”

Providing digital payment tools accompanied by financial education (e.g., according to Nubank, its „Money Boxes” are designed to offer financial planning in combination with interest-bearing savings accounts), encouraging responsible use of credit, and investing in micro, small and medium enterprises can be key ways to bring more people into the digital economy and help accelerate their journey to long-term, sustainable financial health. By applying the findings from this study, innovative solutions can be designed and deployed with the potential to empower people and power economies in Brazil and beyond.

“The journey to financial security and health is non-linear and full of obstacles – the only way to accelerate this journey is by understanding the barriers and then building and deploying inclusive digital solutions,” said Mastercard’s Marcelo Tangioni, division president, Brazil. “Through this study, we have clear evidence that frequent, consistent and responsible use of digital payment tools is critical to building trust and putting people on a path towards a more sustainable financial health.”

For additional information, read the full report here.

_____________

Survey Methodology

Survey: Boston Consulting Group (BCG) surveyed ~2,000 consumers across the Brazilian market

Interviews: Consumer interviews and focus groups, global expert interviews

Customer Data Analysis: 3 years of aggregated and pseudonymized transaction-level data for 3.6 million anonymized customers

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: