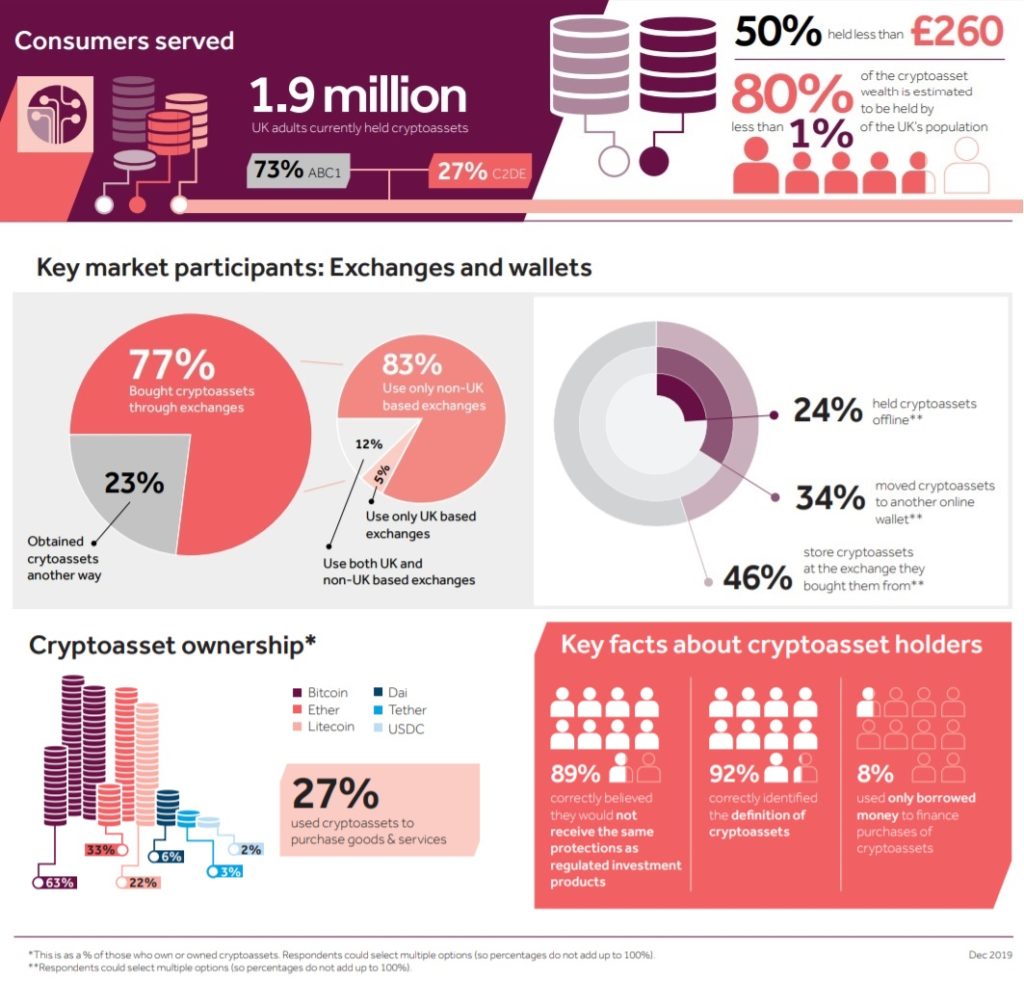

Financial Authority in UK said that almost 4% of the general population currently own cryptocurrencies. 1.9 million Britons holds Bitcoin, Ripple or other cryptoassets – half have more than £260.

An estimated 2.6 million UK consumers have bought cryptoassets at some point, new FCA research reveals. „The number marks a 1.1 million increase since the FCA completed a face-to-face survey on the same topic last year. Of the 1.9 million that still hold their cryptoassets – such as Bitcoin, Ripple or Ether – half have more than £260.”, according to the press release.

The research forms part of the FCA’s work alongside the Government and Bank of England to understand market size, consumer profiles and attitudes towards cryptoassets.

Key findings

. 75% of consumers who own cryptocurrencies hold under £1,000

. Of those who purchase cryptoassets, 83% do so through non-UK based exchanges.

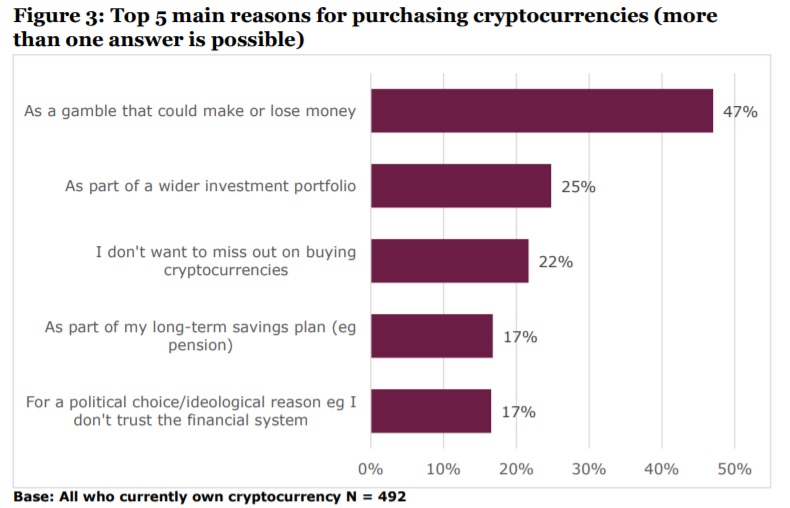

. The most popular reason for consumers buying cryptocurrencies was as ‘as a gamble that could make or lose money’, acknowledging that prices are volatile.

. 45% of all current and previous cryptocurrency owners said they had seen a cryptocurrency related advert. Of these, 35% or approximately 400,000 adults, stated it made the purchase more likely. 16% of current and previous cryptocurrency owners were influenced by an advert.

Amongst the other key findings of the study, which was conducted online by YouGov and saw a total of 2,681 participants questioned, were that:

. The majority of cryptoasset owners are generally knowledgeable about the product, are aware of the lack of regulatory protection afforded and understand the risk of price volatility;

. An estimated 300,000 cryptoasset owners believe they have protection, which leaves them at potential risk of financial harm;

. Adverts play a key role in influencing cryptoasset consumers’ decisions, with more than a third of respondents saying an advert made them more likely to purchase cryptoassets.

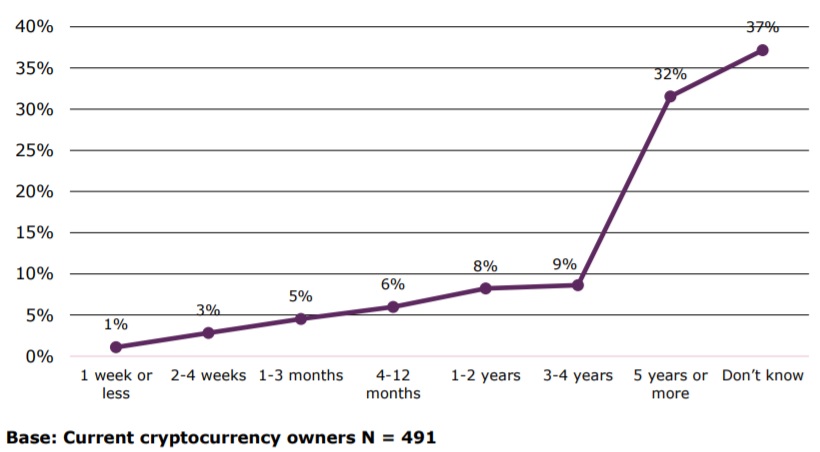

Most current cryptocurrency owners who have a plan for how long they intend to hold cryptocurrencies expect to keep them for 3 years or more. At the same time, almost 40% said they don’t know for how long they will hold their cryptocurrencies.

How long do you expect to typically hold your cyptocurrencies for

Year on year differences

. The research findings highlight a statistically significant increase from 3% in the 2019 FCA Consumer Research to 5.35% this year in those who hold or held cryptocurrencies. This represents an increase of 2.35 percentage points, from approximately 1.5 million people to 2.6 million people.

. In this survey, 8% reported to have used only borrowed money to purchase cryptocurrencies, while none reported so in the previous survey.

. This year 27% had never heard of cryptocurrencies, compared with 58% in the FCA survey last year. This represents a statistically significant increase in the percentage of those being aware of cryptocurrencies from 42% to 73% of adults.

. The media’s role in raising consumer awareness about cryptocurrencies has risen.

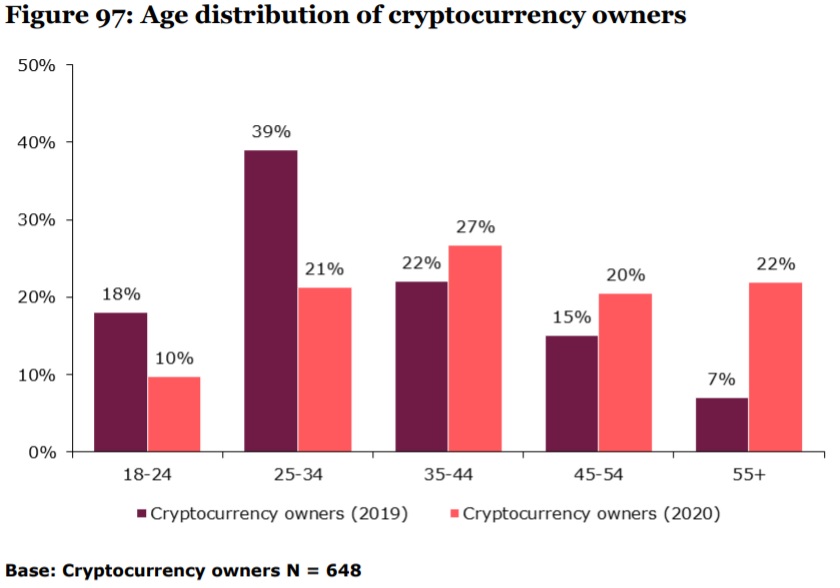

. Similar to the findings of last year’s FCA consumer research, the typical cryptocurrency holder is male (79%) and of social grade ABC1 (73%). When it comes to the age bands however, this year’s online consumer research shows that the cryptocurrency ownership seems to be more evenly spread.

The FCA’s Interim Executive Director of Strategy and Competition, Sheldon Mills, said: ‘”This FCA report reveals the increasing popularity of cryptoassets among the UK consumer population and underlines the importance of our work to gain a deeper understanding of this market and how people interact with these assets.„

„Cryptoassets present risks and opportunities for consumers and we hope these insights will help inform the policy debate in the UK and internationally as the use of these assets continue to grow.„

The FCA has previously warned that cryptoassets are highly volatile and risky. Many are not currently regulated in the UK. „This means that the transfer, purchase and sale of such tokens currently fall outside our regulatory remit, leaving customers unable to make complaints to the Financial Ombudsman Service or seek protection from the Financial Services Compensation Scheme,” FCA said.

The FCA is working with the Government and Bank of England, as part of a UK Cryptoassets Taskforce, to understand and address the harms from cryptoassets whilst encouraging innovation in the interests of consumers.

In its March 2020 budget, the Government said it intends to consult on measures to bring certain cryptoassets into scope of financial promotions regulation.

A policy statement is due this year following a consultation on banning the sale of certain cryptoasset derivatives to retail investors.

###

Of the 2,188 consumers who have heard of cryptoassets and completed the questionnaire, 165 had purchased cryptoassets. FCA boosted the sample of cryptoasset owners with a further 493 consumers and a total of 2,681 proceeded with answering a number of follow-up questions about their experiences

FCA 2019 guidance on cryptoassets can be found here:

https://www.fca.org.uk/publication/consultation/cp19-03.pdf

The 2018 cryptoassets taskforce report can be found here:

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: