Finance worker pays out $25 million after video call with deepfake ‘chief financial officer’

A finance worker at a multinational firm was tricked into paying out $25 million to fraudsters using deepfake technology to pose as the company’s chief financial officer in a video conference call, according to Hong Kong police, CNN reports.

The elaborate scam saw the worker duped into attending a video call with what he thought were several other members of staff, but all of whom were in fact deepfake recreations, Hong Kong police said at a briefing on Friday. Believing everyone else on the call was real, the worker agreed to remit a total of $200 million Hong Kong dollars – about $25.6 million.

The scam involving the fake CFO was only discovered when the employee later checked with the corporation’s head office.

Hong Kong police said they had made six arrests in connection with such scams.

At the press briefing, the police said that eight stolen Hong Kong identity cards – all of which had been reported as lost by their owners – were used to make 90 loan applications and 54 bank account registrations between July and September last year.

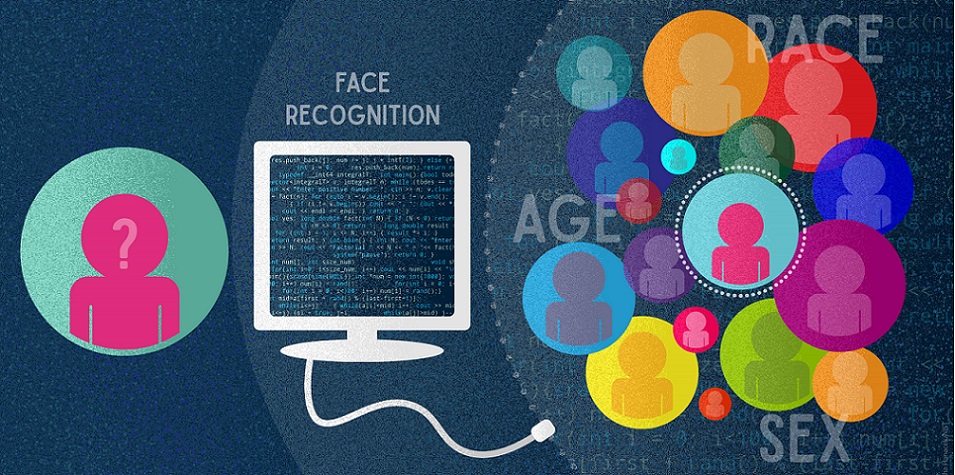

On at least 20 occasions, AI deepfakes had been used to trick facial recognition programs by imitating the people pictured on the identity cards, according to police.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: