Most countries in Latin America and the Caribbean are implementing fast payment systems (FPS), often with the goal of enhancing access to and use of affordable financial services. FPS offer immediate transfer of funds on a 24×7 basis between end users. This paper assesses how FPS can promote financial inclusion.

The authors find that FPS go hand-in-hand with greater access to loans and savings in the financial system. The paper also discusses the current experience of countries across the region in FPS and related payment innovations, including central bank digital currencies (CBDCs).

Finally, the authors discuss the key challenges in practice associated to cybersecurity risks and fraud, interoperability, end user and participant fees and universal access.

Access to financial services has improved but gaps remains

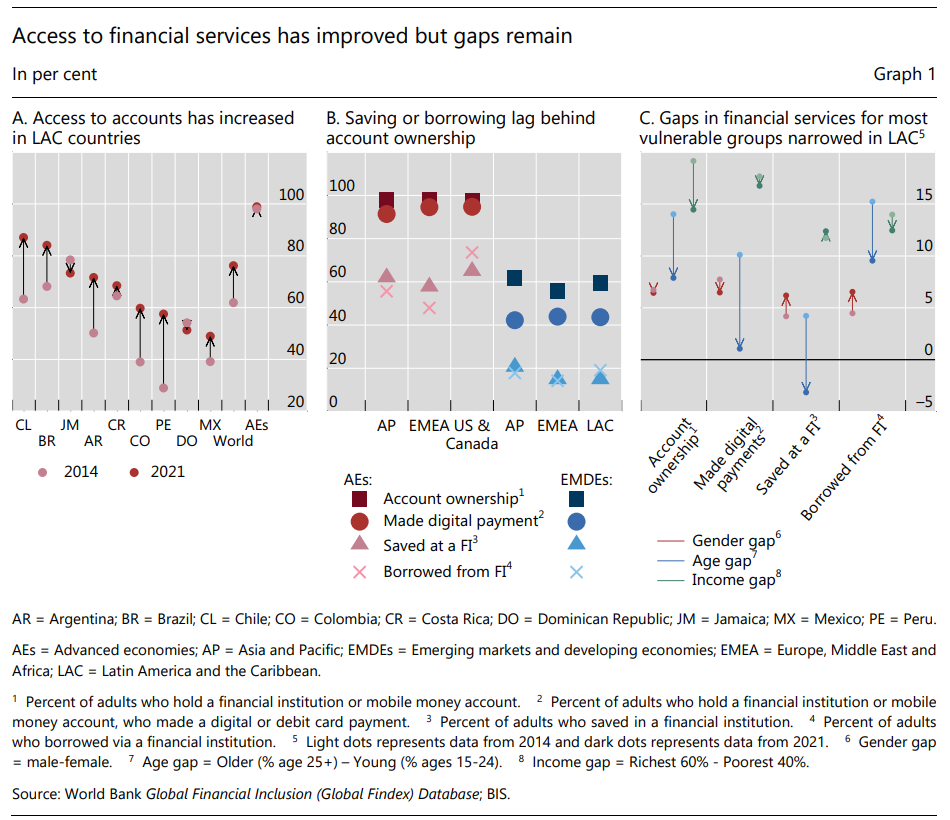

Significant progress has been observed in Latin America and the Caribbean (LAC) in the expansion of access to financial services. Between 2014 and 2021, nearly all LAC countries have increased the share of individuals with access to a transaction account, thereby allowing them to become part of the formal financial system.

Notable examples include Argentina, Chile, Colombia, Brazil and Peru. By contrast, some countries in the region (eg Dominican Republic and Jamaica) show a decrease in access to accounts (Graph 1.A). Despite progress over the past decade, the lack of access to financial services remains acute in many EMDEs. Only a quarter of adults in EMDEs use a savings account, and about half borrow – with more than half of this coming from informal sources (Demirgüç-Kunt et al (2022)).

Access to credit or savings products is even lower in some regions, such as LAC (Graph 1.B). Between 2014 and 2021, gaps in access to accounts, payments and financial services for the most vulnerable populations (ie women, low-income individuals and the youth) have narrowed considerably. An important exception is the gender gap in savings and loans, which widened (Graph 1.C).

More details: BIS Papers No 153 – Fast payments and financial inclusion in Latin America and the Caribbean

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: