Facial recognition technology trialled as card fraud prevention

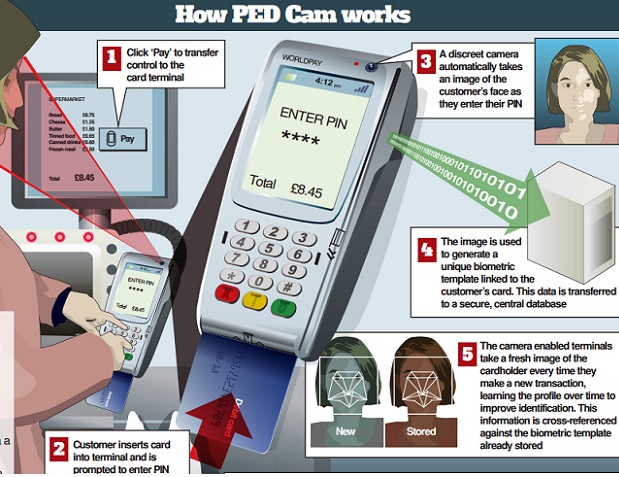

Researchers at Worldpay are investigating the use of facial recognition technology to help combat card fraud in stores across the UK, it was announced at the Better Business Conference last week. “PED Cam” (Pin Entry Device Camera) a prototype device developed by Worldpay, uses an upward-facing camera, embedded into a standard card terminal to take a picture of the card-user whenever they enter their PIN. The resulting image generates a unique biometric template, linked to the individual’s card and is stored in a secure, central database managed by Worldpay.

Card terminals linked to the central database capture a fresh image of the card-user’s face every time they enter their PIN learning the profile of the user over time to improve identification. This image is automatically cross-referenced against the biometric template already captured and recorded in the system, providing a second layer of authentication to verify the identity of the card-user.

„The prototype design uses low-cost, readily available technology and whilst the team behind the research is keen to stress its design is still in concept phase, they believe the principle of using facial recognition to verify the identity of card users has a number of distinct advantages over other forms of biometric security currently being trialled in the payments space.” according to the press release.

Speaking at Worldpay’s Better Business Conference, Nick Telford-Reed, Worldpay’s Director of Technology Innovation, explains: “Biometrics has attracted a lot of attention, but achieving sufficient scale has always been difficult in a face-to-face environment. It’s partly because of cost, but also because people don’t want the admin hassle of registering their details.

“With this prototype we would remove that hassle. Card users could be automatically enrolled in the system when they use their card. The design also means retailers would not have to find space for another device on their already busy sales counters.”

Worldpay’s team of researchers are currently evaluating consumer reaction to the camera in controlled trials as well as investigating how consumers could opt in to the biometric system, to assess the viability of the prototype. The team is also exploring the potential of using the biometric profile captured by the device as a way of verifying user identities online as well as in-store.

Worldpay is a global leader in payments processing technology. On a typical day, company process approximately 31 million mobile, online and in-store transactions. In 2014, Worlfpay supported approximately 400,000 merchants in 126 currencies across 146 countries offering 326 local and alternative methods of payment.

The Group has three operating divisions: global eCom, Worldpay US and Worldpay UK. Worldpay UK has a 42% market share in the UK and helps businesses of all sizes sell more to their customers by accepting card payments in-store, online, via mail or telephone, and on the move.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: