Facebook Messenger will now have person to person payments

Facebook added a new feature in Messenger „that gives people a more convenient and secure way to send or receive money between friends”, according to the company’s press release. The new payments feature is rolling out in the coming months in the US across Android, iOS, and desktop.

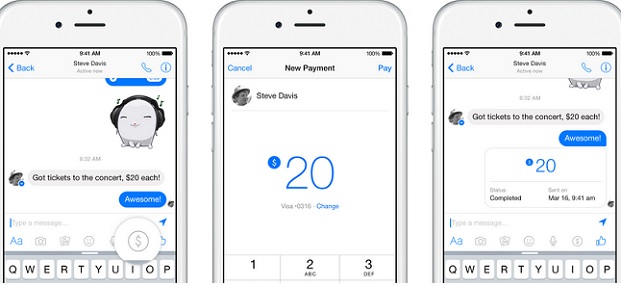

The peer-to-peer method of sending money inside Facebook Messenger is much more convenient than what Western Union and MoneyGram offers right now. People will only have to launch the Messenger app from their phones or tablets, send a message to a friend, click the $ icon, input the amount of the money to send, and then add a Visa or Mastercard debit card to complete the procedure of sending the money.

In the US there has not yet been a person to person payment system centered around a communication platform, according to letstalkpayments.com. One could argue that Google’s system was a communication platform centered around gmail but it was not fully linked to the chat system.

„It turns out a vast majority of Facebook’s 500 million monthly users are logged on to Facebook Messenger with about 80 million payment cards on file. With Facebook Payments, the entire system is currently built around the Messenger platform.”

How does Facebook payments work

To use the system, the sender associates a US based debit card with a Visa or MasterCard logo to her Facebook account. If the user already has a debit card on file with Facebook from gaming, advertising or donations, this can be the default card. The system will allow for the user to image the card via a camera or to manually enter the card into the setup form. Users will be prompted to set a passcode or use Apple TouchID on compatible iOS devices to confirm transfers, although one can opt out of this authentication in the settings panel. Once an account is confirmed, it’s ready for use.

To send money, press the “$” button in the Messenger message composer – you have an option to send a photo or sticker along with a text message and the money – enter in an amount that is currently less then $250 and tap the “Pay” button.

The money is instantly removed from the sender’s debit account and delivered to the recipient’s Facebook associated debit card. Facebook uses the debit card network which can take about 24 hours to become usable. Both sender and recipient will see a confirmation message detailing the transfer status and time.

If the recipient has not associated a debit card, they will be prompted to register, going through the same process and choices as the sender. If for some reason the money is not claimed by the recipient in 30 days, it will revert back to the sender. Along the way, Facebook will send the recipient notices to claim the money.

As an added security feature, Facebook may ask users some extra security questions before a transfer can be authorized. This may take the form of “Did you ever own a red car?” or “In what city did you live in during the period of 1984 – 1986?”, etc.

Facebook says that „the money you send is transferred right away – it may take one to three business days to make the money available to you depending on your bank, just as it does with other deposits.”

„The first time you send or receive money in Messenger, you’ll need to add a Visa or MasterCard debit card issued by a US bank to your account. Once you add a debit card, you can create a PIN to provide additional security the next time you send money. On iOS devices you can also enable Touch ID. As always, you can add another layer of authentication to your account at any time.”, accordint to the mentioned source.

The side effects of the movement from a capital market analyst perspective

„This super convenient money transfer method coupled with the 500 million user base of Messenger could hurt Western Union, MoneyGram and other traditional/digital money remittance firms. People will no longer have to spend time going to a bank or remittance center to send or receive money via Western Union or MoneyGram. They also avoid paying the expensive transaction fees that Western Union charges.

The money transfer feature of Facebook Messenger will only initially be enabled in America but the huge number of Facebook users outside the U.S. will eventually compel Zuckerberg to expand the feature to other countries. The potential damage to Western Union and MoneyGram is significant considering they are the two top players in the global remittance business. PayPal might also get hurt.

The global mobile payment transaction market will be worth $2.85 trillion by 2020. Facebook’s growth prospect therefore just got better with Facebook Messenger now enabling people to send money. Facebook’s future is no longer exclusively tied to mobile advertising.

However, investors should now also take into account the multi-trillion dollar opportunity in digital payments when evaluating the future of Facebook. I say FB is a Buy. Facebook, by virtue of its viral popularity, could be a credible future digital payments leader. „

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: