An European Payments Council interview featuring Saar Carre – Head of Payments and Daily Banking and Program Manager at Febelfin.

What are the main characteristics of the current Belgian payment landscape and how has it evolved in the recent past?

The Belgian payments landscape could be summarised by three characteristics: interbank cooperation, digital and instant.

Firstly, innovative means of payment have always been at the heart of the Belgian financial sector. In the 1970s and 1980s, the sector was the European leader in digital payments thanks to thorough interbank cooperation – think SWIFT and the local card scheme, Bancontact (now Bancontact Payconiq Company). Over the past decade, the Belgian financial sector has successfully embraced the digital revolution, resulting in high-end digital bank apps and payment experiences.

This is also reflected in the findings of the yearly online survey commissioned by Febelfin on the use of online and offline bank channels1.

Although PC banking was clearly preferred in the past (eighty-seven percent), the app is now gaining the same level of interest (eighty-five percent). Sixty-nine percent of all transfers are done via an app, and thirty percent via PC banking. The top three services most used via mobile and internet banking are: making payments (seventy-seven percent), checking balances/transactions (sixty-eight percent) and making transfers between a customer’s accounts (forty-seven percent). This evolution towards digital does not however mean that banks are not committed to the non-digital client.

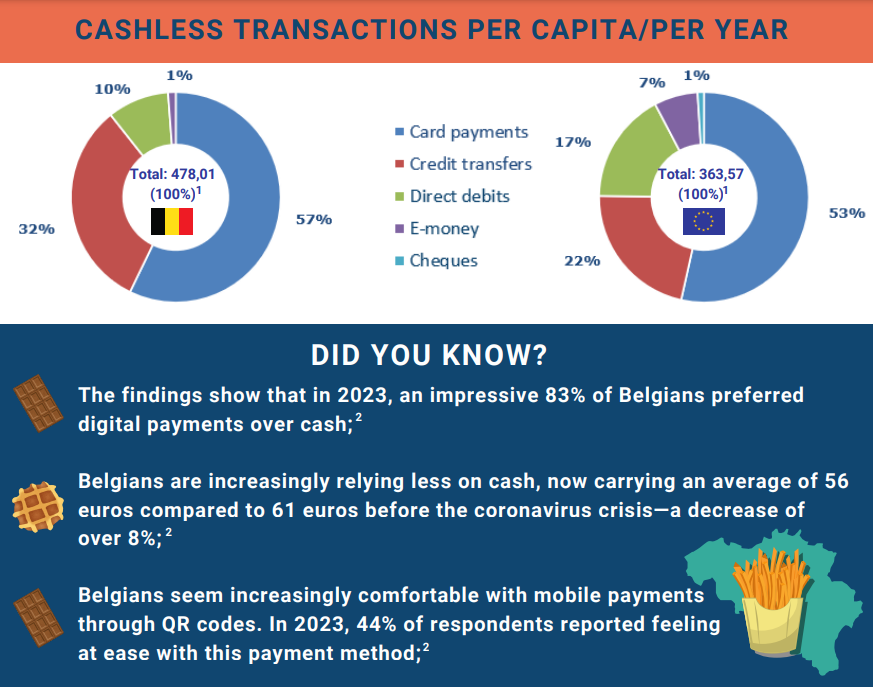

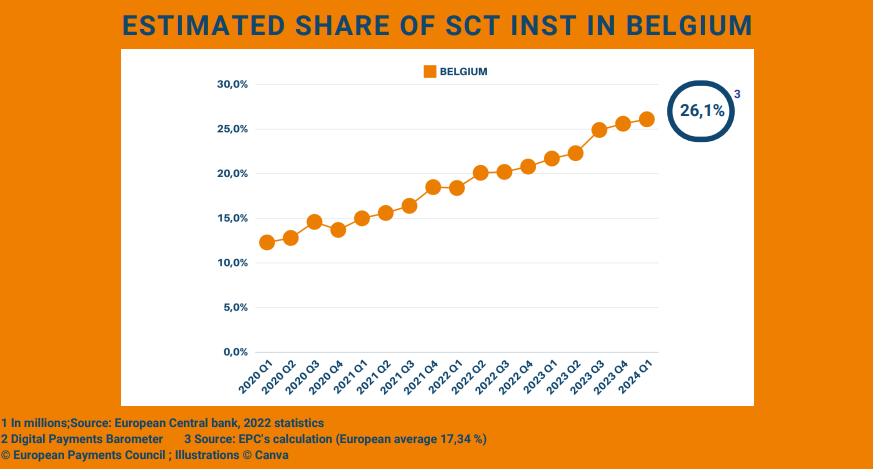

Secondly, Belgium was a frontrunner to implement instant credit transfers in 2019. Today we have 47 credit institutions offering regular credit transfers, of which 24 offer instant credit transfers. These 24 credit institutions cover ninety-six and a half percent of all payment accounts in Belgium. When we look at the volume of instant credit transfers, we see that in 2023 more than twenty-six percent of the total credit transfer volume was processed instantly. This number will continue to rise with the new Instant Payment Regulation.

On 1 July 2022, it was made obligatory for merchants to accept digital payment methods at the point of interaction (POI). How does this reflect in payment statistics?

This new law acknowledges shifting payment behaviours and empowers merchants to better meet the expectations of their customers. Refusing digital payments can significantly impact merchants, as highlighted by our Digital Barometer3, which indicates that more than one in ten Belgian customers have walked away from a store because they were unable to pay digitally. The Barometer explores payment trends in Belgium, encompassing contactless payments via QR codes or connected devices, as well as the emergence of cryptocurrencies.

On average, Belgians use electronic payments twice as frequently as cash transactions in brick-and-mortar shops. This trend signifies a decreasing reliance on carrying cash, with Belgians now carrying an average of fifty-six euros compared to sixty-one euros before the coronavirus crisis – a decrease of over eight percent.

What will the arrival of the European Payments Initiative (EPI) mean for the Belgian payments sector?

I welcome the arrival of the EPI and the digital wallet, Wero. The EPI is the first step towards an instant European account-to-account-based pan-European payment solution – something that is lacking in Europe today. Today, consumers are often confronted by the fact that their local payment app does not work abroad, so they have to fall back on using their payment card. Although the participating countries are still limited, this will already be of added value for Belgian customers, as the countries taking part are our neighbouring countries and popular holiday destinations. The impact on the existing payment solutions in Belgium remains to be seen.

How do you see the Belgian payments sector developing in the near future?

I see three main challenges for the Belgian payments sector in the near future.

Firstly, we have the emergence of new types of fraud that are becoming more sophisticated by the day. New technologies, like generative AI, can be an opportunity for banks but also entail risks as they can also be used by fraudsters. Banks will have to protect themselves and their clients against these new risks.

Secondly, Belgian banks are confronted with a tension between instant and “slow” banking. The latter is becoming an increasingly stringent demand from Belgian policy makers and customers. As I mentioned before, banks strive to serve all customers but this tension will be a challenge in the years to come.

Thirdly, the banking sector is being confronted by an avalanche of new regulations impacting the core of the payment sector. This will lead to an even higher cost of compliance in the future.

_____________

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: