Data presented by Buy Shares indicates that Europe’s card fraud value has hit Є1.55 billion with the United Kingdom accounting for almost half at 45.36%. The UK’s value stands at Є706.9 million. From the data, Romania has the least card fraud value at Є2.9 million.

The United Kingdom accounts for the highest fraud cases considering that it’s one of the significant card markets based on volumes and values of card transactions. The high value, of fraud, is a result of a high level of using cards for online purchases.

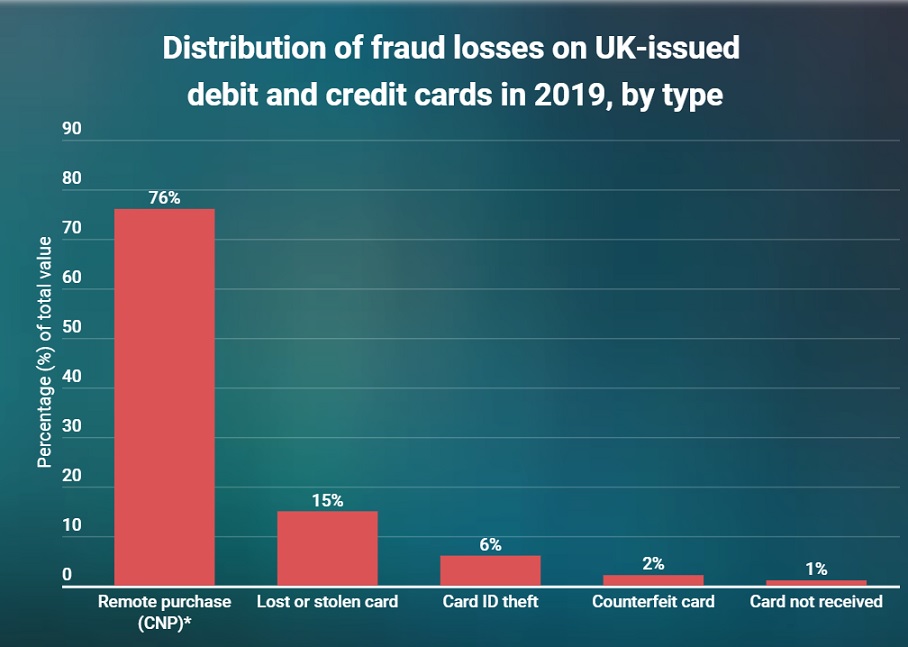

From the data, the Card not Present (CNP) fraud continues to gain popularity in a period most customers are turning away from using their physical cards and simply enter their details to make a purchase. Notably, CNP fraud has become more popular with the growth of eCommerce and the increased security around other types of fraud.

One notable source of CNP fraud has been the malware and phishing attacks that have become increasingly sophisticated. In Europe, most cards come with an EMV chip which requires a PIN to be entered into the merchant’s terminal for payment authorization. However, a PIN isn’t required for online transactions, posing a perfect avenue for fraudsters.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: