Europe’s banking population surpasses 400 million. The average percentage of banked population in EU countries is almost 80%.

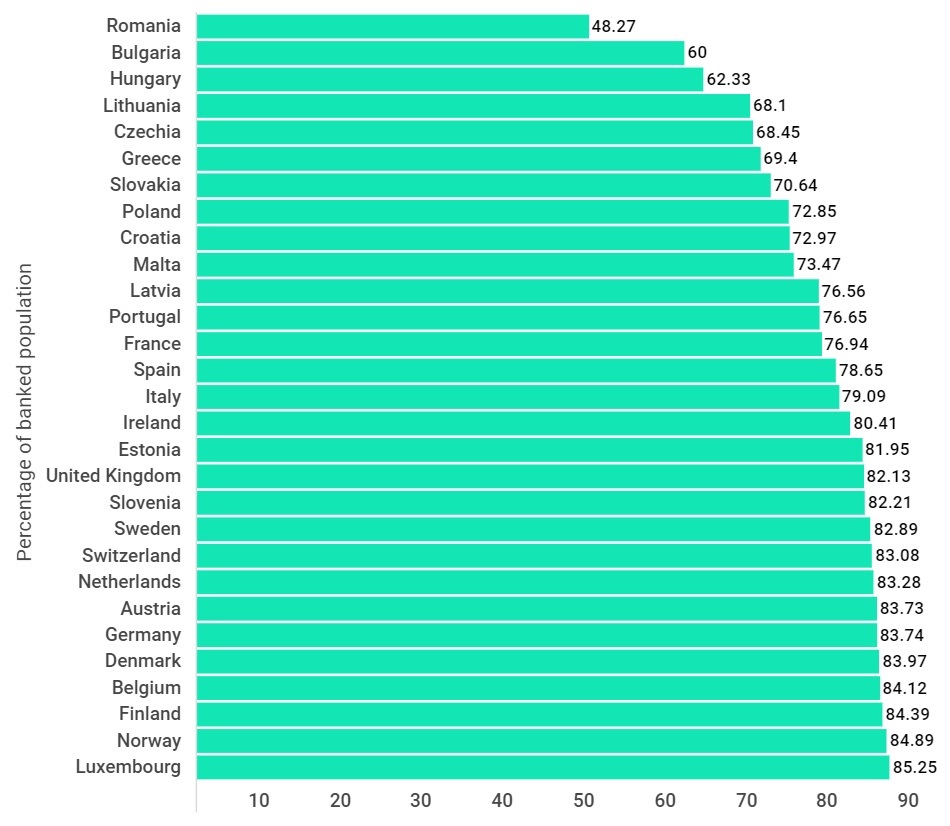

Although Romania ranks ninth in the top countries in terms of population, less than half of Romanians are banked (48%) – the lowest percentage of all EU countries.

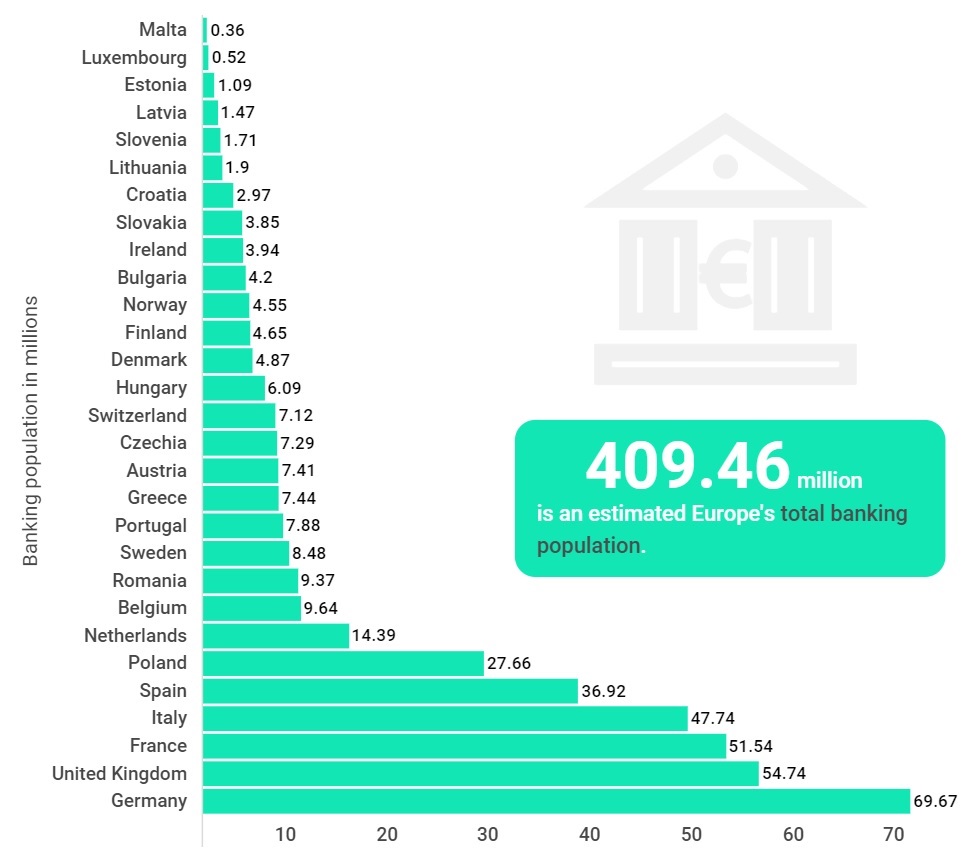

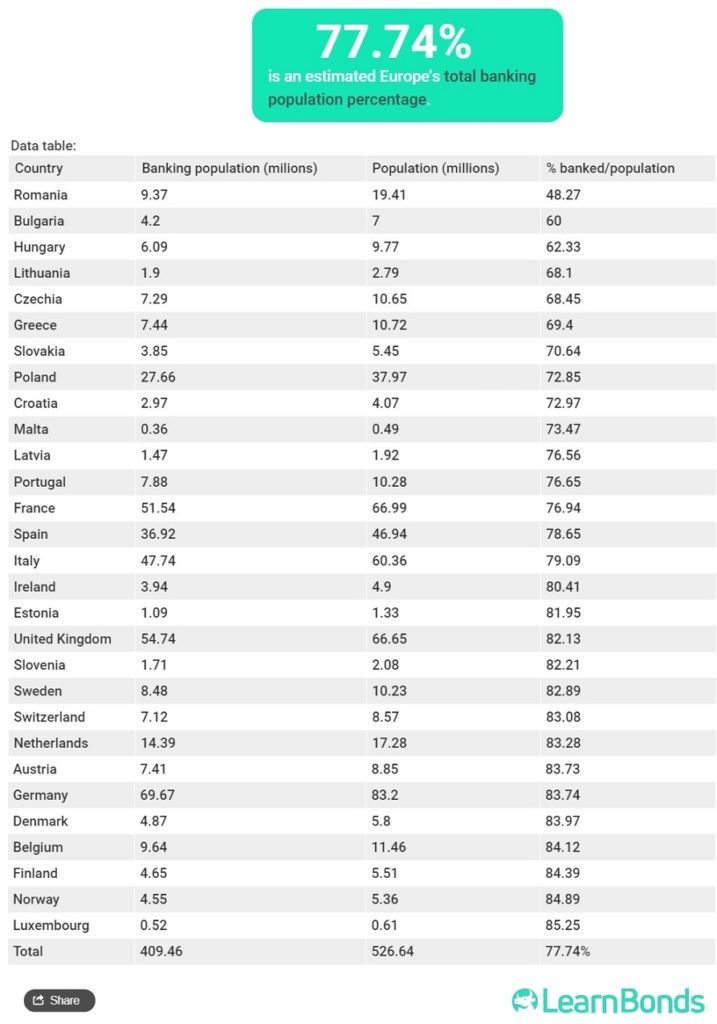

Europe’s banking population continues to grow with over three-quarters of the population having access to a bank account as of 2019. Data obtained by Learnbonds.com shows that currently, about 409.46 million European residents are now part of the banking system.

Germany has the highest number of people with access to bank accounts at 69.67 million representing a banking rate of 83.74% based on the country’s current population of 83.2 million. By the end of last year, the United Kingdom had the second-highest banking population at 54.74 million. The country has a population of 66.65 million people, translating to 83.19% banking rate. France has the third-highest banking lot at 51.54million with a banking rate of 76.94 based on its population of 66.99 million people.

Italy with a population of 60.36 million has a banking rate of 79.09. At least 47.74 million Italians have access to bank accounts. Spain occupies the fifth slot with a banking population of 36.92 million and a rate of 73.84%.

Banking population in Europe, by country (in millions) – in 2019

Details: Figures shown are a Statista estimate using the following calculation: Total population over 15 years of age by country multiplied by the percentage of adults that reportedly have a bank accounts.

Percentage of banked population in Europe, by country (%)

Source: Worldometers.info, World Bank; Statista; Statista estimates; EBF; Various sources

text

Luxembourg emerges with the high banking population rate

On the other hand, Malta with a population of 0.49 million has the least banked people at 0.36 but a higher rate of 78.77%. Elsewhere Estonia also has the least banking population at 1.09 million with a rate of 81.95% based on its current population of 1.33 million. Out of all the European countries, Luxembourg has the highest banking rate at 85.25% with a banking population of 0.52 million. On the other hand, Romania with a population of 19.41 million has the least rate at 48.27%. In general, the current European population stands at 526.64 million representing a banking rate of 77.74%.

The banking population refers to individuals with bank accounts that enable them to manage their finances through traditional financial services. Bank accounts act as a source of storing money but also connect customers to the formal financial system and enable them to make day-to-day living less complex as well as allowing them to establish their wealth.

The high number of banking population in Europe can be attributed to various aspects. In this case, banking has become a social integration element since access and use of a bank account has become a way of life. At the same, the use of cash is on the decline since salaries, benefits, and utilities are being paid via bank accounts while consumer goods and services are paid via payment cards.

Technology has also played a role in the rising banking population. For example, the emergence of challenger banks enables individuals to open banks at the click of a button on their smartphones. Europe has emerged as one of the leading regions with challenger banks that seek to disrupt the traditional systems.

Efforts towards increasing the banking population

The existence of the unbanked population might be due to a lack of access to convenient, affordable banking services, or they simply prefer to use alternatives to traditional financial systems. Efforts to increase the banking population usually target people who are unbanked and underbanked. It is worth mentioning that having a banking population goes beyond merely opening a bank account.

It is not clear why some individuals do not take advantage of traditional financial services, however levels of education, and income play a key role. Individuals outside the banking populations have generally lower incomes and lack advanced education like college diplomas and degrees. Additionally, access to credit also plays a key role. Some individuals have no access to traditional bank credit hence they choose to stay away.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: