ETTPA, the European trade association representing the interests of bank-independent TPPs, has published a new EU-wide registry of obstacles (available here) compiled by Third Party Providers (TPPs), which highlights the many problems experienced with PSD2 APIs.

„Following more than three years since the introduction of PSD2 APIs we still don’t see a successful and coherent implementation of PSD2 that Fintechs can succeed on and that payment service users can rely on. This public registry shall contribute to the fruition and full implementation of PSD2 by disclosing these obstacles, and thus putting additional pressure for their much needed removal.” – according to the press release.

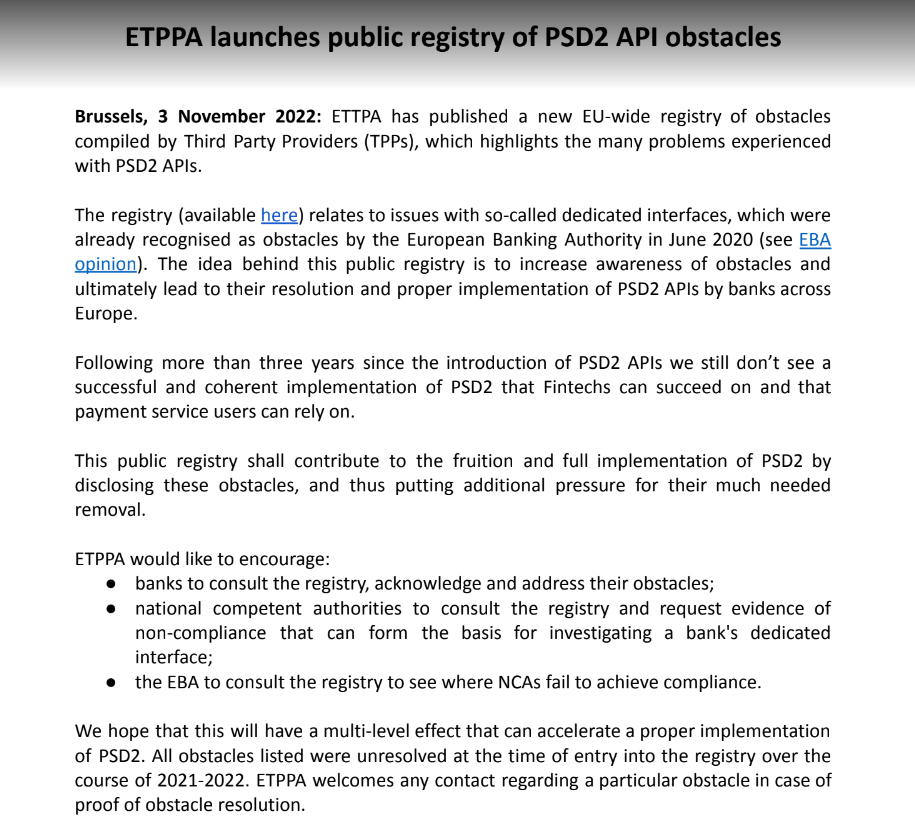

The official press release.

ETTPA will be represented at the Banking 4.0 international conference by its vice-president, Arturo Gonzales Mac Dowell. He is also Co-Chair Sepa Payments Access Scheme Multi Stakeholder Group within European Payments Council and the Chair of AEFI – Asociación Española de FinTech e InsurTech.

Banking 4.0 is dedicated to the impact of the emerging technologies in banking (AI, machine learning, cloud computing, Robotic Process Automation, Banking as a Service, open banking, SoftPOS technology, etc.) and is probably the most relevant digital banking event in SEE region. Tickets are available here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: