European Payments Council: „we believe that end-2020 is a realistic target for achieving a critical mass of SCT Inst scheme participants across SEPA”

Sixty-eight percent of the participants to a European Payments Council (EPC) poll think the SEPA Instant Credit Transfer scheme will reach a critical mass by 2020.

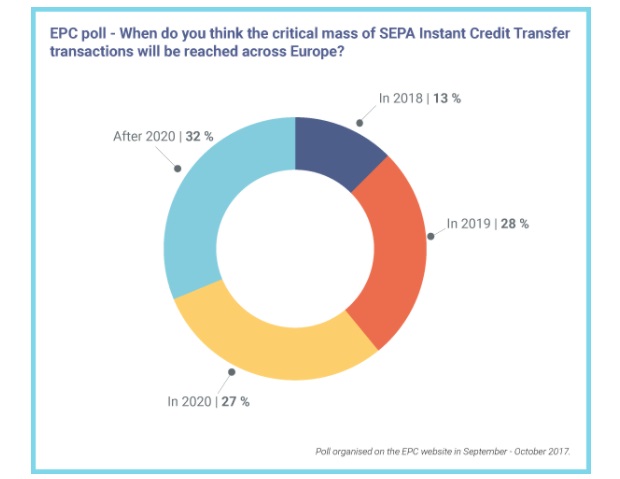

EPC recently organised on their website a poll open to all, with the following question: ‘When do you think the critical mass of SEPA Instant Credit Transfer transactions will be reached across Europe?’

The results show the confidence of European payment professionals that this new scheme launched on 21 November 2017 will quickly take-off. Sixty-eight percent of the persons who cast their vote think the critical mass will be achieved in 2020 at the latest.

Here are the detailed results:

The SCT Inst scheme enables the transfer of up to 15,000 euros in less than ten seconds. For the moment, nearly 600 payment service providers from eight European countries (Austria, Estonia, Germany, Italy, Latvia, Lithuania, the Netherlands and Spain) propose SCT Inst services.

In addition, nearly 1,000 PSPs have already committed to offer SCT Inst services by July 2018, and more are expected to join the scheme by 2019. Among them, PSPs from Belgium, Bulgaria, Finland, Malta, Portugal and Sweden, and more PSPs from Germany and the Netherlands.

„We share the opinion of the persons who participated in our poll, and also believe that end-2020 is a realistic target for achieving a critical mass of SCT Inst scheme participants across SEPA.”, the European Payments Council says.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: