European Payments Council: best use case of the SEPA Instant Credit Transfer scheme is consumer-to-business (P2B) payments

European Payments Council (EPC) recently ran on its website a poll on the forthcoming Instant Credit Transfer (Inst) scheme. EPC asked the following question: “In your opinion, for which situation would the Inst scheme be the most useful?”.

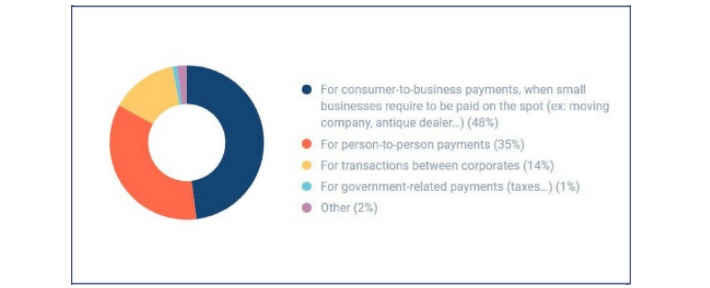

The results are clear: nearly half of the voters (48 percent) think that consumer-to-business payments will benefit the most from Inst. The new scheme is deemed to be a relevant payment solution in particular for small businesses who require to be paid on the spot (e.g. moving company or antique dealer).

35 percent of the voters believe on the contrary that Inst will be mostly useful for person-to-person payments.

Only 14 percent of those who cast their vote see Inst as a relevant instrument for transactions between corporates. This low share of votes can be explained by the scheme’s current transaction limit — 15,000 euros — which might not sound attractive for corporates. This parameter will however be regularly reviewed starting in November 2018, after the scheme’s first anniversary.

A mere 1 percent of voters believe government-related payments to be the most useful situation for Inst. Finally, 2 percent chose the ‘other’ answer.

Source: European Payments Council

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: