The value of digital payments for retail sales in the EU has more than doubled since 2017 to more than €1 trillion in 2023. Still, there are persistent issues with account data-sharing.

The EU’s approach to digital payments has helped to make them safer, faster and cheaper for users. However, a new report by the European Court of Auditors (ECA) points to two key aspects of price interventions and account data-sharing.

„First and foremost, there is no provision requiring the Commission to periodically review EU price interventions, in particular for card fees. Furthermore, sharing account data free of charge may act as a disincentive to delivering high-quality open banking services in the EU.” – according to the press release.

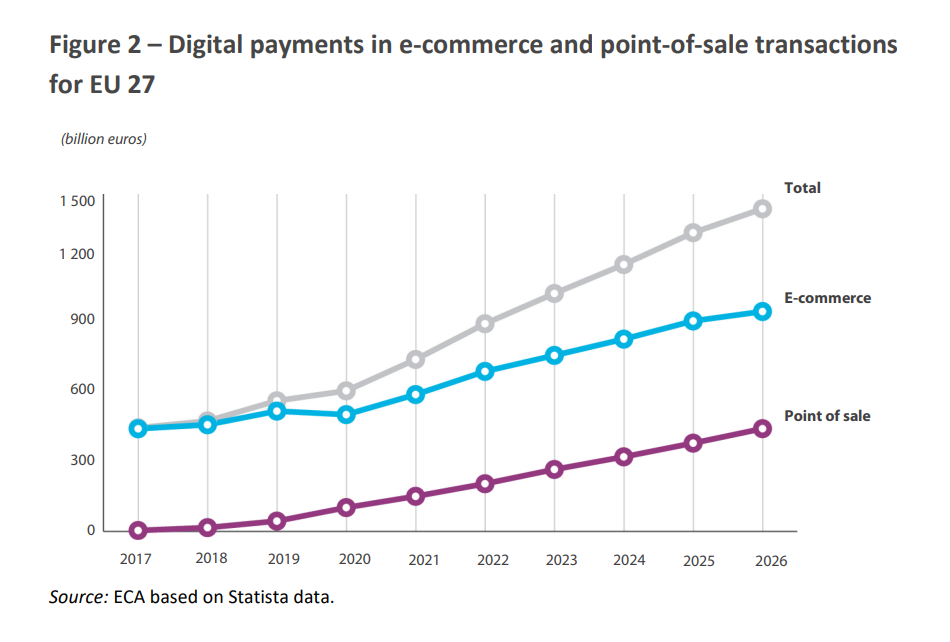

Digital payments for retail sales in the EU more than doubled in value between 2017 and 2023, surpassing €1 trillion in 2023 (figure 2). As digital payments are crucial for the EU’s internal market to function smoothly, especially across borders, the EU has responsibility for ensuring that they operate efficiently and effectively. In the case of card fees, for example, the auditors estimate that EU consumers paid €5 billion to €6 billion in 2023.

EU price interventions aim to reduce the harmful effects of unfair competition or to meet certain policy goals, potentially in consumers’ favour. Under the EU’s digital payments system, such interventions include the interchange fee cap for card payments, the surcharge ban on card payments and SEPA (Single Euro Payments Area) payments, the provision of open banking free of charge, and price parity between cross-border euro payments.

“We found that the basic legal acts on digital payments do not stipulate clear criteria for assessing whether price interventions are justified, or how long they should apply. There are also no requirements for periodic reviews”, said Ildikó Gáll-Pelcz, the ECA Member in charge of the audit. “For some of the interventions linked to card payments, the European Commission could not demonstrate that the positive effects for consumers clearly outweigh the negative ones”.

In this context, the auditors also note that poorly designed price interventions may lead to inefficiencies for payment service providers, distort market supply and demand and, in the worst case, negatively impact consumers and merchants.

The impact of the EU’s digital-payment policies remains largely unknown because the Commission has not put in place an effective monitoring system and, more importantly, lacks access to the relevant data. However, several EU actions have the potential to improve the transparency, speed and costs of payments.

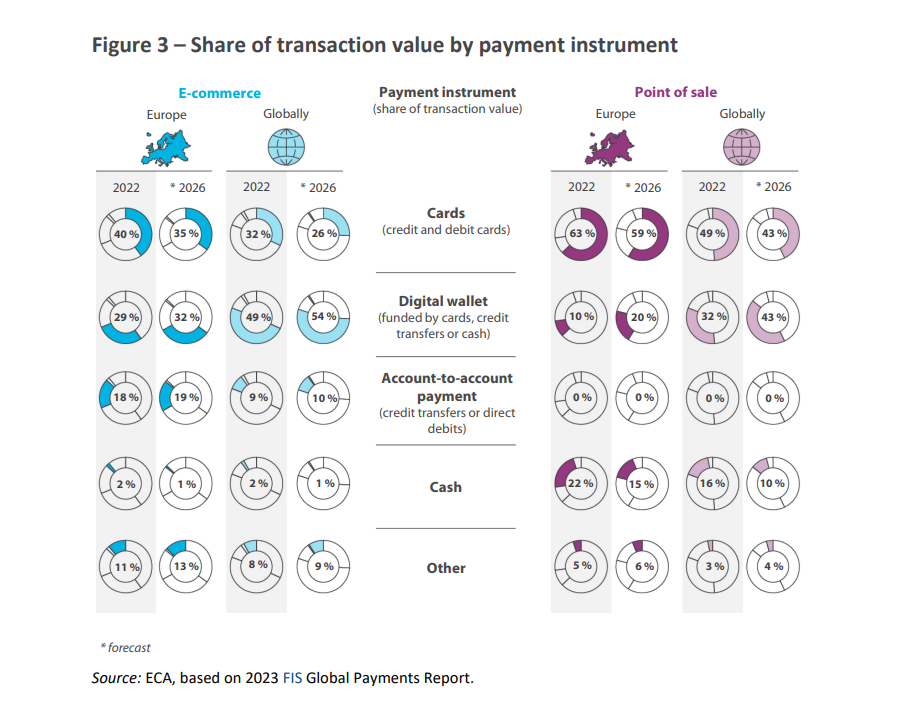

The auditors also identified two key issues with the EU’s open banking framework: the obligation to provide third-party providers with access to payment user data free of charge, which may discourage account data holders from providing high-quality service, and a lack of standardised application programming interfaces, hindering third-party providers from using those data. In addition, open banking has so far been implemented and monitored only at national level, meaning that no reliable consolidated data on open banking in the EU are available.

Lastly, despite the Commission stepping up its efforts to fight discrimination based on the location of payment accounts, payments are still declined because of a foreign account number. Although such discrimination is prohibited by the SEPA Regulation, this remains a real problem for consumers throughout the EU. Effective action to combat this problem is impacted by regulatory loopholes in enforcement and cooperation by national authorities, note the auditors.

___________

The EU has an advanced legal framework for digital payments, which has been expanded and reviewed over the past decade to reflect rapid developments in the industry.

In 2022, the Commission launched a review of the application and impact of Payment Service Directive 2 (PSD2), where the first provisions on open banking in the EU were introduced.

Taking account of the main findings of the review, the Commission put forward a legislative proposal in 2023 to improve the payments framework in the EU. Besides an amended directive on payment services and e-money services (PSD3), the Commission also proposed a regulation on payment services in the EU (the PSR).

Amid concerns about limited competition in the EU’s card payments market, the Commission launched a market survey in 2024 to examine potential market-distorting practices, such as unfair trading conditions and abuse by key industry players of their dominant position. The investigation is ongoing.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: