The European Banking Authority (EBA) published a Report on non-bank lending in response to the European Commission’s February 2021 Call for Advice on this topic. The EBA’s proposals aim at addressing risks arising from the provision of lending by non-bank entities in the areas of supervision, consumer protection, anti-money laundering and countering the financing of terrorism (AML/CFT), macro and microprudential risks.

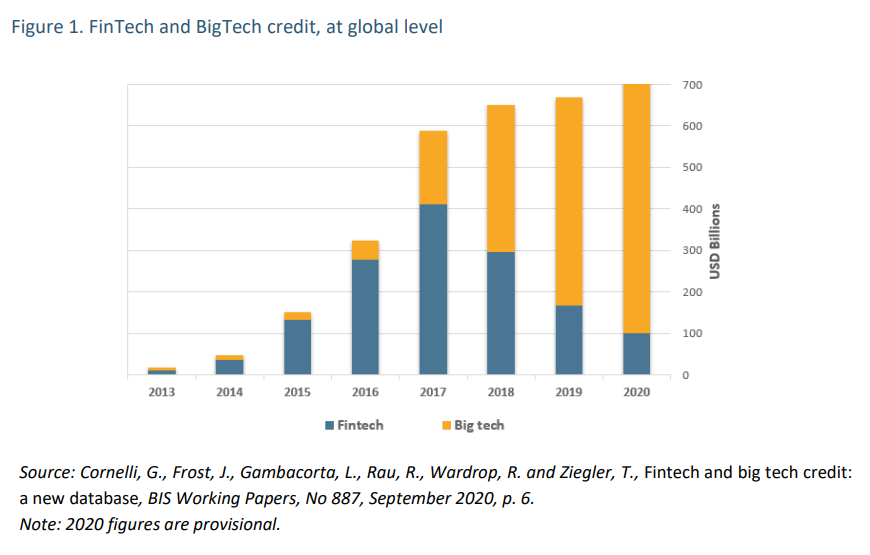

While the magnitude of non-bank lending in the EU remains limited compared to credit provided by banks, FinTech activity has been increasing over the last years. The trends observed outside the EU also show that BigTechs and other non-traditional operators have already developed, and successfully rolled out, business models for lending.

The provision of innovative financial services may bring benefits for consumers and increase competition in the market. However, the analysis of the regulatory regimes currently in place indicates that non-bank lending remains largely unharmonised across the EU, and this may create challenges for all the stakeholders, including regulators.

For most Member States where data are available, FinTech lending as a share of total lending remains very small, between 0 and 1% (Table 2); however, there are four Member States (LT, LV and to a lesser extent EE and SI) where FinTech lending, while still accounting for a minor share of total lending, is possibly non-negligible and thus deserves more attention.

In this Report, the EBA has identified the risks related to provisions of credit by non-bank lenders and put forward some proposals to address them. In particular, the Report highlights the importance of:

Ensuring that the consumer protection framework remains fit-for purpose in view of new players entering the market. For that, the EBA is proposing i) to enhance the disclosure requirements and ensure that they are fair, effective and well-suited for new forms of lending; ii) to strengthen the requirements for creditworthiness assessment, to ensure it is conducted in the interest of consumers.

Strengthening the provisions in terms of authorisation and admission to activities and clarifying the identification of the prudential perimeter and the supervisory responsibilities in cross-border provision of services, to allow for a more effective oversight.

Covering all non-bank lenders in a more comprehensive way in the EU-wide AML/CTF framework, to achieve greater harmonisation and capture such entities as ‘obliged entities’.

Enhancing the monitoring and reporting frameworks to avoid that any sudden increase of macroprudential risks remain unaddressed and considering the introduction of activity-based macro-prudential measures to cover all credit providers.

____________

DOCUMENTS

Report on response to the non-bank lending request from the CfA on digital finance

Letter to European Commission on its call for technical advice on non-bank lending

LINKS

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: