Indonesia sees electronic payments continue to be the fastest-growing mode of personal payment transactionsin APAC. ‘Cashless Vision’ leads Japan’s society, with a CAGR of 19% for debit cards’ payment transactions in 2018-2023. South Korea sees biggest decline in paper payment transactions.

Asia-Pacific has recorded the highest paperless payment transaction value in 2023 worth USD 29,063 billion and accounting for 52% of the global total, according to findings from Euromonitor International.

With cards being the most popular payment method in Asia Pacific as a whole, credit and debit cards are expected to generate the bulk of new sales over the 2023-2028 period.

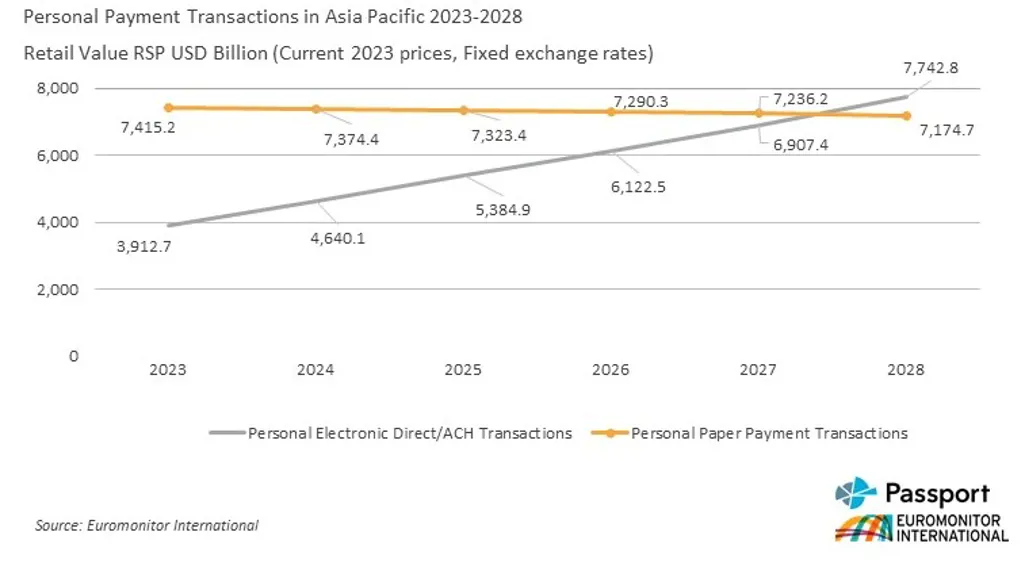

Credit cards are forecast to record a slightly stronger compound annual growth rate (CAGR) than electronic direct transactions. Additionally, personal electronic direct payments are forecast to overtake personal cash transactions in 2028.

Convenience of digital wallets favoured by both consumers and merchants

While paper transactions remain important in some countries, the convenience of digital wallets continue to drive up adoption in the region, especially gaining in popularity in emerging countries including Thailand, Indonesia, China and India. Almost 70% of consumers in China use WeChat Pay daily and over half of Indian consumers use PhonePe every day.

Indonesia shows the fastest-growing mode of personal payment transactions with a CAGR 67% in 2018-2023, driven by the popularity of smartphones, increasing usage of digital wallets, mobile banking, and Quick Response Code Indonesia Standard (QRIS), developed for cashless payments.

In developed markets, there remains potential for growth. Countries such as Singapore and Hong Kong saw a CAGR of 31% and 19% respectively for mobile proximity payments, in the period of 2018-2023.

Ease, speed and security of card payments drive growth

Among card payments, debit cards remain the most popular transaction type for personal card payments in China, with popularity boosted by its state-backed inclusive finance programme to encourage bank account openings in rural areas.

In India, credit card payment transactions recorded the highest growth in APAC. The shift to Unified Payments Interface (UPI), has drawn local consumers to faster, more convenient and secure transactions compared to wallets, contributing to the exponential growth in personal electronic transactions. In turn, cash transactions will continue to lose their share. Driven by the strong growth in UPIs, credit cards will outperform debit cards in terms of transaction value in the forecast period by 2028, while cards in circulation remain dominated by debit cards.

In East Asia, Japan has the second highest growth in personal card payments transaction, attributed to the country’s ‘Cashless Vision’ initiative. Debit card payments are at the forefront of the country’s vision, boasting a CAGR increase of 19% in 2018-2023.

Paper transactions witnessed a rapid decline in Japan and South Korea, as a result of digital conversion to electronic payments and card payments. Japan sees a negative growth in the same period, the second highest decline in terms of retail value after China. South Korea records the highest decline percentage in paper transactions by negative 39% in 2018-2023, while mobile proximity payments have grown 29%.

David Zhang, Insights Manager for Payments and Lending at Euromonitor International, said: “In Asia Pacific, embedded finance partnerships between incumbent financial organisations and FinTechs, have accelerated the development of digital IDs and remote verifications. Additionally, advanced credit decisioning and governments’ initiatives including payment standardisations (fast payment and QR) and subsidies have paved way for greater financial inclusion, payment diversification and cashless payment growth.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: