Jean-Michel Chanavas Délégué Général, MERCATEL: „A pan-European QR code, as favoured by the EC, could be a top enabler of request to pay at the POS and for other use cases.”

The Euro Banking Association (EBA) today released a report on the corporate perspective on request to pay. The report is based on the EBA Request to Pay Survey that ran between September 2020 and February 2021 and was delivered in cooperation with PPI and with the support of an expert group of bank practitioners.

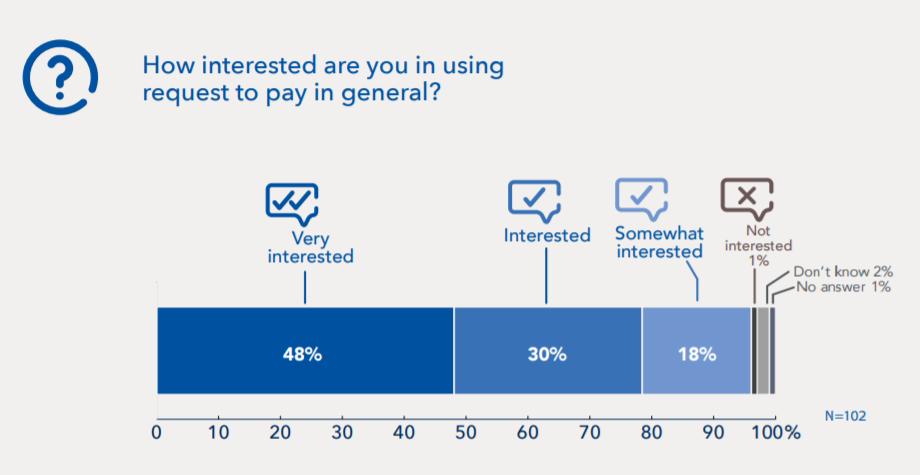

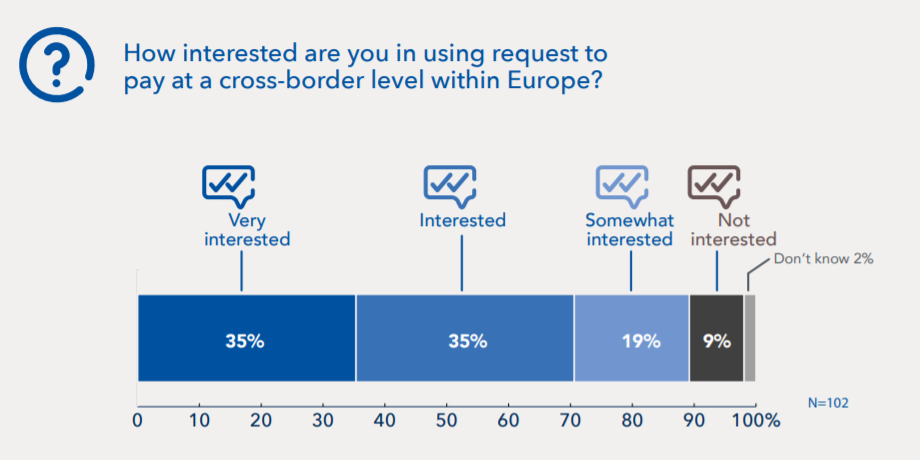

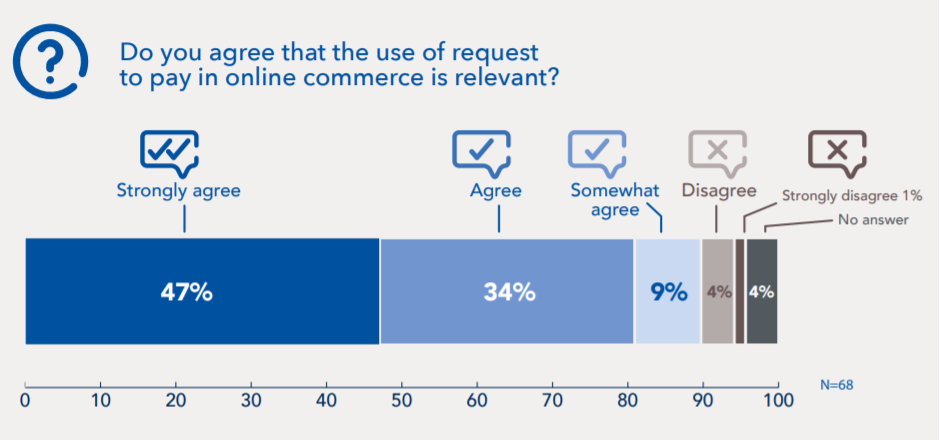

The EBA surveyed over 100 corporate experts from 20 countries and conducted additional one-on-one interviews to find out how businesses would like to use request to pay and where they see its value.

The typical respondent is either a payment professional or a corporate treasurer, is located in Germany, Italy or France, represents a large multinational company operating in the B2C and B2B space and is already aware of the new panEuropean request to pay instrument.

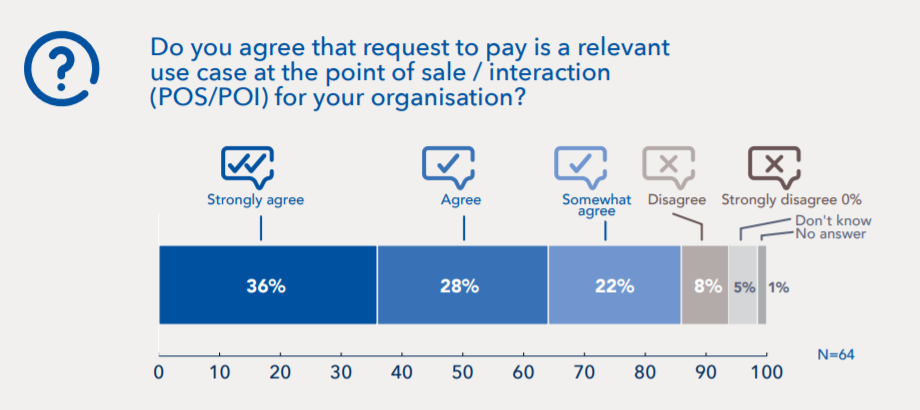

The report pinpoints corporate needs, pain points and expectations related to request to pay in general and to the following use cases in particular: 1) point of sale/interaction (POS/POI), 2) online commerce, 3) e-invoicing and 4) recurring payments

What do the experts say

Jean-Michel Chanavas Délégué Général, MERCATEL: „Request to pay offers a path that leads straight to the customer, making instant payments and normal credit transfers universally accessible. Unlike the PSD2-based payment initiation, for which only large corporates can put in place the necessary prerequisites, request to pay can be used by businesses of all sizes and holds benefits for all of them.”

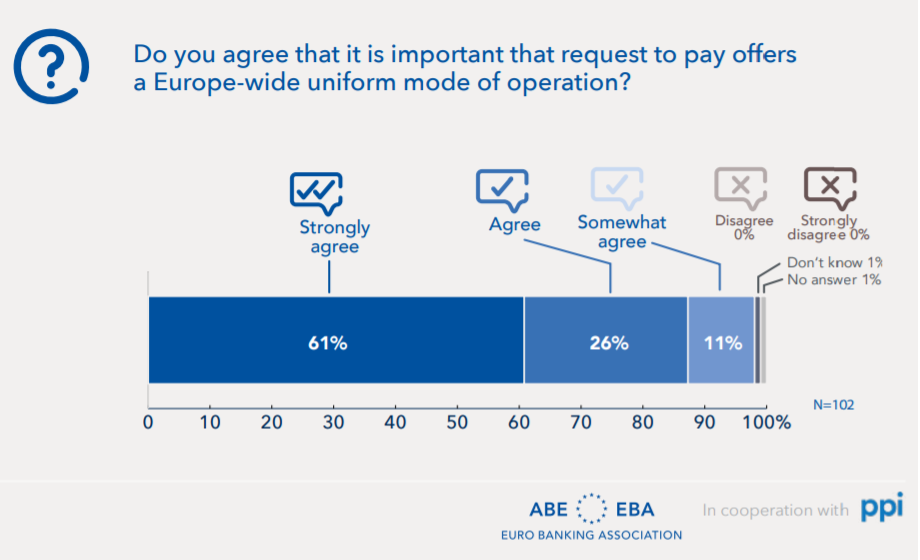

Michel Dekker Chair, Verenigde Groot Incassanten (VGI): „It is very important that request to pay will indeed trigger solutions that are fully standardised at a pan-European level and empower corporates to take advantage of the most competitive products offered within the internal market. With the introduction of SEPA, fully harmonised payment instruments were also promised. However, the reality is that some market fragmentation and proprietary solutions continue to exist. This mistake should be avoided with the roll-out of the pan-European request to pay tool.”

Norbert Hambloch Head of Treasury, STRABAG-PFS: „Request to pay will only be a success if all customers in Europe are reachable. This may require regulatory action. With instant payments, we currently still have a 30% risk that the payment will be rejected.”

Dr. Thomas Krabichler Senior Manager Treasury, MediaMarktSaturn Retail Group: „Request to pay could help us further integrate the payment process into the sales process, by replacing cashdesks and queuing with software terminals on the sales floor. For broad customer acceptance, it is important that there is no need to use new devices or identification processes.”

Heimo Tiefenböck Cashmanager, Porsche Corporate Finance GmbH: „We need a shortcut to the person on the floor who has to act on the payment information. Combining request to pay with virtual accounts, instant pay and push notifications for our salespersons would do the trick.”

Shriyanka Hore Director, Global Product Strategy, Oracle Corporation UK Ltd: „Request to pay offers a strong collection mechanism and alternative at the POS. However, to make this a success, corporates will want to create the same customer experience and have a standardised approach regarding, for instance, authentication of the customer or data coming through a QR code.”

___________

WHAT IS REQUEST TO PAY?

A request to pay means that a payer and a payee electronically exchange structured data through a request for payment, before they exchange the money. Request to pay improves the standard payment process by adding a message exchange, which takes place before the actual payment and includes: 1) A request to the payer for a payment 2) The acceptance (or refusal) of this request by the payer.

Thanks to the information delivered as part of this request to pay exchange, the payer can identify the payee and the payee can easily identify and reconcile the subsequent payment.

Request to pay is not a payment means or a payment instrument, nor an invoice, but a way to request a payment initiation. Neither the underlying business transaction nor the payment that should follow the request to pay exchange are part of the request to pay process. It is important to note that the acceptance of a request to pay by the payer does not constitute any form of guarantee regarding the payment, which is a separate process.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: