EUR 36 billion lost in online scams, Scamadviser reports

More and more consumers have become online shoppers as the Covid-19 virus is restricting physical retail. As ecommerce is expected to grow between 30% to 50% this year, the number of online scams is growing at a comparable rate, according to „The Global State of Scams 2020„, a Scamadviser report.

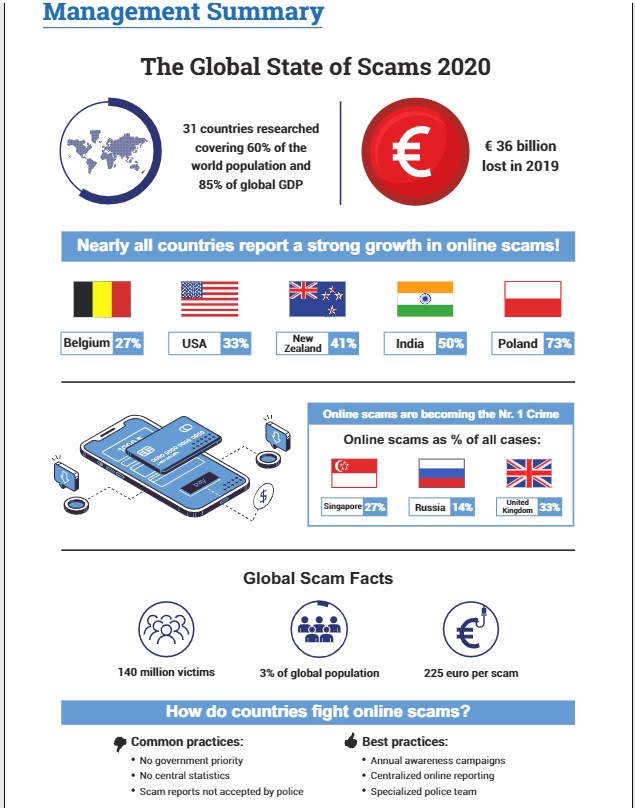

The report has stated the volume of online scams and money lost has grown by 40% in 2020 and EUR 36 billion are lost in online scams.

Nearly all countries researched stated growth in the number of online scams and money lost. Only Sweden (-6%) and Italy (-9%) reported a decrease in the number of scams in 2019.

Several countries report that online fraud is becoming the most reported crime. Singapore reported that scams made up 27% of overall crime in 2019, up from 19% in 2018. Likewise, fraud is the most experienced crime in the United Kingdom and the biggest source of consumer angst in the US. Russia reports that cybercrime’s share as part of all crimes may grow from 14% in 2019 to 30% in 2023.

Based on the analysis of the 30+ countries, 140 million scams were reported. Extended to the global population, 3% of the global population was scammed in one way or another.

Online fraud is less visible as only 7% of all cases are reported. Especially in developing countries, scam reporting has not yet been centralized and no specialized law enforcement team has been set-up to combat online fraud. Likewise, in countries where police forces are historically set-up decentralized like Germany, Spain, and Switzerland a central approach to scam prevention, reporting and fighting is still developing.

Even in countries where online scams are receiving government attention like Australia, Canada, the Netherlands, Singapore and the United Kingdom, scam reporting is still spread across multiple organizations such as banks, credit card companies, consumer protection agencies, police forces, public-private partnerships and review sites.

As scammers nearly always operate internationally and spread their scams across multiple countries, the chance of getting identified, investigated and, in the end, caught is very low.

Source: thepaypers.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: