EU intentions: creation of a new anti-money laundering authority, proposal of a ceiling of EUR 10,000 for large cash transactions and better regulation of crypto-assets

New EU AML rules will ensure full traceability of crypto transfers. The package of legislative proposals includes the creation of a new EU authority to fight money laundering and a single EU rulebook to provide a consistent and harmonised framework for tackling financial crime across member states.

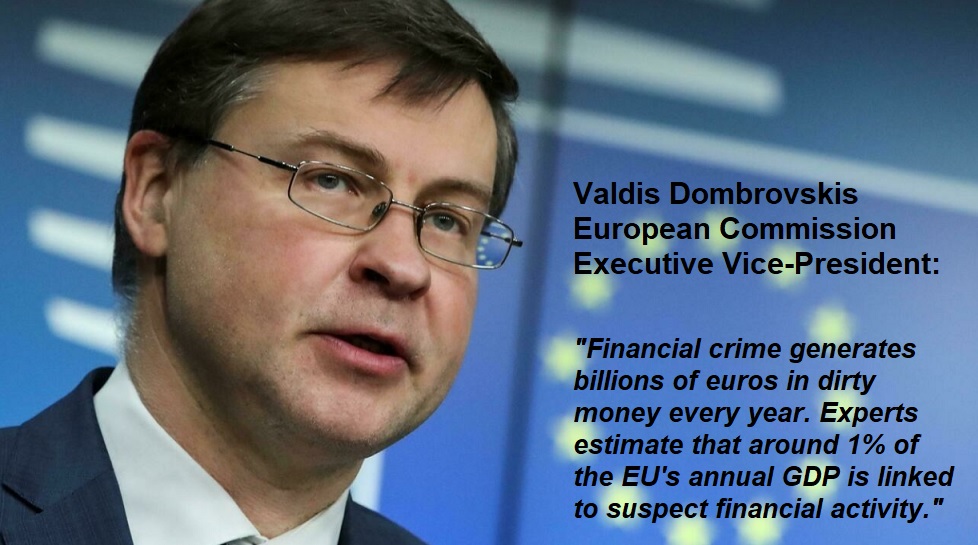

Remarks by Executive Vice-President Dombrovskis at the press conference on the Anti-money laundering package

„Financial crime generates billions of euros in dirty money every year. At any one time, we know that criminals are filtering at least some of their proceeds through the EU financial system.

Experts estimate that around 1% of the EU’s annual GDP is linked to suspect financial activity. While the scale of laundering is difficult to assess, we are talking about many billions of euros in dirty money that is highly mobile and often invisible.

The EU has worked on anti-money laundering – or AML – over many years, with the first AML Directive issued thirty years ago.

Despite extensive international cooperation and increasingly sophisticated EU legislation, money laundering remains a serious problem. That became very clear after a major money-laundering scandal hit multiple banks across Europe in 2019.

Our AML laws are now among the toughest in the world, but still not enforced equally across the board. And there are still loopholes in our financial system that we need to close.

With today’s package, we are following up on the AML action plan we presented last year.

First, we intend to create a new EU Anti-Money Laundering Authority – or AMLA.

It will strengthen the supervision of anti-money laundering and countering financing of terrorism in all EU countries.

AMLA will not replace national authorities but coordinate them to make sure that EU rules are enforced correctly and consistently.

It will directly supervise only some of the most risky financial institutions which operate across multiple EU countries or which need action to deal with immediate threats.

Second, we will devise a single rulebook to clarify, strengthen and align AML obligations across all EU countries.

In a sense, this is similar to what we did for banks after the 2008 financial crisis: creating single rulebooks and an EU supervisor.

We will also propose a ceiling of €10,000 for large transactions in cash.

Then, I mentioned our laws having to keep up with time and technological development. In the case of crypto-assets, this has become urgent. Crypto-assets are increasingly used for money laundering and other criminal purposes.

We will now bring crypto-assets fully within the scope of EU AML rules. All transfers of crypto-assets must be accompanied by the details of sender and beneficiary.

This already applies for real money transfers.

The international dimension

Money laundering does not stop at the EU’s borders. It is a global challenge that demands a global response. We must make sure that illicit money flows from outside the EU do not threaten our financial system.

Our approach here should reflect the actual risks involved. This is why we are taking a new differentiated approach regarding non-EU countries: a black list and a grey list.

We will list countries either based on the assessment of the Financial Action Task Force, the international watchdog – or, if the Commission finds that a country poses a threat to the EU’s financial system, then the Commission will do it autonomously.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: