„EU banks are robust, but signs of credit quality deterioration are becoming apparent”, the EBA’s risk dashboard shows

The European Banking Authority (EBA) today published its Q4 2023 quarterly Risk Dashboard (RDB), which discloses aggregated statistical information for the largest EU/EEA institutions. EU/EEA’s banks capitalisation stands at record levels, liquidity has improved, while return on equity (RoE) stood at 10.3%. Yet, early signs of credit quality deterioration have become more apparent. The publication also includes information on minimum requirements for own funds and eligible liabilities (MREL).

. EU/EEA banks reached record high capitalisation levels, with the weighted average common equity tier 1 (CET1) ratio (fully loaded) at 15.9%, 50 bps higher than in December 2022.

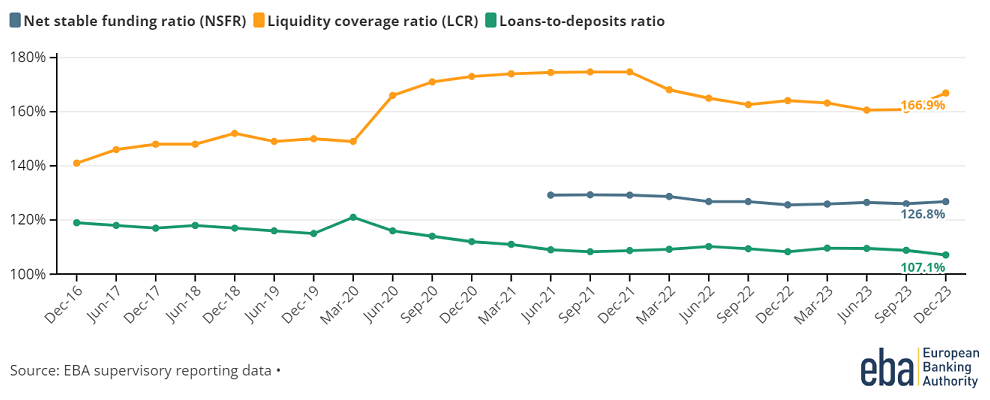

. The liquidity coverage ratio (LCR) increased after several quarters of decline. The net stable funding ratio (NSFR) also slightly increased during the last quarter but remains close to levels reported during the last several quarters. The LCR and NSFR stand comfortably at 167% and 127%, respectively. Financial market conditions during the first months of 2024 were benign with high level of debt issuances from banks.

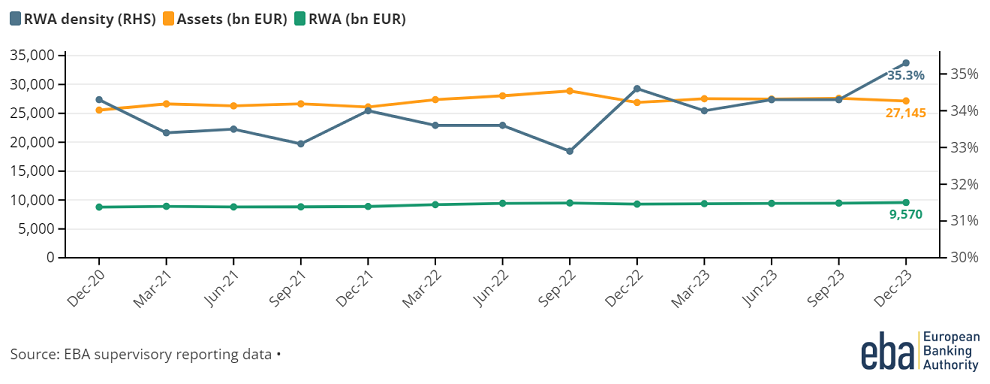

. Loan and asset growth remained subdued, still affected by banks’ tightening of lending standards and lower demand. Risk weighted assets (RWAs) have increased slightly, driving RWA density higher mainly due to increased operational risk (from 9.6% to 10.1% of total RWA).

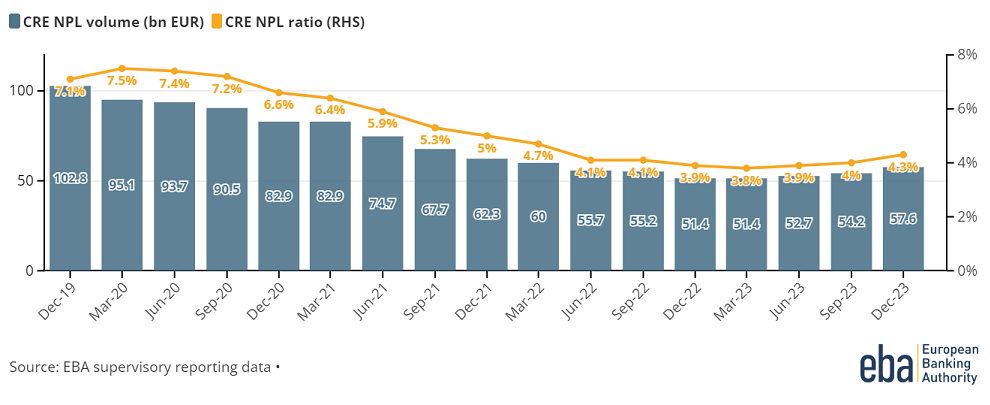

. While asset quality remains robust, the non-performing loans (NPL) ratio increased slightly from 1.8% to 1.9%. Stage 2 loans and average cost of risk also increased during the last quarter of the year. NPLs collateralised by commercial real estate (CRE) increased marginally and the NPL ratio of these exposures was 4.3%.

. EU/EEA banks’ exposure to sovereigns increased slightly in 2023, after its decline in previous years.

. Profitability for 2023 remained high at 10.3%, albeit with wide dispersion. While all banks have benefited from rising interest rates, the share of banks with a RoE higher than 10% has decreased from 60% to 45%.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: