Erste is ready for PSD2 and open banking. The group provides unified access to the APIs of all its subsidiary banks in the eastern part of the EU.

Erste Group Bank AG has decided to provide unified access to the application programming interfaces (APIs) of its subsidiary banks in Central and Eastern Europe. Erste Group’s offering is launching with APIs that address those services and roles established by the regulations of the Payment Services Directive 2 (PSD2).

The Erste Developer Portal (http://developers.erstegroup.com) serves as the central access platform for Erste Group’s APIs. It provides third parties with documentation, API access, and testing opportunities via a “sandbox”. „As of mid-May 2019, over 120 organizations had registered on the Erste Developer Portal and 25 API solutions based on the data and services the platform offers had gone into production.”, according to the press release.

As part of its broader commitment to making the advantages of PSD2 and open banking accessible to its over 16 million customers in the CEE region, Erste Group aims to soon expand its offering on the Erste Developer Portal to also include so-called “premium APIs”. By providing consolidated access to its APIs, Erste Group ensures that not only third-party providers (TPPs), but also its customers, enjoy easy access to bank data while experiencing a consistent approach within the Group.

Erste Group’s Czech banking subsidiary Česká spořitelna was the first within the banking group to offer live API access, namely since the start of 2018. Erste’s existing API offerings have generated excellent feedback from TPPs and partners, contributing to Erste Group being recognized as a “Master in Openness” in the Open Banking Monitor survey published by Innopay.

PSD2 provides bank customers with more options

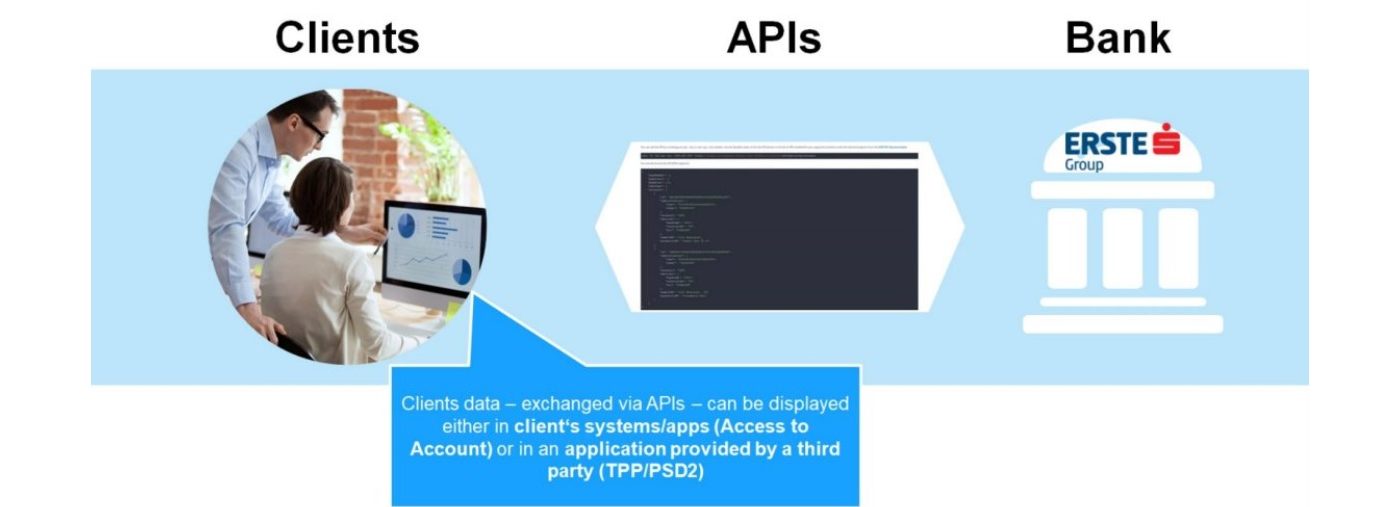

The regulatory environment of PSD2 creates new competition in payment services by giving third-party service providers the opportunity to access a customer’s payment account data – based on that customer’s explicit consent. Providing customers with access to a broader range of services, promoting innovation, and enhancing consumer protection are among the aims that this regulatory environment pursues. At the same time, it also contributes to an increased need for customers to be able to effectively manage their bank data.

“At its core, PSD2 is about making certain that the ownership of banking information and decisions about its use lie squarely in the hands of the customer. At Erste, that customer-empowering focus is complemented by our guardian role for customers’ financial data. We will continue to protect their data and make sure it is safe in the bank, while also supporting clients in making well-informed decisions about sharing their data,” says Peter Bosek, the Chief Retail Officer at Erste Group.

Under PSD2 and the accompanying Regulatory Technical Standards (RTS), all Erste Group banking subsidiaries (with the exception of the subsidiary in Serbia, which is not a EU member state) need to provide direct access to approved/enlisted and regulated non-traditional payment service providers (TPPs). This includes the ability to access the bank account information of a bank customer and to be able to initiate payments, all at the customer’s explicit request. By extending its API offerings to TPPs via the Erste Developer Portal, Erste Group has taken a decisive step to meeting these PSD2 requirements.

“Our commitment to ensuring that a customer’s data will only be shared upon the customer’s explicit request and consent goes hand-in-hand with our enthusiasm for the opportunities that PSD2 offers, particularly for customers. The Erste Developer Portal plays an integral role in our achieving these aims, as it enables third-party developers to create solutions and thus jointly shape open banking in our region,” says Milos Toman, Head of Group Product and Business Management in the Corporates and Markets division at Erste Group. “In addition to our offerings for customers in the Retail segment, we aim to provide the first dedicated API solutions for our Corporate customers, granting them central access to data and services for the entire Group.”

George invites potential partners to join the party

In the same context of open banking, „George, the largest pan-European banking platform with 4,7 million customers, is opening up to external partners that are able to meaningfully expand the range of innovative services it is offering.”, according to a press release.

One of George’s distinctive features is its open and modular architecture that allows partners to directly plug their solutions into the platform. While most of George’s functionalities have so far been conceived in-house by George Labs, its designers think “easy integration with partners is definitely the way to take George to the next level.”

“Our goal in building this ecosystem is for potential partnerships to be win-win-win, so that our customers benefit from even more innovative services, partners can offer their solutions to a wide user base and our platform keeps growing through new plug-ins,” explains Maja Gostovic, Product Owner at George Labs. “We will carefully evaluate all proposals to determine whether they fit with our DNA and our values and if providing the respective service is the right thing to do for our customers.”

„In its current call for new partner submissions, the main focus will be on smart payment services, integrating loyalty schemes as well as enhancements for investments, savings or donations; but all ideas that have the potential to make users’ experience more personal and simple are welcome.”, the bank said.

Ultimately, George’s designers are seeking fresh and sharp new features that can seamlessly integrate into the George experience and make a difference in people’s lives.

More details here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: