Erste Bank introduces video-based identification of new customers – opening an account takes less than 10 minutes

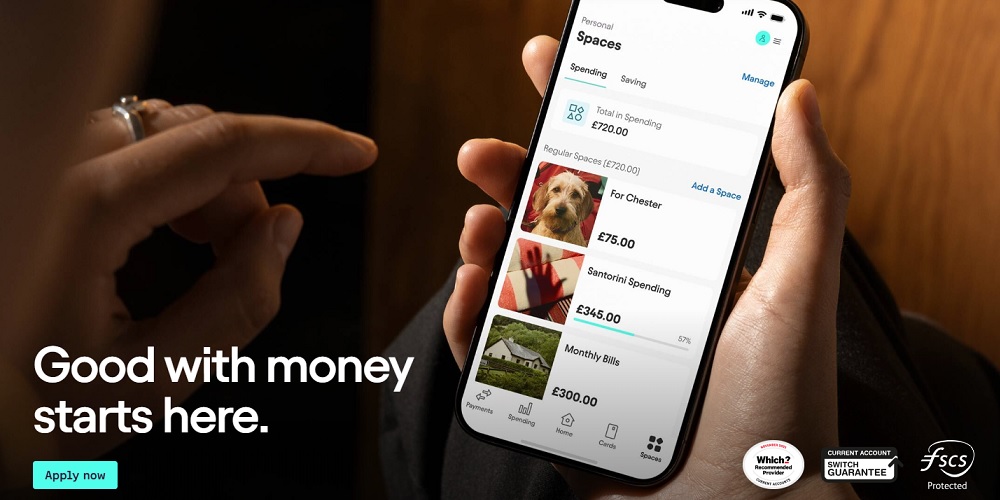

Erste Bank und Sparkassen is making video-based online identification, which has only just been approved by the Austrian Financial Market Authority (FMA) on 3 January 2017, available to the banking group’s new customers with immediate effect. With the aid of IDnow Video-Ident solution, persons taking part in the new client onboarding process can choose to identify themselves directly via video chat, thus saving themselves the time and effort involved in visiting a branch office for this purpose.

„This new solution makes opening a current account faster and simpler than ever – it can now be done via a computer, as well as via mobile devices such as smartphones or tablets. In order to complete the identification process in a few minutes via video chat, all one needs is a government-issued photo ID. A special feature for Austrian citizens is that in addition to passports and national identity cards, they can also use their driver’s licenses for video identification.”, according to the press release.

“We are the first large Austrian bank to offer this innovative option to new customers, implementing it just three weeks after the authorities approved the procedure,” said Thomas Schaufler, chief retail officer of Erste Bank. In other countries such as Germany, the procedure has been already approved for quite some time, which enabled fintech companies to offer this easy identification process in Austria as well. “Our introduction of online video identification also eliminates what had previously been a significant competitive advantage for fintech companies,” Schaufler notes. Prior to the FMA’s recently-issued regulation, banks had not been permitted to provide this service in Austria.

„The number of number of online-based current account openings at Erste Bank and Sparkassen grew by 40% last year. This increase in the share of online applications shows that the Austrian market is ripe for online video identification. Tablets, smartphones and nearly every laptop are equipped with cameras, and thanks to the newly-approved procedure, switching from one bank to another will from now on be even faster and simpler in Austria.” says the bank.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: