JPMorgan Chase & Co. is killing an experiment to attract younger customers to a new digital-banking app a year after making it available nationwide, according to Wall Street Journal. The nation’s largest bank began informing clients Thursday that it is shutting down Finn, the no-fee banking brand designed to meet the financial needs of younger consumers, and transferring their funds to new Chase checking and savings accounts.

JPMorgan Chase is shutting down Finn, the mobile-only banking offshoot aimed at millennials, just a year after its nationwide launch.

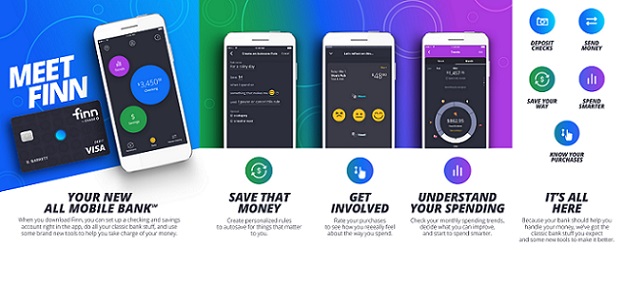

JPMorgan designed mobile-only Finn by working closely with millennials for more than a year to understand their unique money challenges and what influences their spending. It launched nationwide last June following a trial in St Louis. Finn came complete with a set of smart budgeting tools, autosaving features and the ability to use emojis to rate transactions and purchases bought using the app.

JPMorgan isn’t saying how many Finn customers it has but more than half also have a Chase account.

A JPMorgan spokesman said the bank realized millennials don’t need a separate mobile banking experience or brand. „We know the Chase brand is already among the most popular banks for millennials, so we’re leaning in on that, rather than continuing to build a brand from scratch,” said the spokesman. „They simply want a bank that gives them the tools to manage their money, along with access to branches when they need them. Given all this, we have taken some of the favorite Finn features, such as rules to automatically save, and have already integrated them into our Chase mobile app and have other capabilities we have yet to announce.”

“Finn was an interesting concept to get young adults straight out of high school to start saving,” said Sankar Krishnan, EVP Banking and Capital Markets at Capgemini, the consulting firm. “Given that the Chase mobile app has excellent features and functionality and has enjoyed considerable success it does not make sense to operate two parallel apps and that could be one reason for ending Finn.”

JPMorgan Chase is one of several established lenders to launch a standalone mobile offering in an effort to win over younger customers and fend off the challenge of digital upstarts. But the bank has now decided that Chase is better suited to provide Finn’s services itself, sources tell the WSJ.

The failed attempt at a stand-alone mobile banking app underscores the problem traditional banks have, according to Forbes. With an increasing number of consumers conducting their banking on smartphones, financial institutions are having a tough time reaching them. FinTechs, on-the-other-hand aren’t. Their zero-fee mobile banks are resonating with a large swath of the U.S. population. Chime, the San Francisco challenger bank is one example. It has a valuation of about $1.5 billion and as of March surpassed 3 million FDIC bank accounts. Meanwhile, BankMobile has 1.8 million account holders, claiming to serve one in every three college students in the U.S.

While JPMorgan is the leader in banking in the U.S. with more than 50 million active digital users, it has been doubling down on its branches, announcing plans last year to open 400 physical locations over the next five years. It also allocated $11.5 billion for tech spending this year. Technology it developed for Finn including automatic savings tools, is expected to be integrated into the Chase mobile banking app.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: