Founded in Finland in 2016, Enfuce recently expanded its geographic presence in Germany, Latvia, Sweden, and the UK and has over 16 million active card users on their platform from whom Enfuce processes close to €1 billion transactions annually.

Enfuce, one of the fastest growing fintechs in Europe, has chosen Konsentus Verify „to protect its customers from unauthorised or fraudulent third parties gaining access to valuable account data and funds,” according to the press release.

Enfuce provides a modern, flexible, scalable, open banking service that is both safe and compliant. Their embedded payment experience seamlessly delivers the features and products that their customers want within a safe and secure environment.

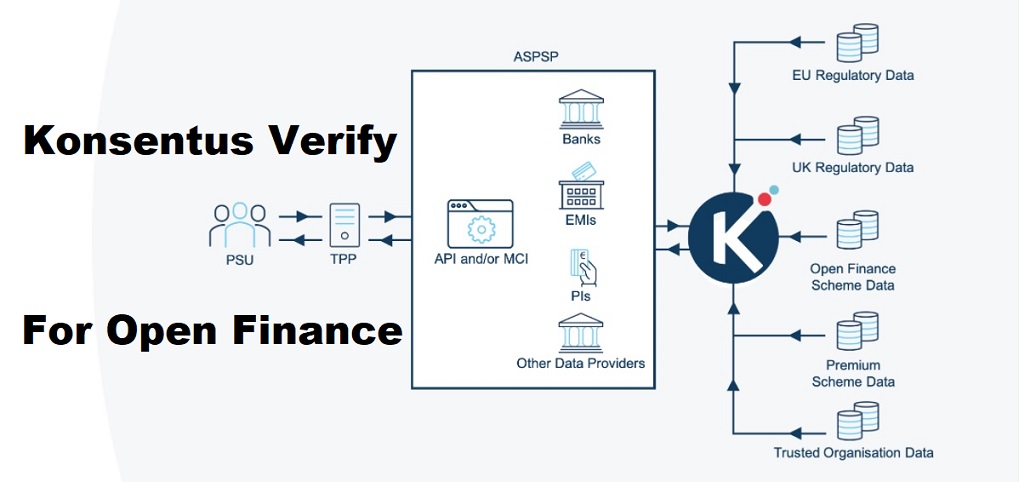

Konsentus Verify is an infrastructure platform enabling Financial Institutions to transact safely and securely within the open banking and open finance ecosystems. Verify checks a third party’s identity and regulatory status each time it attempts to access a Financial Institution’s open banking API. The information is sourced in real-time directly from the hundreds of databases and registers across the EEA and UK and passed back to the Financial Institution in real-time, through a single API, so informed risk management decisions can be made.

Niklas Apellund, Co-Founder & CTO at Enfuce commented: “Providing our customers with a fast and efficient PSD2 API which enables the secure exchange of data and funds is our primary focus. Embedding Konsentus Verify into our wider managed service offering will allow us to deliver on this promise to our customers.”

Mike Woods, CEO, Konsentus, stated: “Enfuce is known for technical excellence and security standards. By seamlessly integrating their products into the customer experience flow without compromising on safety or speed, they are well-positioned to be at the forefront of open banking implementation across Europe.”

___________

Enfuce offers payment, open banking and sustainability services to banks, fintechs, financial operators, and merchants. By combining industry expertise, innovative technology and compliance, Enfuce delivers long-term and scalable solutions quickly and securely.

Founded in Finland, Enfuce recently expanded its geographic presence in Germany, Latvia, Sweden, and the UK and has over 16 million active card users on their platform from whom Enfuce processes close to €1 billion transactions annually.

Enfuce has raised multiple rounds of venture capital funding and has been recognised by e.g. TheFinTech50, Visa Fintech Fast Track programme, Mastercard Lighthouse Development Programme, Deloitte Technology Fast 50, and as winner of the 2019 PayTech Award for “Best Payments solution for Payment Systems in the Cloud”.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: