EMVCo reports 6.1 billion EMV chip payment cards in global circulation

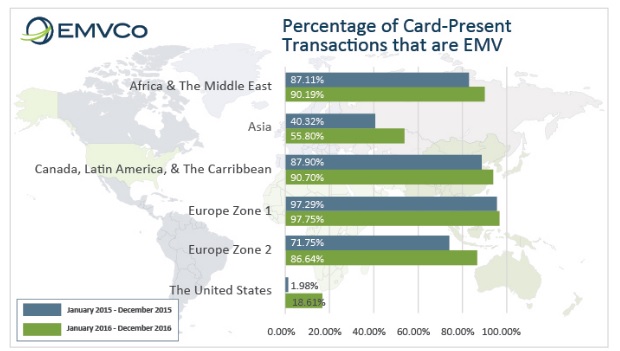

The data released by EMVCo highlights that 52.4% of all card-present transactions conducted globally between January and December 2016 used EMV chip technology, up from 35.8% for the same period in 2015. To qualify as an EMV transaction, both the card and terminal must be EMV-enabled.

Official figures of aggregated data published by technical body EMVCo show that by the end of 2016, the number of EMV® payment cards in global circulation had increased by 1.3 billion in the previous 12 months to a total of 6.1 billion*.

The latest statistics show that the percentage of EMV enabled chip card issuance has continued to increase across all regions:

. Europe Zone 1, EMV chip card adoption rate: 84.9% (up from 84.3% in 2015).

. Canada, Latin America and the Caribbean, EMV chip card adoption rate: 75.7% (up from

71.7% in 2015).

. Africa and the Middle East, EMV chip card adoption rate: 68.7% (up from 61.2% in 2015).

. Europe Zone 2, EMV chip card adoption rate: 63.7% (up from 52.3% in 2015).

. United States, EMV chip card adoption rate: 52.2% (up from 26.4% in 2015).

. Asia Pacific, EMV chip card adoption rate: 38.8% (up from 32.7% in 2015).

Figures represent the percentage of all card-present transactions processed by each member institution that are EMV transactions (contact or contactless). The data represents the most accurate possible data that could be obtained by American Expres, Discover, JCB, MasterCard, Union Pay and Visa during the perriod.

Europe Zone 1 – where Romania belongs – continued to have the highest penetration of card-present transactions made with a chip card (97.8%). This was closely followed by Canada, Latin America & the Caribbean at 90.7%, Africa and the Middle East at 90.2%, and Europe Zone 2 at 86.6%. The US and Asia demonstrated notable increases as they continue migrating card-present based payments to EMV chip technology.

Worldwide EMV chip card deployment and adoption

(figures reported in Q4 2014, 2015 and 2016, respectively, and represents the latest statistics from American Expres, Discover, JCB, Union Pay, MasterCard and Visa as reported by their member institutions globally)

*Data represents the latest statistics from American Express, Discover, JCB, Mastercard, UnionPay and Visa during the noted period. Transaction data is reported from the acquirer perspective. These figures do not include offline transactions, ‘on us’ transactions (defined as a transaction handled exclusively by another processor) and/or transactions processed by non-EMVCo member institutions, such as national payment networks.

EMVCo is the global technical body that facilitates the worldwide interoperability and acceptance of secure payment transactions by managing and evolving the EMV Specifications and related testing processes. EMVCo is collectively owned by American Express, Discover, JCB, Mastercard, UnionPay and Visa.

Source: EMVCo

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: