EIB announces plan to boost funding for European fintechs

The European Investment Bank (EIB) has proposed a series of measures designed to strengthen funding for fintechs and startups within Europe. Plans discussed with European Finance ministers in Luxembourg will broaden financing options and tools available to scale up European innovative companies and unicorns.

The instruments to be deployed by the EIB Group include expanding the successful European Tech Champions Initiative Fund-of-Funds, equity and venture capital investments for scale-ups, and a new Exit platform to facilitate purchases and listing of tech start-ups.

European Union Finance ministers have welcomed an Action Plan to be deployed by the European Investment Bank (EIB) Group, to support the development of the Capital Markets Union. „The Plan includes measures to untap private savings and channel them into productive investment, to boost innovation, competitiveness, strategic autonomy, and productivity growth in Europe.” – according to the press release.

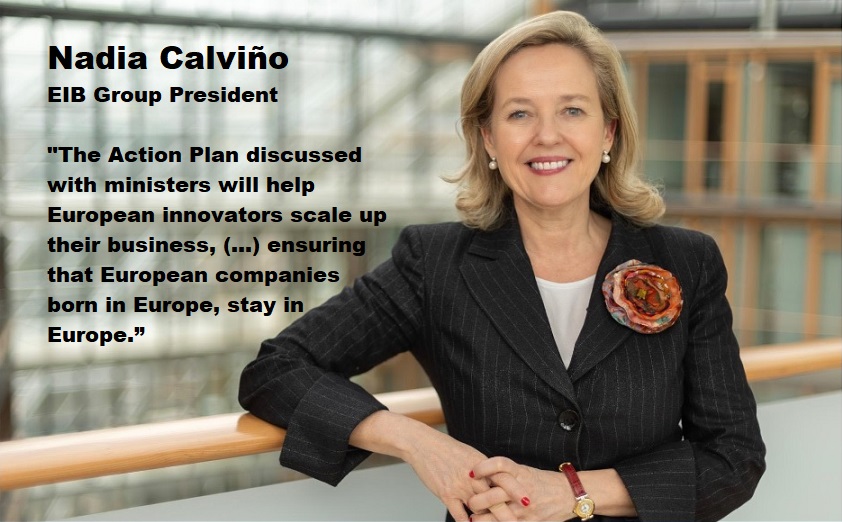

The Action Plan was discussed at the meeting of EIB Group President Nadia Calviño with finance ministers at the Eurogroup in Luxembourg. It was developed after months of intensive engagement with member states and financial markets partners, and received broad support by the Boards of Directors of the EIB and of the European Investment Fund (EIF) last week.

EIB Group President Nadia Calviño, said “The EIB Group is itself already a Capital Markets Union instrument. The Action Plan discussed with ministers will help European innovators scale up their business and contribute to channel savings into productive investments, boost innovation, create jobs and lead Europe toward a more robust growth model, ensuring that European companies born in Europe, stay in Europe”.

The Action Plan covers three main areas:

Improving market integration for green and digital bonds: The EIB Group will continue to play a leading role in the European green bond market, through issuance and also scaling up bond acquisition.

Closing the funding gap throughout the company and innovation cycle: The EIB Group plans to scale up support for the EU venture capital and private equity markets to help close the financing gap and to retain the most innovative scale-ups in Europe.

Mobilizing large-scale investments for EU policy priorities: For instance, working with the Commission on a financing platform for housing.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: