Ecosystem development director at Open Banking Implementation Entity (OBIE) about the possibilities: “We’re just at the start of the hockey stick”

With the introduction of PSD2 all the way back in January 2018, we’ve seen its usage explode to nearly 6m users across the UK and more and more fintechs and incumbent financial institutions alike adopt it.

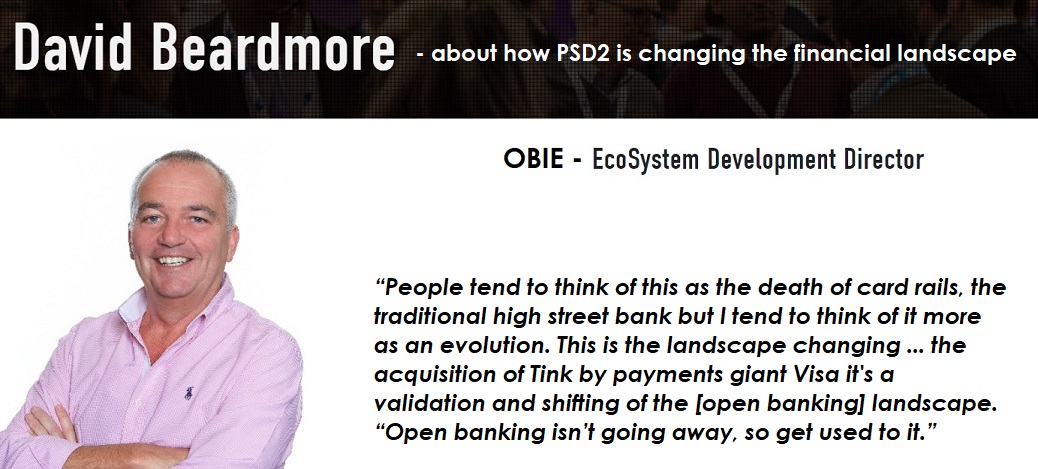

At the AltFi Festival of Finance 2021, David Beardmore, ecosystem development director at Open Banking Implementation Entity (OBIE) gave AltFi the rundown of just how far open banking has come and what it’s still got left to do.

Slow burner

“Looking at the number of digitally active accounts and at the beginning of 2019 it was about two per cent and now we’re up to about five or six per cent. We’re certainly going in the right direction and growing at pace,” Beardmore said.

When PSD2 was first rolled out, there were just nine banks mandated to use the regulation, now there are 86 actively providing customer account data, with more than 230 third party providers also active.

As it stands, there are also more than 450 entities currently in the OBIE’s sandbox programme testing open banking-powered propositions, with most of them likely to come to market.

“Not everything is complete but there’s enough that’s there to warrant real excitement. We’re pleased with the levels of growth but the job is not done.”

“Open banking isn’t going away, so get used to it,” Beardmore added.

Changing landscapes

With the implementation of PSD2 we saw a shift in the financial landscape that we hadn’t seen in a while, and three and a half years down the line, the landscape is still changing.

“People tend to think of this as the death of card rails, the traditional high street bank but I tend to think of it more as an evolution. This is the landscape changing and it’s no different to any other evolution or change that has happened throughout banking or any other sector for that matter.”

Beardmore called the acquisition of Tink by payments giant Visa a “validation and shifting of the [open banking] landscape”.

Visa, a traditional card issuer that is constantly trying to break into new sectors, first made a grab of the open banking sector last year when it attempted to acquire Plaid in a now-shelved deal that would have seen the fintech bought for $5.3bn.

And now, we are seeing more and more government departments get on board with open banking, such as HMRC or the long-awaited Pensions Dashboard that will be a welcome step towards open finance.

“When you start to see government departments endorsing and accepting open banking payments as the primary means of paying tax, for example, you start to see that hockey stick growth,” Beardmore said.

“Expectation is unreasonable that open banking seems to be required to make a case for successful implementation within three or four years when many other new technologies and new ways of doing stuff takes a lot longer. There will always be some segments of society that refuse to play with anything new.”

Follow the link to see what Beardmore is saying about the death of traditional payments …

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: