A new study by global tech strategists Juniper Research has found that eCommerce payments will exceed $13 trillion globally in 2030; up from $8.3 trillion in 2025. This substantial 57% growth will be driven by emerging markets, with Latin America and the Indian Subcontinent experiencing the fastest growth rates.

In these developing regions, access to local payment methods is transforming access to eCommerce, particularly in markets where card penetration has typically been low. As such, over the next five years, access to eCommerce will broaden significantly; providing growth opportunities to well-positioned merchants and payments providers.

“Identifying and supporting the right local payment methods for each developing market will be critical to enabling international merchant growth and make or break for eCommerce payment provider success,” says Nick Maynard, VP, Fintech Market Research at Juniper Research.

Top 3 eCommerce Payments Leaders Revealed

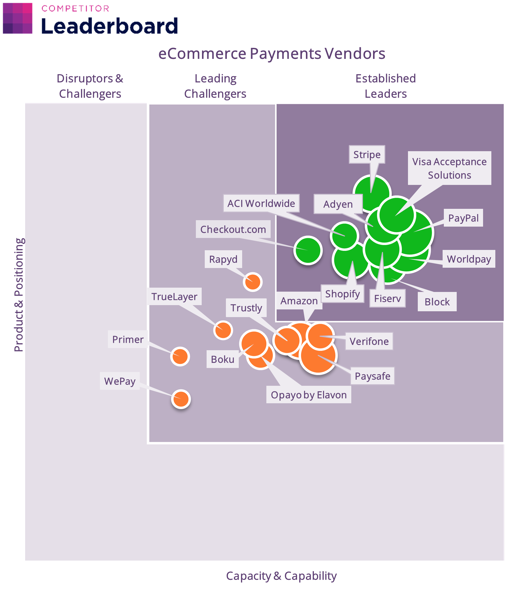

Juniper Research’s recent eCommerce Payments Competitor Leaderboard evaluated 20 key eCommerce payments players against robust criteria, including size of operations, commercial proposition, and the comprehensiveness of their payments acceptance. The top 3 vendors for 2025 are: Stripe, Visa Acceptance Solutions and PayPal.

Juniper Research found that leading vendors are balancing strong local payments acceptance with powerful value-added services, such as fraud and dispute management. However, the Competitor Leaderboard is highly clustered; showing eCommerce payments vendors increasingly offer similar services.

“To differentiate, vendors must embrace local payments; providing global reach with local granularity that reflects cultural and regulatory trends. Failure to do so will mean losing out in a highly competitive market,” Maynard concluded.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: