ECC-Net report: 12% of internet users across the EU have already fallen victim to online fraud – 8% have had to deal with identity theft

A new report by the European Consumer Centre Network (ECC-Net) takes a look at the scams faced by consumers when shopping online. The most common kind of fraud highlighted by the participating ECCs (70%) were scams involving fraudulent sites which require a bank transfer purchase and never deliver the products offered.

The report focuses on fraud in cross-border e-commerce and what consumers can do to protect themselves from online fraud. It has been prepared based on the complaints reported by consumers to ECC-Net in 2012.

The EU Commissioner for Consumer Policy, Neven Mimica said: „On-line shopping is booming as consumers take advantage of the digital single market. But the risk of fraud is rising too. The ECC report is a timely reminder to consumers that they need to ‘shop smart’ and avoid the fraudsters’ traps“.

The EU Commissioner for Consumer Policy, Neven Mimica said: „On-line shopping is booming as consumers take advantage of the digital single market. But the risk of fraud is rising too. The ECC report is a timely reminder to consumers that they need to ‘shop smart’ and avoid the fraudsters’ traps“.

It has been estimated that savings from online shopping amount to €11.7 billion equivalent to 0.12% of the EU’s GDP. However many consumers are missing out. Studies show that 62% of consumers cite fear of fraud as the reason why they do not go online to shop.

According to the results of the Eurobarometer on Cyber Security, the highest figures of internet users that say they have experienced online fraud are in Poland (18%), Hungary (17%), Malta (16%) and UK (16%), while respondents in Greece (3%), Slovenia (6%) and Spain (7%) are least likely to have experienced online fraud.

Most common frauds

The working group circulated a questionnaire to all ECC-Net centres to gather information on the most common scams reported by consumers and seek details of any emerging scams. A total of 27 ECCs responded to the questionnaire. The column bar below shows the number of ECCs that reported fraud in specific areas. Number of ECCs reporting that the following type of fraud is frequent (among the 27 ECCs which participated to the project).

The report highlights a number of tips and tricks to avoid being scammed online. For example always use a secure payment method and never transfer cash. The tips also include advice on how to screen unfamiliar online traders and what to do if you happen to fall victim to a fraudulent site.

The most common kind of fraud highlighted by the participating ECCs (70%) were scams involving fraudulent sites which require a bank transfer purchase and never deliver the products offered. The second highest type of online fraud, mentioned by 45% of participating centres, involves second hand cars sold online, followed by sale of counterfeit goods and fraudulent ticket sales. The report also analyses emerging issues in online fraud with malicious software targeting mobile phones, and scams involving gaming and online dating sites.

Research shows that 70% of Europeans use the internet regularly. Almost half of EU consumers (45%) shop online, with 11% shopping from traders based in another European country. The European Commission has set ambitious targets for the growth of e-commerce, with the Digital Agenda establishing targets of 50% of the population buying online and 20% buying online cross-border by 2015.

Background

The ECC-Net is a European network giving European citizens professional and free consumer advice in cross-border problems, for example while travelling in another country or e-shopping. The ECC-Net covers 30 countries (all EU countries plus Norway and Iceland).

For more information download the full ECC-Net Report on „Fraud in Cross Border e-commerce”

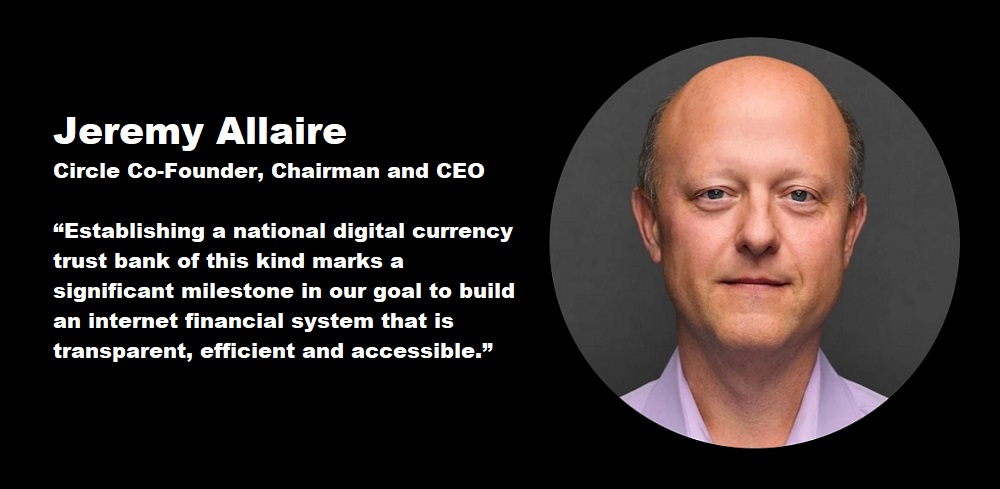

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: