ECB publishes first progress report on digital euro preparation phase. The next progress report on the preparation phase will be published in autumn 2024.

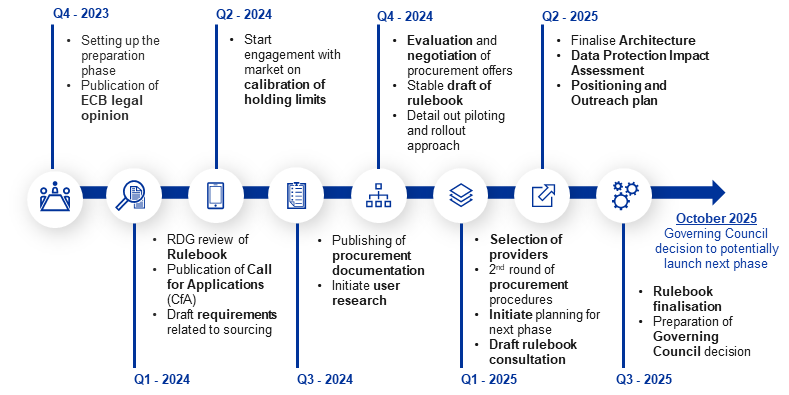

The European Central Bank (ECB) published its first progress report on the digital euro preparation phase, which was launched on 1 November 2023 with the aim of laying the foundations for the potential issuance of a digital euro. The report outlines the progress made on key digital euro design aspects and the envisaged next steps for the project.

Digital euro privacy

The design of the digital euro includes an offline functionality that would offer users a cash-like level of privacy for payments in physical shops and between individuals. When paying offline, personal transaction details would only be known to the payer and the payee and would not be shared with payment service providers, the Eurosystem or any providers of supporting services.

In recent months, the ECB has agreed on the technical features required to guarantee that online digital euro transactions will provide an even higher privacy standards than current digital payment solutions, while still ensuring robust end-user protection against fraud. The Eurosystem would use state-of-the-art measures, including pseudonymisation, hashing and data encryption, to ensure it would not be able to directly link digital euro transactions to specific users.

In line with current practice, payment service providers would only have access to the personal data that are required to ensure compliance with EU law, such as anti-money laundering regulations. To use data for commercial purposes, payment service providers would need users’ explicit consent. As the issuer of and payment infrastructure provider for a digital euro, the ECB will be supervised by independent data protection authorities that will monitor its compliance with the European Union Data Protection Regulation (EUDPR) and the General Data Protection Regulation (GDPR).

An offline digital euro

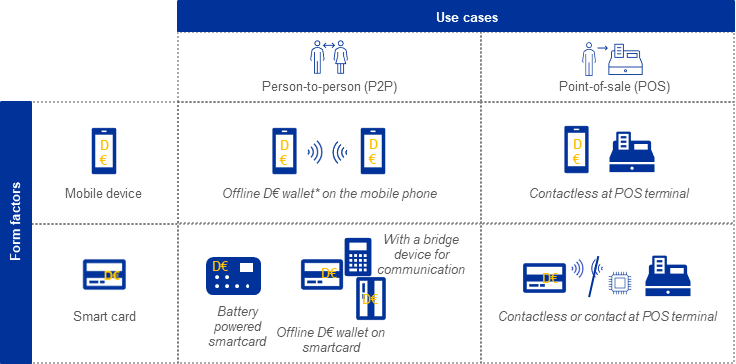

The Eurosystem is developing an offline functionality that would enable digital euro users to pay without an internet connection after pre-funding their digital euro account via the internet or an ATM. Payments would take place directly between the offline devices – e.g. mobile phones or payment cards – belonging to the users involved in the transaction, without having to rely on third parties.

The ECB has been investigating the technical tools already available on the market that could allow the settlement of offline digital euro transactions directly in end users’ devices. It has also assessed other essential aspects of offline digital euro payments, with a view to making them seamless, secure and user-friendly.

The ECB’s technical work has focused in particular on delivery considerations and how to fund and defund offline digital euro wallets, including how to perform anti-money laundering and forgery checks. For offline payments, users would be able to use their mobile devices, while the Eurosystem is also investigating the potential use of battery-powered smart cards or non-powered smart cards which use a bridge device to communicate.

The effective implementation of an offline digital euro on mobile devices will ultimately depend on the requirements laid down for equipment manufacturers and providers of electronic communication services in the digital euro Regulation.

Digital euro holding limits

The design of a digital euro must ensure it can be widely used as a means of payment while still preserving financial stability and the transmission of monetary policy. For this reason, digital euro holdings of individuals would not be remunerated and would be subject to holding limits.[3] Moreover, users would have the option to link their digital euro wallet with a commercial bank account, allowing them to make payments through their digital euro wallet without needing to pre-load it with funds.

The ECB has started work on a calibration methodology to define the holding limits, which entails a comprehensive monetary and economic assessment.[4] A newly created workstream, including experts from the national central banks of the Eurosystem and national competent authorities, has begun to identify the factors that could influence the holding limits calibration. In this context, the ECB has launched a dialogue and a data collection exercise to obtain the granular data required to perform the assessment. As this is a collective endeavour, the ECB is holding regular exchanges with co-legislators and market participants (consumers, merchants and financial institutions) to update them on the technical work and gather feedback. The first engagements have already taken place, with more to follow in the coming months given the relevance of this work for all the stakeholders involved in the digital euro project.

Findings from this initial assessment will feed into the design of the calibration methodology. The exact holding limits would be based on this methodology and defined closer to the time of issuance, taking the prevailing economic conditions into consideration.

Number of digital euro accounts per user

Anyone in the euro area would be able to open a digital euro account. During the investigation phase of the project, the Eurosystem’s research into the digital euro design found that limiting users to one digital euro account would be easier to implement than allowing multiple accounts per user. On the other hand, the Commission’s legislative proposal did not provide for a limit to the number of digital euro payment accounts that users could open with the same or a different bank or payment platform.

To support the decision that co-legislators are taking on this matter, the ECB has published an in-depth technical analysis of the feasibility and implications of having multiple digital euro accounts per user. The analysis shows that:

. it is technically feasible to provide users with multiple accounts in conjunction with an individual holding limit;

. a multiple account scenario would not have implications for privacy, as it would not require the Eurosystem to process more personal data than in a single account scenario;

. joint digital euro accounts would be possible in both a single account and a multiple account scenario; however, holding a joint digital euro account and an individual digital euro account simultaneously would only be possible in a multiple account scenario;

. unlike the current IBAN system, a digital euro would offer the unique functionality of carrying over, or “porting”, the account number when the user switches from one PSP to another. This would make changing payment service provider as easy as switching from one mobile phone provider to another.

That being said, trade-offs would be necessary, mainly in terms of user experience, as well as technical and operational implementation for PSPs. For instance, a multiple account scenario would lead to a higher degree of complexity: users would need to go through more steps if they wanted to open an additional digital euro account, such as allocating their holding limit between their existing and new account(s) for both online and offline payments. PSPs would also need to provide additional customer support and manage requests for opening and closing digital euro accounts. Implementing multiple accounts would require a coordinated effort from PSPs to check for and avoid duplication of holding limits, and in the event that a user’s data (e.g. surname) changes in one of their accounts

Compensation model

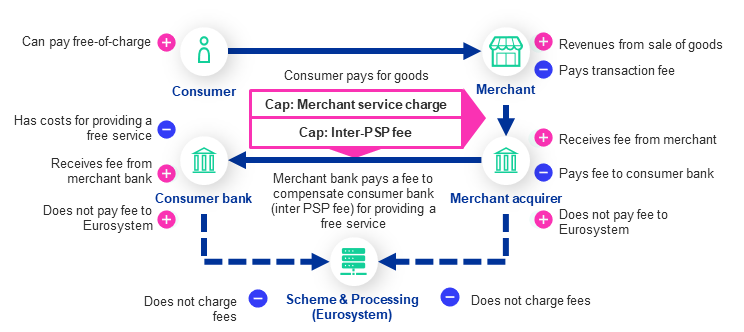

The compensation model ensures that consumers, merchants and PSPs would all benefit from the introduction of a digital euro.

While the compensation model would ultimately be decided by European co-legislators, the Eurosystem supports a model that creates fair and reliable economic incentives for PSPs, helping them to meet the operational costs of distributing a digital euro. The draft legislation envisages a compensation model with fair economic incentives for all involved (e.g. consumers, merchants, banks), in line with the following principles:

. As a public good, a digital euro would be free of charge for basic use. It would be equally accessible in all euro area countries.

. PSPs would charge merchant fees for providing digital euro-related services to offset the operational costs of distributing a digital euro, as is the case today for other digital means of payment. PSPs would also be able to develop additional digital euro services for their customers, on top of those required for basic use.

. The fees that merchants pay to PSPs for digital euro services would be subject to a cap to provide adequate safeguards against excessive charges, as outlined by the European Commission in its legislative proposal on a digital euro.

. The Eurosystem would bear the issuance costs, as it does in the production of banknotes.

Digital euro rulebook and tender process

The digital euro Rulebook Development Group has completed an interim review of the first draft of the rulebook, which sets out the rules and procedures to standardise digital euro payments across the euro area. The group is expected to deliver an updated version of the digital euro rulebook by the end of 2024, including the pending chapters, which focus on user identification and authentication as well as infrastructure-related requirements.

In parallel, the ECB issued five calls for applications aimed at establishing framework agreements with suitable external providers for the provision of digital euro components and related services. The Eurosystem will now proceed with the selection process by inviting the highest ranked respondents to tender. This process will help decide the final technical details for designing a digital euro.

Supporting the legislative process

As legislative deliberations evolve, the ECB has continued to provide technical expertise to the European institutions involved. In particular, to support ongoing discussions, the ECB has (i) provided technical input with regard to analysing the dynamics in the euro retail payments market; (ii) published an in-depth technical analysis of the feasibility and implications of allowing multiple digital euro accounts per user and (iii) conducted additional technical work on a digital euro app with a view to making it highly inclusive and accessible.

“The digital euro preparation phase is progressing well and we support the ongoing democratic debate on the legal framework for the digital euro,” said Executive Board member Piero Cipollone, who chairs the High-Level Task Force on a digital euro. “The digital euro is a common European endeavour. As such, we will continue engaging with all stakeholders, including the European public, to ensure that it is successful and benefits us all.”

The next progress report on the preparation phase will be published in autumn 2024, one year after it began. The Governing Council of the ECB will only decide on the possible issuance of a digital euro once the relevant legislation has been adopted, since this legal framework is essential for the concrete function of the digital euro.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: