In Western Europe, the percentage is even higher and is predicted to reach more than 25% in 2017. Payment methods like mobile payments and e-wallets have come to represent a serious competition to the payment services provided by banks, according to the latest EBA Consumer Trends Report.

Mobile payments (M-payments) can be briefly described as payments for goods and services made using mobile devices, which does not include accessing banking services via an internet browser on a mobile phone. E-wallets are a means of electronically storing digital cash and billing, shipping and payment information for online transactions.

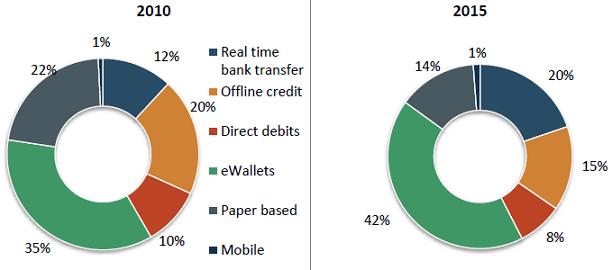

Te first graphic, which is based on research carried out by alternative payment providers, shows the past and estimated market shares of these new payment methods and suggests that the importance of these alternatives is growing.

Global share of alternative payment methods

Source: WorldPay 2012 (Optimising your alternative payments: a global view)

As early as 2010, e-wallets accounted for the largest share of alternative payment methods and they are expected to grow further from 35% to 42% by 2015. In the same period, real time bank transfers are expected to double their share, growing from 12% to 20%. These shares will grow at the expense of paper-based options, which are expected to decrease from 22% to 14%.

While mobile payments continue to account for a relatively small share of payment transactions (1%), forecasts show they will experience significant growth. The graphic below shows that global mobile payments are expected to increase in the next five years, as more than 15% of mobile users will be using their handsets for payments. In Western Europe, the percentage is even higher and is predicted to reach more than 25% in 2017.

Percentage of mobile users who acces mobile banking information services

Source: WorldPay 2012 (Optimising your alternative payments: a global view)

As growth is confirmed, so is the competition that these new alternative payment methods will represent to banks. The next graphic depicts the evolution of the share of banks and alternative providers of M-payments and E-payments. As the numbers of transactions are expected to grow in both types of payments, alternative providers will be taking a higher share of the market.

Global number of M-payment and E-payment transactions (billions)

Source: Cap Gemini/EFMA 2012, World Payments Report

Some of the new payment methods are being introduced by non-banks, e.g. supermarket chains and independent payment companies.

According to the EBA report, a number of possible consumer detriment issues can arise: unauthorised charges, misleading information disclosure, absence of dispute resolution and redress mechanisms, data protection concerns, accountability for payment instructions carried out and the involvement of third-party service providers in fund transfers and remittance.

The PSD2 is anticipated to address issues related to new payment services, their providers and security. The EBA will be monitoring the mandates that are proposed to be assigned to it, and will commence work on the implementation of those mandates in the second half of 2014.

Read the full EBA report: Download the document now 844 kb (PDF File)

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: