EBA report: between 2009 and 2012, cash transactions decreased from 83,5% to 80% as share in all payment transactions in Europe

The trends identified by the European Banking Authority (EBA) indicate a slow but constant shift on the usage of traditional payment methods that include cash, debit and credit cards, cheques, and bank transfers. Cash has been the dominant form of payment by far, and forecasts suggest it will remain so.

However, gradually card payments and electronic transactions, such as electronic funds transfers, wire transfers and direct debits, are gaining a higher share of transactions.

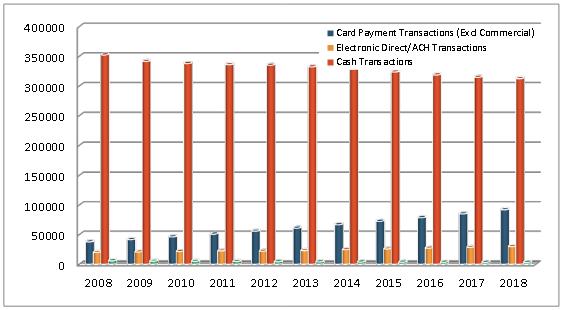

In 2009, cash transactions represented 83.5% of all payment transactions in Europe, while card payments represented 10.2% and electronic transactions accounted for 5%. By 2012, cash transactions decreased to 80.3%, while card payments and electronic transactions increased to 13.4% and 5.3%, respectively.

Payment transations in Europe (in millions)–history and forecast

Source: Euromonitor (2013), Passport–Consumer finance

The forecasts predict the trend to continue in the years to come, as cash transactions will slowly diminish further while card payments will grow at a faster rate.

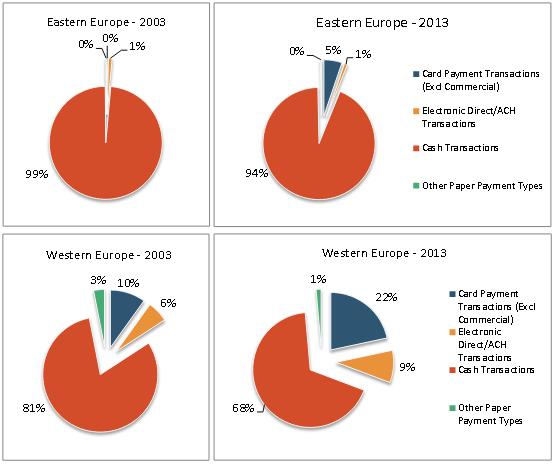

However,geographical distinctions need to be made, as the national markets in the EU do not behave homogeeously. While payment methods have grown and benefitted from innovation for a number of years in Western Europe, with card and electronic payment options being implemented and now widely spread, in some eastern European countries the trend seems to have started changing only more recently.

Exhibit 7 presents some of these differences. For example, Eastern European markets have seen a pronounced growth of card transactions to 5%, which is likely to continue in the future, but are still at a significantly lower level compared to the 22% recorded for Western Europe, up from 10% a decade before.

Electronic transactions have reached a significant share, growing in Western Europe from 6% to 9% over the same period, while cash transactions saw a reduction from 81% to 68%.

By contrast, until the present day, cash transactions remain the primary means of payment in Eastern Europe.

Payment transactions per type, year and geographical region

Source: Euromonitor (2013), Passport–Consumer finance

Read the full EBA report: Download the document now 844 kb (PDF File)

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: