EBA publishes the results of its 2021 EU-wide stress test: „those banks more focused on domestic activities or with lower net interest income, display a higher depletion”

The European Banking Authority (EBA) published today the results of its 2021 EU-wide stress test, which involved 50 banks from 15 EU and EEA countries, covering 70% of the EU banking sector assets. This exercise allows to assess, in a consistent way, the resilience of EU banks over a three-year horizon under both a baseline and an adverse scenario, which is characterised by severe shocks taking into account the impact of the pandemic.

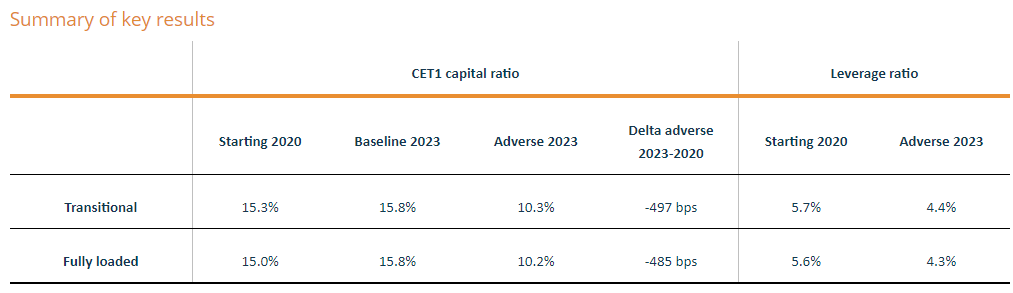

The individual bank results promote market discipline and are an input into the supervisory decision-making process. The adverse scenario has an impact of 485 bps on banks’ CET1 fully loaded capital ratio (497 bps on a transitional basis), leading to a 10.2% CET1 capital ratio at the end of 2023 (10.3% on a transitional basis).

Since the previous EBA EU-wide stress test in 2018, banks have continued building up their capital base, and at the beginning of the exercise (i.e. end-2020), had a CET1 ratio of 15% on a fully loaded basis (15.3% on a transitional basis), the highest since the EBA has been performing stress tests. This was achieved despite an unprecedented decline of the EU’s GDP and the first effects of the Covid-19 pandemic in 2020.

This year’s stress test is characterised by an adverse scenario that assumes a prolonged Covid-19 scenario in a “lower for longer” interest rate environment. With a cumulative drop in GDP over the three-year horizon by 3.6% in the EU, and a negative cumulative drop in the GDP of every member state, the 2021 adverse scenario is very severe, also having in mind the weaker macroeconomic starting point in 2020 as a result of the pandemic. The baseline scenario also provides some comparable information about individual banks in the context of a gradual exit from the pandemic.

Against this background, under the adverse scenario, the EU banking system as a whole would see its CET1 reduced by 485 bps on a fully loaded basis (497 bps on a transitional basis) after three years, while staying above 10%[1]. The results also show dispersion across banks. For instance, those banks more focused on domestic activities or with lower net interest income (NII), display a higher depletion.

Credit losses and lower income are the main drivers

The overall impact results in a CET1 depletion of EUR 265bn, and in an increase of the total risk exposure amount (REA) of EUR 868bn at the end of the three-year horizon, resulting in a 485 bps decrease in the CET1 ratio. The key specific risk drivers contributing to the overall impact on CET1 capital ratio on a fully loaded basis include:

. credit risk losses of EUR 308bn (i.e. -423 bps of CET1);

. market risk losses, including counterparty credit risk, of EUR 74bn (-102 bps of CET1);

. operational risk losses, including conduct risk, of EUR 49bn (-68 bps of CET1).

The final CET1 capital ratio is also affected by a sluggish economic environment. The contribution of income only stands at 290 bps, significantly lower compared to previous exercises, mainly as a result of lower NII.

Special focus on the Covid-19 support measures

Based on the stress test methodology, EBA-compliant moratoria are assumed to have expired, and their mitigating effect is, therefore, disregarded. On the other hand, Public Guarantee Schemes (PGS) benefitting certain exposures are assumed to stay in place throughout the stress test horizon.

The 2021 exercise provides additional disclosures on the exposures that have been subject to Covid-19 support measures – i.e. moratoria and PGS. In the adverse scenario, banks with more exposures towards sectors highly affected by the pandemic display an increase of their loans in stage 3 (with a ratio of stage 3 to total loans from 2.8% in 2020 to 9.1% in 2023) which shows a higher credit risk when compared to the overall sample of banks (the overall stage 3 ratio increased from 2.1% to 6.3%).

In terms of Covid-19 support measures, at the beginning of the exercise, 4.2% of total exposures had benefitted of EBA-compliant moratoria (of which 1.4% had not yet expired as of December 2020) and 1.6% of total exposures benefitted from PGS.

Given the importance of tracking the evolution of credit risk for loans that had been subject to public support measures, it is worth highlighting the higher increase of the stage 3 ratio over the stress test horizon for loans under moratoria (from 3.1% to 13.4%). For exposures under PGS, the stage 3 ratio reaches 6.8% in 2023 (1.1% in 2020).

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: