The European Banking Authority (EBA) published the 9th edition of its biennial Consumer Trends Report for 2024/25. „The Report has identified payment fraud, indebtedness, and unwarranted de-risking as the most important issues affecting EU consumers.” – according to the press release.

The Report is based on information provided by the national authorities of the 27 EU Member States, selected national and EU consumer associations, EU industry associations, national ombudsmen, as well as quantitative data from a variety of sources, including for the first time the EBA’s new Retail Risk Indicators, which the EBA publishes separately since 2022 with a view to identify potential consumer harm.

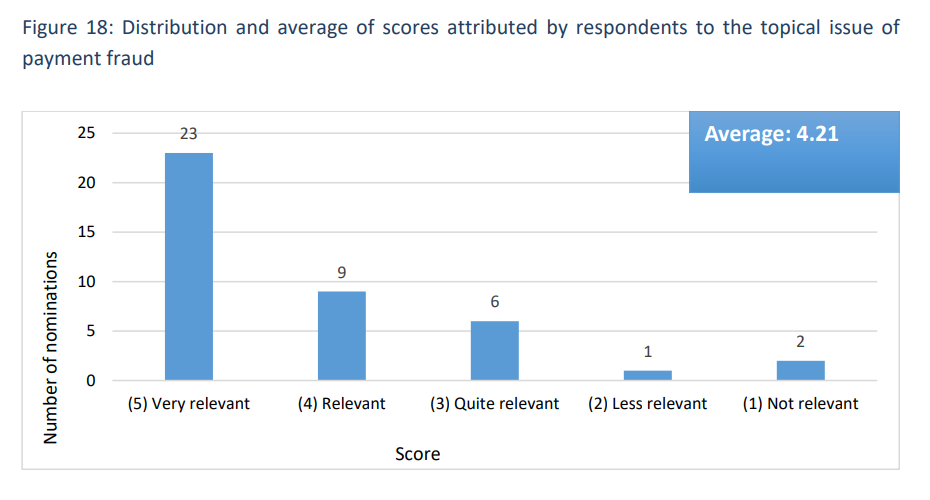

The Report concludes that payment fraud is still the most significant issue for EU consumers. This also reflects the emergence of new types of fraud, such as social engineering techniques. In this type of scams, payers are manipulated into making a payment to the fraudsters, who have adapted their techniques to elude the application of the strong customer authentication requirements imposed by EU law.

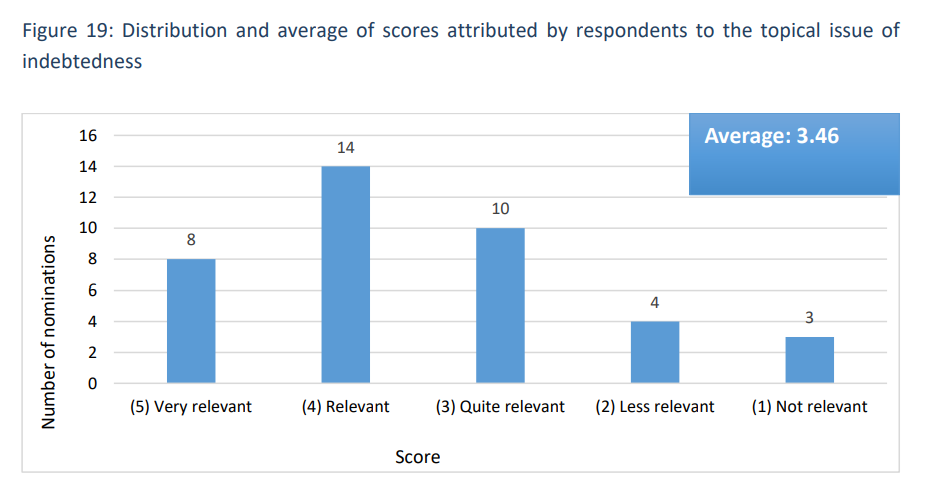

Indebtedness emerges as the second most relevant issue, with a significant rise of what is commonly referred to as ‘Buy-Now-Pay-Later’ credit and other types of small, fast, accessible and short-term credit. Inadequate creditworthiness assessment practices of lenders and poor disclosure of pre-contractual information are found to be key drivers to indebtedness.

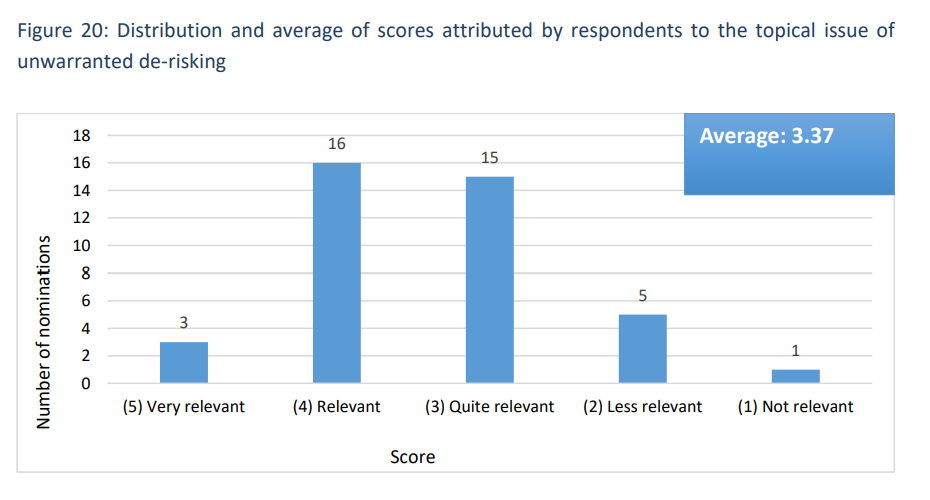

Unwarranted de-risking is the third most relevant issue, with more consumers facing increased difficulties in opening and retaining payment accounts, access to which is a prerequisite for residents in the EU to be able to participate in the EU economy. This issue materialises in the form of refused onboarding of new and the offboarding of existing consumers and seems to be affecting mostly specific categories of vulnerable consumers, i.e., migrants, refugees, the homeless, cross-border workers, and individuals with poor financial histories.

Following these findings, the EBA will consider which actions to take in 2025/26 to address the topical issues identified in 2024/25 and with the aim of further enhancing consumer protection across the EU.

_________

More details: Consumer trends report 2024/2025 (916.68 KB – PDF) – Download

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: