European Association for Secure Transcations (EAST) has just published a European Payment Terminal Crime Report covering the first six months of 2017 which reports that ATM black box attacks took place in eleven countries.

A total of 114 such attacks were reported, up from 28 during the same period in 2016, a 307% increase. ‘Black Box’ is the connection of an unauthorised device which sends dispense commands directly to the ATM cash dispenser in order to ‘cash-out’ the ATM. Related losses were up 268%, from €0.41 million to €1.51 million. EAST Executive Director Lachlan Gunn said, “This sees the continuation of a trend that we first reported in April of this year when we published full year statistics for 2016. Our Expert Group on All Terminal Fraud (EGAF) is actively monitoring all logical threats against payment terminals and against the wider banking infrastructure.”

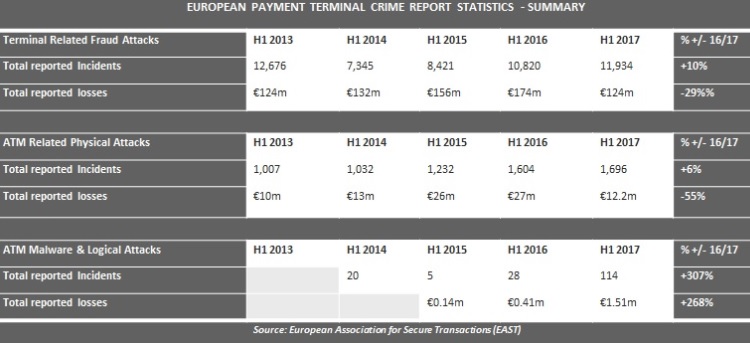

Overall payment terminal related fraud attacks rose 10% when compared with H1 2016 (up from 10,820 to 11,934 incidents). This rise was mainly driven by an 88% increase in transaction reversal fraud (up from 4,840 to 9,081 incidents). The downward trend for card skimming continues with 1,221 card skimming incidents reported, down 22% from 1,573 in H1 2016. This is the lowest number of skimming incidents reported since EAST first began gathering data in 2004.

Losses due to payment terminal related fraud attacks were down 29% when compared with the same period in 2016 (down from €174 million to €124 million). Within these totals international skimming losses fell 32% (down from €142 million to €96 million) and Domestic skimming losses fell 15% (down from €26 million to €22 million).

ATM related physical attacks rose 6% when compared with H1 2016 (up from 1,604 to 1,696 incidents). Within this total ATM explosive attacks (including explosive gas and solid explosive attacks) were down 2% (down from 492 to 481 incidents). Losses due to ATM related physical attacks were €12.2 million, a 55% drop from the €27 million reported during the same period in 2016. Part of this decrease is due to the fact that one major ATM deploying country that used to report this data is currently unable to do so.

The average cash loss per explosive or gas attack is estimated at €14,575, the average cash loss for a robbery is €10,357 per incident and the average cash loss for a ram raid or burglary attack is €9,761. These figures do not take into account collateral damage to equipment or buildings, which can be significant and often exceeds the value of the cash lost in successful attacks.

A summary of the report statistics under the main headings is in the table below.

Source: EAST

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: