e-commerce in Europe shows strong growth – the shift from PCs to tablets and smartphones is changing the business

For the first quarter of 2014 the total amount spent on-line by the French was 13.4 billion euros, a 11% increased compared to the same perriod last year. There are now 144,000 active sites in France, an increase of 17% over the year, and 34 million French on-line consumers, over a million more than last year.

The latest research on Polish e-commerce suggests that 24 per cent of internet users do their grocery shopping online. This is almost twice more than last year and threefold the result for two years ago. Furthermore, every third Polish internet user has at least once done some online shopping on their smartphone, and every fifth did so on a tablet. The research also shows that over half of internet users among those who buy online on different devices, begin the shopping on a mobile phone screen and complete the purchase on a computer or tablet.

A growth of 11% for French e-commerce in the 1st quarter of 2014

FEVAD (French national association of Ecommerce Europe) has released the French internet sales figures for the first quarter of 2014. The internet sales increased by 11% compared to the first quarter of 2013. In the same period, the number of transactions increased by 15%. The total amount spent on-line by the French was 13.4 billion euros. These results are based on information collected from the main retail websites and on the total value of transactions handled by the main payment platforms on behalf of 144,000 internet sites.

If the value of the average basket continues to fall to 81.5 euros, a decrease of 4% in a year, the frequency of purchase continues to rise, to reach six purchases per quarter (+10 %).

The average amount spent by online shoppers is 491 euros (as compared to 467 euros in the first quarter of 2013), an increase of 5%. The increase in frequency of purchase therefore offsets the decline in the average value of purchases.

There are now 144,000 active sites in France, an increase of 17% over the year. This means that in 12 months, 21,000 additional sites have been added, to enrich the internet offer accessible to online shoppers. There are now 34 million French on-line consumers, over a million more than last year. (Source: Médiamétrie).

Growth in the first quarter was particularly driven by sites selling consumer products (including online marketplaces), which registered an 8% growth over the year. At the same time, business-to-business sites have seen their sales rise by 9% over the period.

So far as internet sales in travel and tourism are concerned, there is a slight drop (1% down), due to the decline in the value of the average basket (-4%). These results arise in a global context, marked by a decline in long and medium-term activity, to the benefit of the French market. (Source: SNAV).

The iCM index, which measures internet sales via mobile devices (smartphones and tablets, mobile sites and applications, excluding application downloads and online marketplace sales) increased by 76% in the first quarter of 2014, as compared to the first quarter of 2013.

Sales made via mobile devices (smartphones and tablets) represent an average 19% of turnover in sites participating in the index. 72% of these sales are made via an application or website optimized for mobile devices, while the remaining 28% go through the e-trader’s standard internet site.

Every fourth Polish user shops for grocery online

This is almost twice more than last year and threefold the result for two years ago. The average grocery bill at an e-store in Poland is PLN 70 – a Gemius report for e-Commerce Polska shows.

The latest research on Polish e-commerce suggests that 24 per cent of internet users do their grocery shopping online. It’s rather women (26 percent) than men (23 percent). Most often the users hold a degree (29 percent) and see their financial standing as average or more (49 percent).

– As recently as two years ago, 8 per cent of internet users declared they had had some experience with online food shopping, and a year later it was 13 per cent. This year a quarter of internet users claimed they chose e-stores when buying food, and every third intends to do so in the future – says Mateusz Gordon, e-commerce expert at Gemius. – On one hand, this is an opportunity for Polish e-businesses selling food online, but also a considerable challenge. A competitive advantage may be attained by those who will be alert to the moves made by their competitors, compare against them, but also adapt their websites to the needs of e-customers – believes Gordo

The respondents get their knowledge about the offered range of products from their family, friends and acquaintances (85 percent of internet users), Google search (83 percent) and e-shop websites (78 percent).

– One crucial factor that may sway internet users’ willingness to shop for grocery online is the opinion of other users who already have the experience – comments Patrycja Sass-Staniszewska from the E-commerce Chamber. – This is the reason why the e-businesses who want to be successful should pay extra attention to e-customer care. Internet users want clear information on the details of delivery, quality of the produce, options to take if a product is not available – Staniszewska elaborates.

The research also provides information on the amount the Polish users spend on grocery products online. It turns out to be PLN 70 on average, with men spending PLN 93, and ladies PLN 52.

– The game is definitely worth the candle – notices Michał Kot, Research Director at IIBR. – Grocery e-stores hold enormous potential and should look up to these product categories that now enjoy the greatest popularity, i.e. apparel, books, CDs and films, household goods – the expert believes.

Multichanneling is changing the business

When making a purchase online, Polish internet users do not limit their perspectives to a PC screen. They are turning to laptops, tablets, smartphones and e-books: the shopping begins on a mobile and ends on a home computer. The role of mobile shopping may be increasing, but website usability remains deficient.

As it may be concluded from a report prepared by Gemius for e-Commerce Polska, every third Polish internet user has at least once done some online shopping on their smartphone, and every fifth did so on a tablet. Nearly 4 per cent use e-book readers for this purpose. Still, the most frequent e-customer’s choice of device for shopping is a laptop (86 percent) and desktop computer (69 percent). The research also shows that over half of internet users among those who buy online on different devices, begin the shopping on a mobile phone screen and complete the purchase on a computer or tablet.

– The shift from PCs to tablets and smartphones is changing the business – comments Mateusz Gordon, the e-commerce expert at Gemius. – In practice, the growing number of mobile devices means a totally different user behaviour pattern. This concerns the ways of spending free time, frequency of browsing online content, as well as shopping. Poles utilize a number of channels at a time. The awareness of this trend should be reflected in a new model of business presence on the web – explains Gordon.

Grzegorz Wójcik, a board member at the Chamber of Digital Economy, adds that online shopping done on mobile devices is becoming a threat for the present leaders of the traditional internet market. – This is why it is crucial to adapt the form and content of an offer to the equipment or software used by e-consumers – clarifies Wójcik.

The respondents were also asked about the obstacles they encountered when shopping online on a mobile device. It turns out that it is men that complain more. They point out to the unfriendly forms (73 percent), unsuitability of websites (63 percent), complicated procedures for finalizing transactions (54 percent) and lack of mobile apps (45 percent). Women, in turn, are predominantly concerned with too small font (51 percent) and uncomfortable payment methods (29 percent).

– Apparently, e-shops make it more difficult for themselves – says Michał Kot, research director at the Interactive Institute for Market Research (IIBR). – Even with the best intentions e-customers may have, shopping on mobile devices is difficult and websites are poorly adapted for mobile use. The barrier may be key in the purchase process and our potential customer may be easily discouraged and quickly skip to a website better suited to such devices – adds Kot.

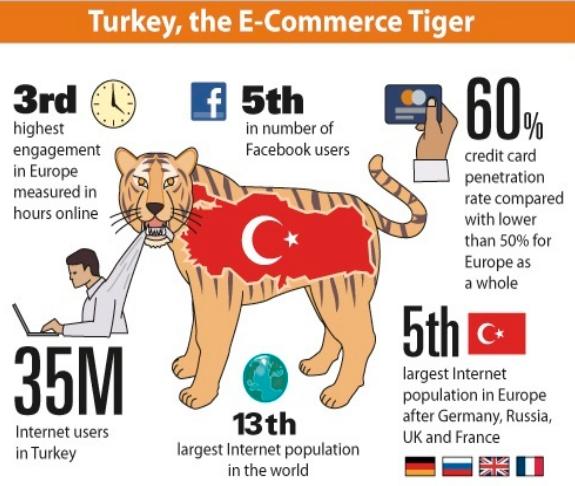

Turkish e-commerce grew the fastest

Turkey represents an enormous market potential, boasting a 90% growth rate over 2012 and an expected 40% year-on-year growth for 2013, thereby ranging ahead of all other Southern European countries in terms of growth.

Source: colderice.com

“As we can see from the results published in this latest Southern Europe B2C E-Commerce Report, the region is full of opportunities for online retailers: for instance, Turkey’s growth rate outperformed the European average by 100% in 2013. Now is the right moment to step in these markets and start growing e-commerce success,” says Wijnand Jongen, Chair Statistical Board Ecommerce Europe

This is revealed by the latest report on B2C e-commerce in Southern Europe by Ecommerce Europe. Ecommerce Europe is the European umbrella organization for online retailers. Figures in Ecommerce Europe reports are based on the Global Online Measurement Standard for E-commerce (GOMSEC).

http://www.ecommerce-europe.eu/home

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: