Over the past few years, Open Banking – a technology that gives consumers and businesses the legal right, for the first time, to access their payment accounts via third party providers (TPPs), has become a global phenomenon, with studies estimating that the Open Banking market will be valued at $123.7 billion by 2031 from the $13.9 billion in 2020.

Since its launch in 2018, mainly in the UK and Europe, Open Banking has gained popularity worldwide. More and more countries are adopting Open Banking solutions towards enhancing customer experience, opening access to data and providing a simple, secure, and frictionless payment journey.

The Middle East follows and speeds up the trend, with countries actively pushing to fasten their positioning as global fintech hubs. Over the past three years, the region has seen an astonishing financial transformation, following innovative and exciting Open Banking frameworks across various countries in the area.

In this article, we’ll walk you through the Open Banking journey of several Middle East countries: how it’s shaping up, the approach and measures taken so far by the authorities and the industry players as well as what’s next for them.

Although a small-sized country compared to its neighbours, Bahrain has become the pioneer of fintech experimentation in the GCC. The Central Bank of Bahrain (CBB) played a key role in this, with its vision to adopt the latest digital trends and innovative financial service solutions in Bahrain, thereby expanding the scope of traditional banking.

The Open Banking Framework (OBF) was launched in October 2020, following comprehensive rules, which were previously released in December 2018. The OBF covers both AIS and PIS and outlines detailed operational requirements, security standards, customer experience guidelines, APIs technical specifications, as well as the overall governance framework for protecting customer information.

With Bahrain’s governing framework (a combination of the European PSD2, the UK’s OBIE, and Australian Open Banking rules), and API technical standards firmly established, it has been possible to lay a solid foundation for the market to stimulate competition, encourage innovation, and foster financial inclusion.

The first use of Open Banking in Bahrain happened back in December 2019, when the National Bank of Bahrain (NBB) launched their Open Banking platform for personal financial management (PFM). With NBB’s Open Banking platform, end-users have a holistic, 360-degree view of their finances, spending habits, and historic records across Bahraini banks, all in one app. It benefits businesses and startups as well. By connecting to banks’ APIs, businesses can recommend the right financial products to enhance their product acquisition strategy.

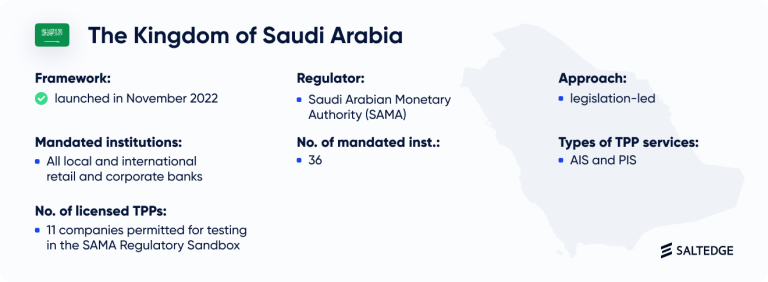

Saudi Arabia is another early adopter of the Open Finance initiative in the Middle East, which chose a unique use-case-first approach. Saudi Central Bank (SAMA) is committed to supporting the Kingdom’s economic growth and maintaining financial stability and has developed a cashless agenda that aims to make 70% of transactions non-cash by 2030. With a strong belief that Open Banking is a pillar in supporting Saudi Arabia’s 2030 vision, the local regulator – SAMA, published in November 2022 the Open Banking Framework and mandated banks to make their account information APIs available by the end of 2022 and the payment initiation APIs by the end of March 2023. In addition to the mandated regime, the comprehensive Framework describes the technical requirements and the standards that market participants should follow, as well as the rules for the third party providers (TPPs).

Back in 2018, SAMA released its Regulatory Sandbox – a controlled environment where institutions can test their platforms on a real audience without being immediately required to comply with all the regulatory obligations. As of now, the central bank has allowed a group of fintechs to offer Open Banking services within the Regulatory Sandbox, and as a result of its switch to an “always open” approach, the number of participants has increased. Out of 42 registered participants, 11 are Open Banking Permitted Fintechs by SAMA.

In January 2023, SAMA launched the Open Banking Lab – a platform that provides banks and TPPs a technical environment for testing use cases, enabling them to develop and certify their Open Banking services under the established Open Banking Framework.

An interesting aspect of Saudi banks is that regulatory compliance does not make up their entire focus. Aside from this, many banks have already set strategies for how to go beyond it and build premium APIs and Banking-as-a-Service (BaaS) on top of their compliance infrastructure.

„SAMA has set deadlines and is working closely with banks, urging them to comply with the KSA Open Banking Framework for AIS and Letters of Guarantee until the end of March 2023, and it is expected that PIS API standards will be released afterwards. Regulatory compliance is being actively pursued by local banks, which are working hard and investing resources to meet the timeline set by SAMA.

As we see, these efforts are already paying off for the Kingdom’s financial industry. With the recent announcement from Riyad Bank that Malaa PFM is connected to its Open Banking APIs, the first use cases are already underway. As well, PIS is another challenge with higher risks involved and more security measures to be taken. I believe that by the end of the year, the ecosystem will be benefiting from a diversity of Open Banking use cases based on AIS and PIS.” – says Alina Beleuta, Chief Growth Officer at Salt Edge.

An exceptional combination of policy-driven and industry-led efforts created an ideal backdrop for a smooth Open Finance implementation in The United Arab Emirates (UAE). Even without a formal Open Finance Framework in place yet but rather a market-led initiative, the API standard is already live.

Currently, the Central Bank of UAE is drafting a high-level regulatory framework on Open Finance.

In February 2023, the CBUAE launched a Financial Infrastructure Transformation Programme (FIT Programme) with nine key initiatives including Open Finance, set to be fully implemented by 2026.

Among the first steps will be the launch of the Card Domestic Scheme, the Instant Payments Platform. While the second stage of the programme is the establishment of the Financial Cloud, eKYC, and Open Finance Platforms. Implementing these technologies will improve regulatory compliance, reduce operations costs, and enhance customer experience, as well as security and operational reliability.

Meanwhile, Dubai Financial Services Authority (DFSA) and Financial Services Regulatory Authority (FSRA) operate within the region on licensing frameworks enabling AIS and PIS activities before the final regulatory framework is in place. As of now, there are 2 licensed TPPs in the UAE, one AIS licensed by FSRA, and one PIS licensed by DFSA.

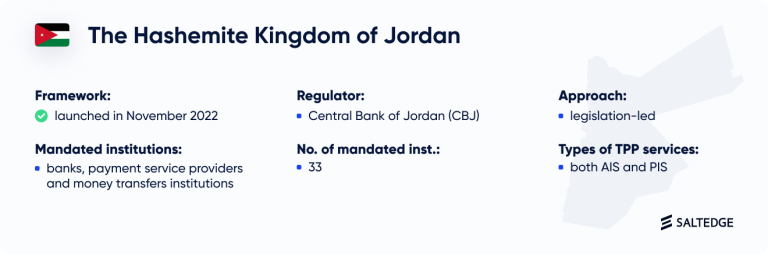

Similar to other regulators in the region, the Central Bank of Jordan (CBJ) is convinced that Open Finance is vital for both competition and innovation to thrive and is fundamental for inclusive and digital growth.

In November 2022, the CBJ issued the Open Finance Framework, which governs all the banks, payment service providers, and money transfer companies in the country.

The Framework includes both types of Open Finance services: AIS and PIS. The local financial institutions are mandated to develop the technology allowing authorised TPPs open and secure access to accounts and customer data by the end of 2023. By contrast to other countries in the Middle East, Jordan requires a contractual agreement between financial institutions and third party providers, which adds an extra layer of friction and sets the rules for a TPP governance model.

„We are closely monitoring the Open Finance movement in the region and are pleased to see so many countries taking confident steps. The recently issued Open Finance Framework proves that the Kingdom of Jordan is ready to accelerate its position as a global financial hub. Our service offerings have lately expanded to Jordan, and we can say with certainty that Salt Edge is equipped with all the capabilities needed to assist financial players to kick-start their Open Finance journey. Banks and other financial institutions in Jordan can focus on setting procedures and strategies to build successful use cases while trusting us with compliance and other technical particularities.” – says Garri Galanter, Chief Executive Officer at Salt Edge

Qatar, Oman, and Kuwait are also taking significant steps towards an Open Finance future, with a legislation-led approach similar to Saudi Arabia and Bahrain. They have launched several initiatives to foster Open Banking innovation, including regulatory sandboxes.

While Open Banking is still in its early stages of adoption in Qatar, the Qatar Central Bank’ (QCB) efforts and the interest of the country’s financial institutions suggest their plans to elaborate a framework for Open Banking and explore its potential benefits.

As of March 2023, the QCB issued the Fintech Sector Strategy Summary, built on 4 strategic pillars. Its aim is to enable a digital transformation of the State of Qatar’s financial services ecosystem, attract foreign direct investment, and promote financial literacy skills. Building an Open Banking architecture is one of the key highlights of the strategy for the next 5 years along with the issuance of fintech regulations including Open Banking and standards.

The regulatory framework is expected to include guidelines for the authorisation and supervision of third-party providers, the secure sharing of customer data, and customer consent.

Qatar’s financial institutions are also exploring ways to implement Open Banking and collaborate with fintech companies to create new services and products for their customers. In 2022, Qatar National Bank (QNB) launched its own Open Banking Platform, to enable customers and partners access to its APIs.

Having developed its fintech framework and roadmap, Oman is in the process of creating an Open Banking API strategy, which encompasses various initiatives with the aim of building and cultivating a robust fintech ecosystem to drive innovation in the financial sector. Among these initiatives are sandboxes, cloud-based frameworks, and eKYC-related activities.

The Central Bank of Kuwait (CBK) is considering an approach combining Open Banking with GDPR (Europe’s General Data Protection Regulation).

In 2018 the CBK launched a Regulatory Sandbox – a stable environment in which innovative fintech products and services can be tested without affecting the stability of the banking and financial system. The Sandbox has been updated in 2019 to expand its acceptance to a broader range of products and services.

Specialists at the CBK conducted a comprehensive study and concluded that a Regulatory Framework and API specifications are needed for Open Banking. To achieve this, the Central Bank also established a working group, “CBK Open Banking Working Group,” comprising CBK specialists and Kuwaiti banks.

What the Middle East can learn from Open Banking best practices

Overall, when comparing Middle East countries’ Open Banking strategy with the UK and EU ecosystem, we can conclude that the region is more ambitious from a regulatory perspective. Notably, the region did their homework and thoroughly examined the Open Banking forerunners to avoid their mistakes and even get better in some instances.

There is also a reputation for persistence among regulators, who demand swift compliance from participants. Some Middle East countries have already begun to adopt Open Finance which is the next step beyond Open Banking and are setting strategies beyond regulatory compliance. Countries like Saudi Arabia and Jordan did not limit their frameworks to payment accounts only. Instead, they are aiming at making consumer data more accessible to a wider range of financial products and services. Meanwhile, the UK and the EU are still considering this path.

More detail here

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: