Domestic networks continue to drive financial inclusion worldwide but face an ongoing challenge to stay

up-to-date on card functionality and flexibility.

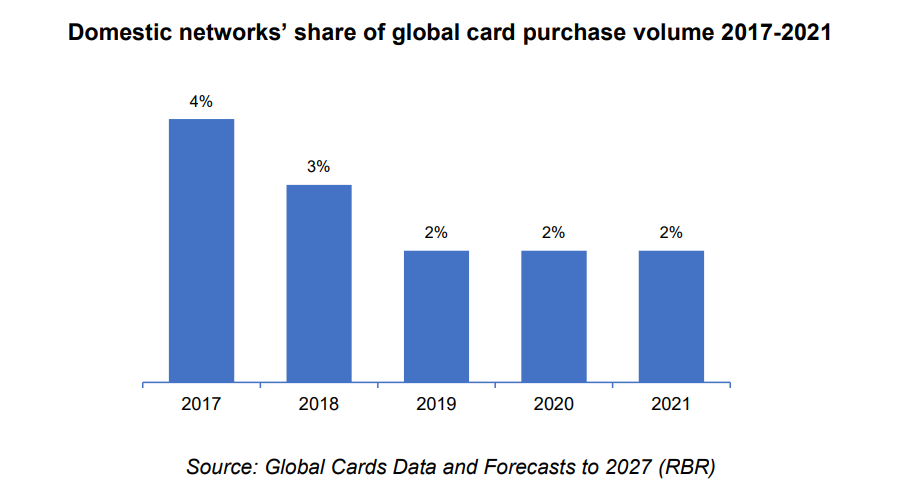

RBR’s Global Cards Data and Forecasts to 2027 study found that the share of spending made on domestic network cards was unchanged at 2% in 2021, but has halved since 2017. A third of all purchase volume in the Middle East and Africa (MEA) region was made with domestic network cards, by far the highest proportion globally, and mostly down to Iran, the only country worldwide where only domestic cards are available.

Domestic network cards remain useful tools for financial inclusion and other political goals

Local cards remain competitive thanks to lower interchange and processing costs and their power to further financial inclusion in emerging markets. Brazil’s Elo network has brought cards to poorer and underbanked members of society and has grown to represent almost a third of the country’s entire card base.

Geopolitical factors also play a role as some countries strive for self-sufficiency in their payments

infrastructure and independence from western-led systems – Russia’s Mir has expanded in these

circumstances and has become the country’s default card network as global players have exited.

Domestic networks are also making progress on functionality, addressing one of their key historical weaknesses in comparison to their international equivalents. RBR’s study found that more domestic cards are contactless than ever before, with their share of contactless transactions reaching 7% in 2021.

Egypt’s Meeza network was only launched in 2019 and has gained traction issuing contactless prepaid cards to those with little banking history, generating large numbers of everyday contactless transactions.

The return of international travel hampers progress for domestic networks

The recovery in international travel and cross-border spending following the COVID-19 pandemic actually worked against growth in domestic networks, which are rarely used or accepted outside of their home markets.

The flexibility to spend abroad is one of the most compelling factors driving usage of international networks over domestic ones. South Korean domestic networks’ share of purchase volume dropped from 27% to 25% in 2021, for example, as customers increasingly opted for cards suitable for both domestic and cross-border purchases

Co-badging and migration to international schemes pose a threat to domestic-only products

While the share of domestic network cards in overall global card numbers stayed stable at 13%, RBR’s research identified many cases where domestic network-only cards are being replaced with dual-badged or international network-only equivalents. Particularly in Europe, dual-badged cards are often preferred as the best of both worlds: providing low-fee domestic transactions on the local network, with the cardholder able to switch to an international network for certain transactions, particularly online or overseas. In Germany, uptake of Girocard-only debit cards has slowed in recent years, with consumers preferring the dual-badged version, particularly for online purchases.

Some issuers are shifting away from domestic-only and dual-badged cards to international networks, although the success of this strategy depends on international scheme acceptance level in the country. Belgian issuer Belfius started issuing Mastercard-only cards for the first time in 2021, while in Israel all domestic Isracard cards are being migrated to Mastercard.

Daniel Dawson, who led RBR’s Global Cards Data and Forecasts to 2027, remarked: “Domestic networks remain instrumental in expanding access to cards and payments in emerging economies, but their potential seems less assured in mature markets. Increased functionality can provide some future proofing for domestic products, but their limitations in terms of travel and e-commerce acceptance may reduce their long-term competitiveness globally”.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: