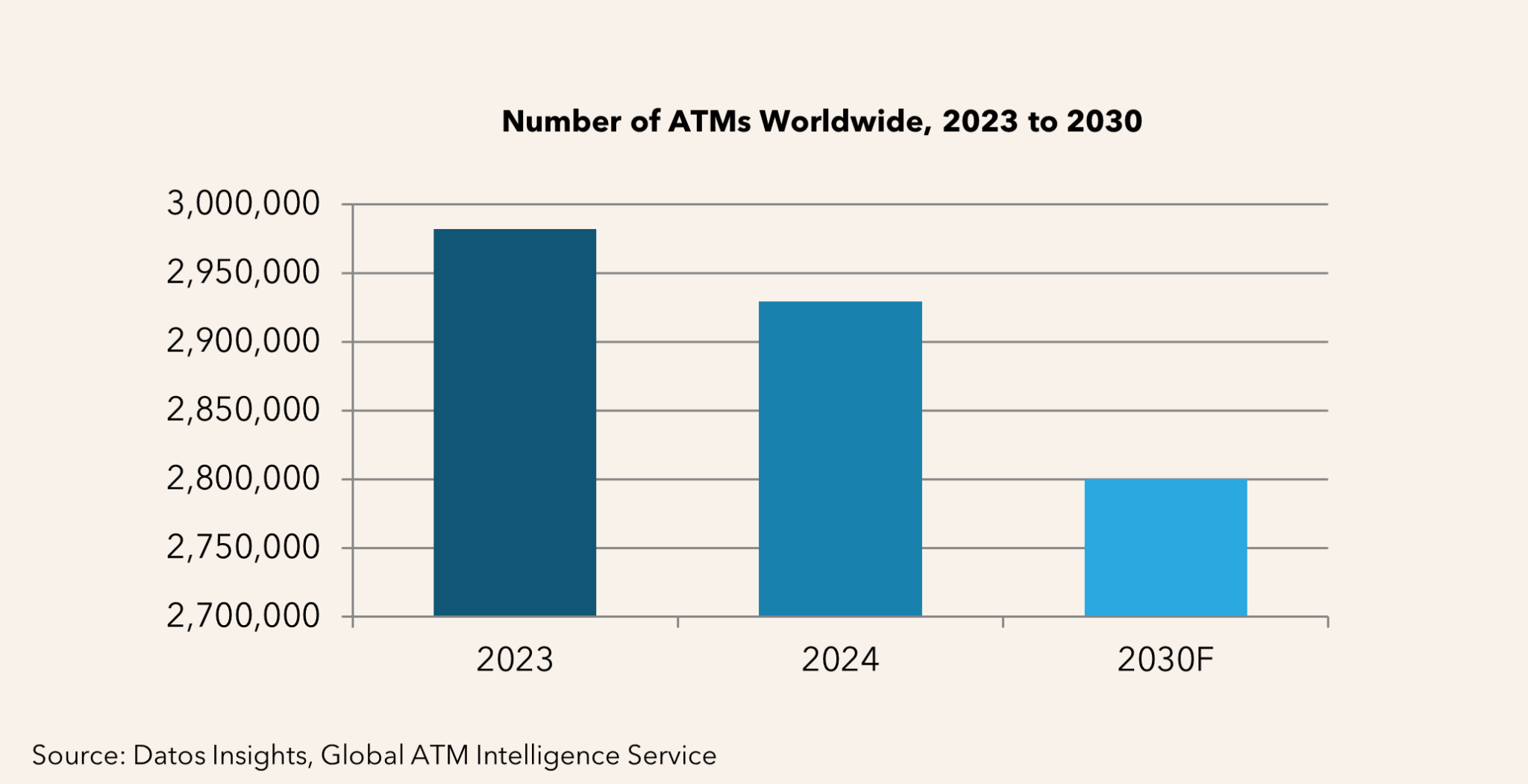

According to the latest research from Datos Insights’ Global ATM Intelligence Service, the number of ATMs worldwide declined by 2% in 2024 to 2.9 million. ATM numbers have fallen every year since 2018, reflecting an ongoing decline in cash usage.

The number and value of cash withdrawals fell by 3%, with Asia-Pacific seeing the sharpest fall in withdrawal value. This was driven by China, where pandemic-accelerated digital payments have caused a marked drop in demand for cash. The resulting ATM rationalisation contributed to Asia-Pacific having the steepest fall in ATM numbers.

Regional patterns reflect varying market dynamics

In western Europe, as in Asia-Pacific, a decline in ATM numbers was driven by the banking sector, as banks responded to reduced demand by removing terminals. In North America, meanwhile, declining usage contributed to the withdrawal of both bank and IAD* ATMs, with IAD* ATMs contracting more sharply than bank ATM numbers across the region.

Digitalisation has also driven branch closures. Western Europe led branch rationalisation, while only the Middle East and Africa (MEA) saw growth in the number of branches.

ATMs evolve beyond cash

Banks are increasingly migrating branch services to ATMs amid ongoing branch rationalisation. For the first time, over half of ATMs worldwide now accept automated deposits, with most of these using recycling technology. As cash withdrawals decline, ATMs are evolving to meet changing customer and bank needs while balancing cost efficiency with service delivery.

In the USA, banks have optimised costs by deploying high-functionality ATMs with broader services while removing basic terminals. Partnerships with IADs have also reduced costs, leading to slower IAD* decline in the USA versus Canada.

Emerging markets drive growth despite global decline

In other markets, cost is a significant factor in the rise of IADs*, with many banks outsourcing ATMs to save operational costs. Strong growth among Poland’s IADs contributed to a marginal increase in the overall Central and Eastern Europe installed base. Uzbekistan also drove growth in the region, with Uzbek banks deploying over 1,000 new ATMs as part of financial inclusion initiatives. IAD* ATM numbers also rose in both Asia-Pacific and MEA, resulting in 1% growth in the number of IAD* ATMs worldwide.

MEA showed particularly strong momentum, with an increase in the installed base of both IAD* and bank-deployed ATMs giving this region the highest overall growth rate in 2024. Rising financial inclusion was the primary driver of growth, particularly in markets such as Egypt, which retains strong potential alongside several other markets in the region. As a result, MEA is expected to maintain its position as the fastest-growing region to the end of the decade.

Latin America is forecast to return to growth after Brazil’s terminal withdrawals drove 2024 decline. Other regions will continue falling, contributing to a 4% global decrease by the end of the decade.

Helen Amos, who led Datos Insights’ Global ATM Intelligence Service research, remarked: ‘While we expect to see a continued fall in ATM numbers in coming years, the rate of decline will slow thanks to growth by IADs and expansion projects by banks in emerging economies. At the same time, we will see features such as cash deposit become much more common, meaning that ATMs will continue to play an essential role in the cash flow economy.’

_________

*IAD – Independent ATM Deployer

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: