Digitalisation of SMEs in Romania – country report released by European Commission and European Investment Bank

Perhaps the primary driver of low digitalisation among Romanian small and medium enterprises is limited digital skills and knowledge of how to digitalise, due to a lack of understanding of the benefits of digitalisation, what it entails and how to do it according to Digitalisation of SMEs in Romania – an assessment of the level of digitalisation of SMEs in Romania and recommendations to increase their

level of digitalisation.

The lower cost of labour in Romania compared to other European countries could partly explain the low level of digitalisation of Romanian SMEs compared to their peers; however, a more detailed assessment of the hurdles to digitalisation is required.

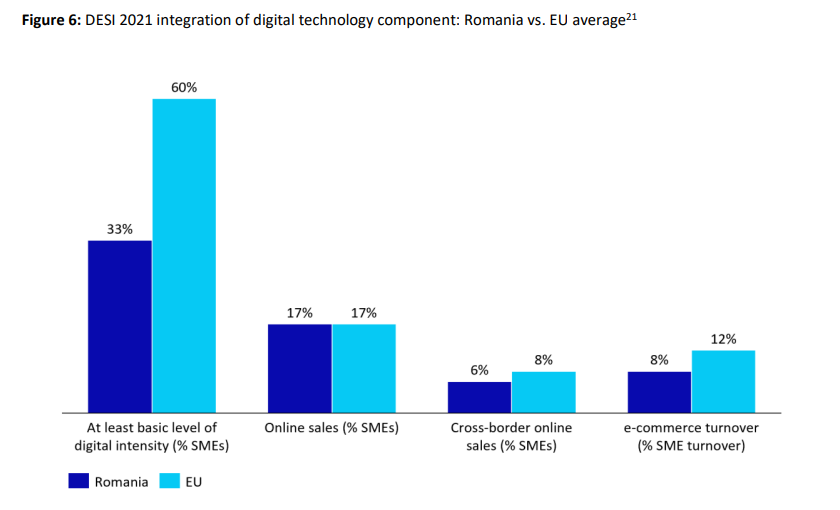

In terms of the digitalisation of businesses (integration of digital technology [within business activities]), the picture is the same: Romania came 25th out of 27, scoring 23.8 compared to the EU average of 37.6. Only 33% of Romanian small and medium businesses were found to have at least a basic level of digital intensity (compared to an EU average of 60%), and they also lag in terms of digital tooling, such as using electronic information sharing, social media, big data and cloud computing/services. Romanian enterprises also lag significantly compared to the EU average in terms of employee ICT training: only 6% of enterprises in Romania provide this, compared to the EU average of 20%.

What European Commission says should be done:

1) „We recommend that the government creates a single source of information on SME digitalisation in order to help reduce the complexity and fragmentation related to the many stakeholders involved in the innovation ecosystem and the services they offer. This could be an online platform working as a single point of access for all digitalisation-related information, pointing small and medium enterprises to the most appropriate type of support and/or stakeholder.”

2) „Strengthen digital innovation hubs and expand their offering of advisory and training programmes to SMEs to improve their digital skills, help them identify opportunities from digitalisation, and set out the business case for digital investments.”

3) „Work with banks and fintechs to improve SME engagement with the financial sector.

Many small and medium businesses are currently excluded from traditional financial services in Romania.

Getting them to engage with financial services, either through banks or through more innovative fintech

players, is a key step to supporting their digitalisation journeys, in particular through providing access to

finance. Supporting banks in deploying targeted outreach efforts to small and medium businesses should be the first step to increasing their engagement with financial services.”

4) „Work with banks and fintechs to improve the current programmes available to SMEs and

tailor them to their specific features and digital maturity. Even for those small and medium businesses that engage with the financial sector, this report has found that they struggle to access the required resources to prioritise investments in digitalisation (whether these are grants or loans). The EIBGroup and the Romanian government should work with banks and fintechs to improve the current programmes available to SMEs and maximise reach and impact.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: