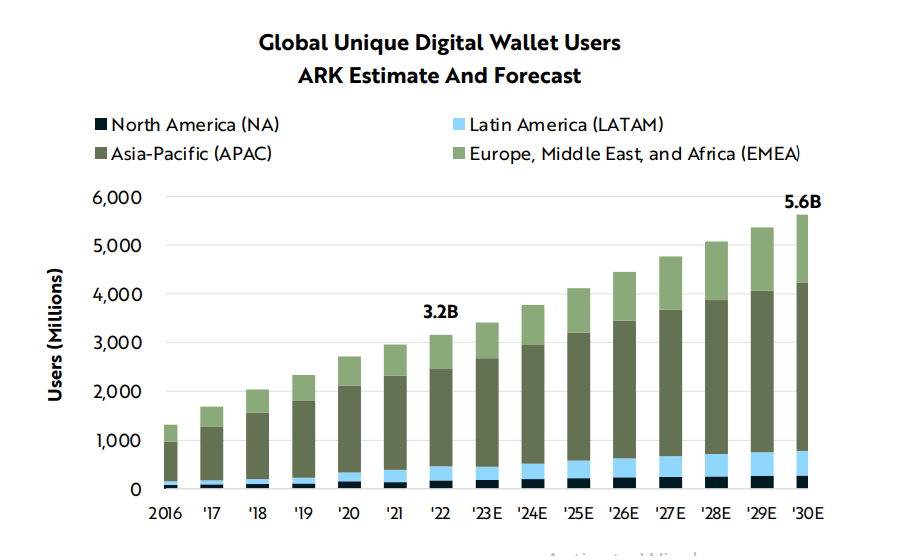

With 3.2 billion users, digital wallets have penetrated 40% of the global population.

Having onboarded billions of consumers and millions of merchants, digital wallets could transform the economics associated with traditional payment transactions, saving them nearly $50 billion in costs, according to a new report from Ark Invest entitled Big Ideas 2023.

ARK research suggests that the number of digital wallet users will increase 8% at an annual rate, penetrating 65% of the global population by 2030. As consumers and merchants adopt digital wallets, the usage of traditional checking accounts, credit and debit cards, and direct merchant accounts should decline, disrupting traditional payment intermediaries.

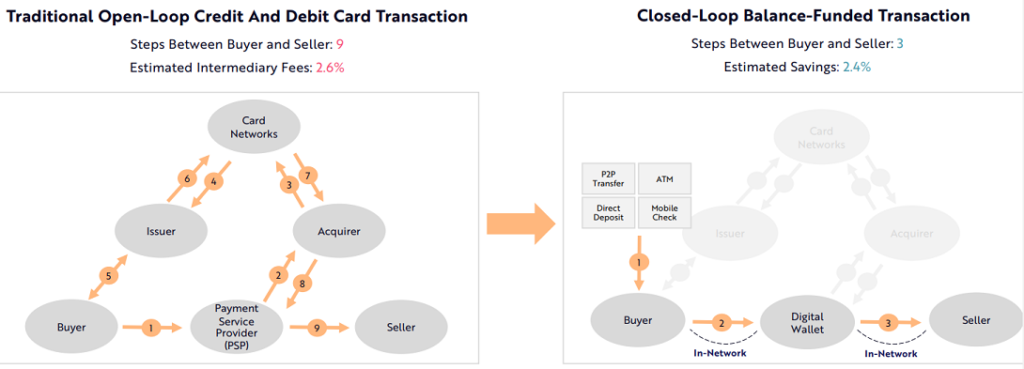

Closed-Loop Transactions Could Account For More Than 50% Of Digital Wallet Payments By 2030

Cutting out middlemen, digital wallets could facilitate closed-loop transactions for more than 50% of their payment volumes, potentially adding $450 billion to the current $1 trillion in digital wallet enterprise value by 2030.

Commonplace in mainland China, closed-loop transactions could disintermediate third-parties and generate nearly $50 billion in cost savings for digital wallet platforms, consumers, and/or merchants outside of mainland China, potentially adding $450 billion to the $1 trillion in total enterprise value of digital wallet platforms by 2030.

Digital Wallets Eliminate Middlemen By Enabling Direct Payments Between Consumers And Merchants

In the traditional payment chain, several intermediaries take tolls on payments* between consumers and merchants. By enabling in-network transactions, digital wallet providers capture more value per transaction and can share the savings with merchants and consumers.

In 2021, digital wallets facilitated 49% of e-commerce transactions, up from 18% in 2016. Since 2016, digital wallets have been gaining share at the expense of credit cards, bank transfers, and cash.

In 2021, digital wallets facilitated 29% of offline transactions, nearly double the 16% in 2018. Overtaking cash as the primary means of offline transactions during the COVID pandemic in 2020, digital wallets continue to gain share.

Digital Wallets Are Scaling Faster Than Accounts At Traditional Financial Institutions

The network effects associated with low customer acquisition costs and a superior user experience are powering digital wallet adoption. After the COVID-induced acceleration and subsequent churn, US digital wallet adoption rebounded in 2022, surpassing previous highs. According to ARK estimates, US digital wallet users will increase 7% at an annual rate during the next eight years, from ~160 million in 2022 to more than 260 million, while the number of global digital wallet users increases 8% at an annual rate, hitting 5.6 billion, 65% of the global population, by 2030.

_________________

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: