A new study from Juniper Research has found that the number of unique digital wallet users will exceed 4.4 billion globally in 2025; rising from 2.6 billion in 2020. It found that mobile wallets are leading this 70% growth, as mobile payments rapidly scale across geographical and vertical markets.

The increasing alignment between in‑person and remote commerce channels is leading to greater use of mobile wallets than ever before, with online wallet use confined to high-value purchases or complex bill payments.

The research recommends that merchants should undertake complete reviews of their processes to ensure that they are offering a highly capable mobile app. This must be inclusive of a seamless checkout process, the correct mobile wallet integrations and high levels of security, or they will lose out to more mobile-adept merchants.

Developed markets lagging behind China & India

The new research, Digital Wallets: Key Opportunities, Vendor Analysis and Market Forecasts 2021‑2025, found that markets such as the UK and US are lagging behind China and India in terms of digital wallet adoption, with China and India accounting for 69% of digital wallet transactions in 2025.

Research co-author Nick Maynard explains: ‘In developed markets, mobile wallets facilitate card payments, but in emerging markets, wallets in places have bypassed cards entirely. Wallet providers in developed markets need to focus on building acceptance and analytics features, in order to boost their appeal in a card-centric environment.’

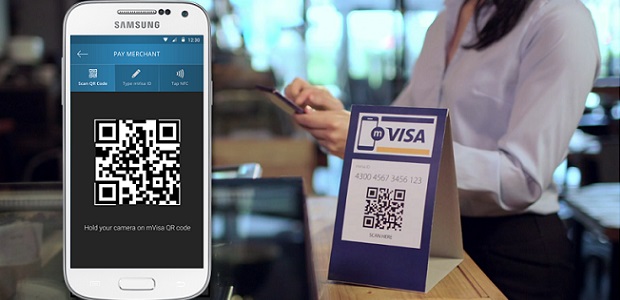

QR Code Payments Leading Wallet Use

The research also found that QR code payments will account for 40% of all digital wallet transactions globally in 2025; a fall from 47% of transactions in 2020. QR code payments are presently playing a leading role, due to their ease of use and acceptance, which makes them a critically important area for wallet use. However, over the next five years, the evolution of features such as card acceptance via NFC smartphones will begin to close the ease of acceptance gap.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: